0001869198FALSEFY2022http://fasb.org/us-gaap/2022#OtherOperatingIncomeExpenseNethttp://fasb.org/us-gaap/2022#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2022#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2022#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2022#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2022#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2022#OtherLiabilitiesNoncurrentP4Y0MP4Y0MP4Y0MP4Y0MP4YP4Y00018691982022-01-012022-12-3100018691982022-06-30iso4217:USD00018691982023-03-06xbrli:shares00018691982022-12-3100018691982021-12-31iso4217:USDxbrli:shares0001869198lth:CenterMember2022-01-012022-12-310001869198lth:CenterMember2021-01-012021-12-310001869198lth:CenterMember2020-01-012020-12-310001869198us-gaap:ProductAndServiceOtherMember2022-01-012022-12-310001869198us-gaap:ProductAndServiceOtherMember2021-01-012021-12-310001869198us-gaap:ProductAndServiceOtherMember2020-01-012020-12-3100018691982021-01-012021-12-3100018691982020-01-012020-12-310001869198us-gaap:CommonStockMember2019-12-310001869198us-gaap:AdditionalPaidInCapitalMember2019-12-310001869198lth:StockholderNotesReceivableMember2019-12-310001869198us-gaap:RetainedEarningsMember2019-12-310001869198us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-3100018691982019-12-310001869198us-gaap:RetainedEarningsMember2020-01-012020-12-310001869198us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001869198us-gaap:CommonStockMember2020-01-012020-12-310001869198us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001869198us-gaap:CommonStockMember2020-12-310001869198us-gaap:AdditionalPaidInCapitalMember2020-12-310001869198lth:StockholderNotesReceivableMember2020-12-310001869198us-gaap:RetainedEarningsMember2020-12-310001869198us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-3100018691982020-12-310001869198us-gaap:RetainedEarningsMember2021-01-012021-12-310001869198us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001869198us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001869198us-gaap:CommonStockMember2021-01-012021-12-310001869198lth:StockholderNotesReceivableMember2021-01-012021-12-310001869198us-gaap:CommonStockMember2021-12-310001869198us-gaap:AdditionalPaidInCapitalMember2021-12-310001869198lth:StockholderNotesReceivableMember2021-12-310001869198us-gaap:RetainedEarningsMember2021-12-310001869198us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001869198us-gaap:RetainedEarningsMember2022-01-012022-12-310001869198us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001869198us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001869198us-gaap:CommonStockMember2022-01-012022-12-310001869198us-gaap:CommonStockMember2022-12-310001869198us-gaap:AdditionalPaidInCapitalMember2022-12-310001869198lth:StockholderNotesReceivableMember2022-12-310001869198us-gaap:RetainedEarningsMember2022-12-310001869198us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-31lth:propertylth:statelth:province0001869198us-gaap:IPOMember2021-10-122021-10-120001869198us-gaap:IPOMember2021-10-120001869198us-gaap:IPOMember2022-01-012022-12-310001869198us-gaap:SeriesAPreferredStockMember2021-01-112021-01-110001869198us-gaap:CommonStockMember2021-01-112021-01-110001869198us-gaap:SeriesAPreferredStockMember2021-10-122021-10-120001869198us-gaap:CommonStockMember2021-10-122021-10-120001869198lth:TermLoanMemberlth:AmendedSeniorSecuredCreditFacilityMember2021-10-132021-10-130001869198us-gaap:OverAllotmentOptionMember2021-11-012021-11-010001869198us-gaap:OverAllotmentOptionMember2021-11-01lth:segmentlth:reporting_unit0001869198lth:CentersReportingUnitMember2021-12-310001869198lth:CentersReportingUnitMember2022-12-310001869198lth:CorporateBusinessesReportingUnitMember2022-12-310001869198lth:CorporateBusinessesReportingUnitMember2021-12-310001869198srt:MinimumMember2022-12-310001869198srt:MaximumMember2022-12-310001869198lth:DMHoldingsMember2019-12-31xbrli:pure0001869198lth:TermLoanMemberlth:AmendedSeniorSecuredCreditFacilityMember2022-12-310001869198us-gaap:SecuredDebtMemberlth:SecuredNotesMaturingJanuary2026Member2022-12-310001869198lth:UnsecuredNotesMaturingApril2026Memberus-gaap:UnsecuredDebtMember2022-12-310001869198lth:TermLoanMemberlth:AmendedSeniorSecuredCreditFacilityMember2021-12-310001869198us-gaap:SecuredDebtMemberlth:SecuredNotesMaturingJanuary2026Member2021-12-310001869198lth:UnsecuredNotesMaturingApril2026Memberus-gaap:UnsecuredDebtMember2021-12-310001869198us-gaap:LandMember2022-12-310001869198us-gaap:LandMember2021-12-310001869198us-gaap:BuildingAndBuildingImprovementsMembersrt:MinimumMember2022-01-012022-12-310001869198srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2022-01-012022-12-310001869198us-gaap:BuildingAndBuildingImprovementsMember2022-12-310001869198us-gaap:BuildingAndBuildingImprovementsMember2021-12-310001869198srt:MinimumMemberus-gaap:LeaseholdImprovementsMember2022-01-012022-12-310001869198srt:MaximumMemberus-gaap:LeaseholdImprovementsMember2022-01-012022-12-310001869198us-gaap:LeaseholdImprovementsMember2022-12-310001869198us-gaap:LeaseholdImprovementsMember2021-12-310001869198us-gaap:ConstructionInProgressMember2022-12-310001869198us-gaap:ConstructionInProgressMember2021-12-310001869198srt:MinimumMemberlth:EquipmentAndOtherMember2022-01-012022-12-310001869198srt:MaximumMemberlth:EquipmentAndOtherMember2022-01-012022-12-310001869198lth:EquipmentAndOtherMember2022-12-310001869198lth:EquipmentAndOtherMember2021-12-310001869198us-gaap:TradeNamesMember2022-12-310001869198us-gaap:OtherIntangibleAssetsMember2022-12-310001869198us-gaap:TradeNamesMember2021-12-310001869198us-gaap:OtherIntangibleAssetsMember2021-12-310001869198us-gaap:MembershipMember2022-01-012022-12-310001869198us-gaap:MembershipMember2021-01-012021-12-310001869198us-gaap:MembershipMember2020-01-012020-12-310001869198lth:InCenterMember2022-01-012022-12-310001869198lth:InCenterMember2021-01-012021-12-310001869198lth:InCenterMember2020-01-012020-12-310001869198lth:CenterMemberus-gaap:TransferredOverTimeMember2022-01-012022-12-310001869198us-gaap:ProductAndServiceOtherMemberus-gaap:TransferredOverTimeMember2022-01-012022-12-310001869198us-gaap:TransferredOverTimeMember2022-01-012022-12-310001869198lth:CenterMemberus-gaap:TransferredOverTimeMember2021-01-012021-12-310001869198us-gaap:ProductAndServiceOtherMemberus-gaap:TransferredOverTimeMember2021-01-012021-12-310001869198us-gaap:TransferredOverTimeMember2021-01-012021-12-310001869198lth:CenterMemberus-gaap:TransferredOverTimeMember2020-01-012020-12-310001869198us-gaap:ProductAndServiceOtherMemberus-gaap:TransferredOverTimeMember2020-01-012020-12-310001869198us-gaap:TransferredOverTimeMember2020-01-012020-12-310001869198lth:CenterMemberus-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310001869198us-gaap:ProductAndServiceOtherMemberus-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310001869198us-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310001869198lth:CenterMemberus-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310001869198us-gaap:ProductAndServiceOtherMemberus-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310001869198us-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310001869198lth:CenterMemberus-gaap:TransferredAtPointInTimeMember2020-01-012020-12-310001869198us-gaap:ProductAndServiceOtherMemberus-gaap:TransferredAtPointInTimeMember2020-01-012020-12-310001869198us-gaap:TransferredAtPointInTimeMember2020-01-012020-12-310001869198us-gaap:DomesticCountryMember2022-12-310001869198us-gaap:StateAndLocalJurisdictionMember2022-12-310001869198us-gaap:ForeignCountryMember2022-12-310001869198us-gaap:DomesticCountryMember2021-12-310001869198us-gaap:StateAndLocalJurisdictionMember2021-12-310001869198us-gaap:ForeignCountryMember2021-12-310001869198us-gaap:GeneralBusinessMember2021-12-310001869198us-gaap:StateAndLocalJurisdictionMemberlth:OperatingLossCarryforwardAndOtherDeferredTaxAssetsMember2022-12-310001869198us-gaap:ForeignCountryMemberlth:OperatingLossCarryforwardAndOtherDeferredTaxAssetsMember2022-12-310001869198lth:TaxCreditCarryforwardMemberus-gaap:ForeignCountryMember2022-12-310001869198lth:OperatingLossCarryforwardMemberus-gaap:StateAndLocalJurisdictionMember2021-12-310001869198lth:OperatingLossCarryforwardMemberus-gaap:ForeignCountryMember2021-12-310001869198us-gaap:LineOfCreditMemberlth:AmendedRevolvingCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2022-12-310001869198us-gaap:LineOfCreditMemberlth:AmendedRevolvingCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2021-12-310001869198lth:ConstructionLoanMaturing2026Memberus-gaap:ConstructionLoansMember2022-12-310001869198lth:ConstructionLoanMaturing2026Memberus-gaap:ConstructionLoansMember2021-12-310001869198us-gaap:MortgagesMember2022-12-310001869198us-gaap:MortgagesMember2021-12-310001869198us-gaap:NotesPayableOtherPayablesMember2022-12-310001869198us-gaap:NotesPayableOtherPayablesMember2021-12-310001869198lth:TermLoanMemberlth:AmendedSeniorSecuredCreditFacilityMember2021-01-220001869198us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2022-12-310001869198us-gaap:LineOfCreditMemberus-gaap:UnsecuredDebtMember2022-12-310001869198us-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2022-12-310001869198lth:TermLoanMemberlth:AmendedSeniorSecuredCreditFacilityMember2021-01-222021-01-220001869198lth:TermLoanMemberlth:AmendedSeniorSecuredCreditFacilityMember2021-10-122021-10-120001869198lth:TermLoanMemberlth:AmendedSeniorSecuredCreditFacilityMembersrt:MinimumMember2021-01-222021-01-220001869198lth:TermLoanMembersrt:MaximumMemberlth:AmendedSeniorSecuredCreditFacilityMember2021-01-222021-01-220001869198lth:TermLoanMemberlth:AmendedSeniorSecuredCreditFacilityMemberus-gaap:LondonInterbankOfferedRateLIBORMember2021-01-222021-01-220001869198lth:TermLoanMemberlth:AmendedSeniorSecuredCreditFacilityMemberus-gaap:BaseRateMember2021-01-222021-01-220001869198us-gaap:LineOfCreditMemberlth:AmendedRevolvingCreditFacilityMemberus-gaap:LetterOfCreditMember2022-12-310001869198us-gaap:LineOfCreditMemberlth:AmendedRevolvingCreditFacilityMembersrt:MinimumMemberus-gaap:RevolvingCreditFacilityMember2021-12-312021-12-310001869198us-gaap:LineOfCreditMemberlth:AmendedRevolvingCreditFacilityMembersrt:MaximumMemberus-gaap:RevolvingCreditFacilityMember2021-12-312021-12-310001869198us-gaap:LineOfCreditMemberlth:AmendedRevolvingCreditFacilityMemberus-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:RevolvingCreditFacilityMember2021-12-312021-12-310001869198us-gaap:LineOfCreditMemberlth:AmendedRevolvingCreditFacilityMemberus-gaap:BaseRateMemberus-gaap:RevolvingCreditFacilityMember2021-12-312021-12-310001869198us-gaap:LineOfCreditMemberlth:AmendedRevolvingCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2022-01-012022-12-310001869198us-gaap:SecuredDebtMember2021-01-220001869198us-gaap:SecuredDebtMember2021-01-222021-01-220001869198lth:UnsecuredNotesMaturingApril2026Memberus-gaap:UnsecuredDebtMember2021-02-050001869198lth:UnsecuredNotesMaturingApril2026Memberus-gaap:UnsecuredDebtMember2021-02-052021-02-050001869198lth:ConstructionLoanMaturing2026Memberus-gaap:ConstructionLoansMember2021-01-220001869198us-gaap:MortgagesMember2022-01-012022-12-310001869198lth:SecuredDebtRelatedPartyMember2020-06-240001869198lth:SecuredDebtRelatedPartyMember2021-01-012021-12-310001869198lth:SecuredDebtRelatedPartyMember2021-01-222021-01-220001869198lth:SecuredDebtRelatedPartyMember2021-01-112021-01-110001869198lth:TermLoanMember2021-01-012021-12-310001869198lth:UnrelatedThirdPartiesMember2021-01-012021-12-310001869198lth:UnrelatedThirdPartiesMember2021-12-310001869198lth:UnrelatedThirdPartiesMember2020-01-012020-12-310001869198lth:UnrelatedThirdPartiesMember2020-12-3100018691982021-01-112021-01-110001869198srt:ChiefExecutiveOfficerMemberus-gaap:RestrictedStockMember2021-04-012021-06-300001869198srt:ChiefExecutiveOfficerMemberus-gaap:RestrictedStockMember2021-06-300001869198us-gaap:RestrictedStockMember2022-12-310001869198us-gaap:RestrictedStockMember2022-01-012022-12-310001869198lth:RestrictedSeriesAPreferredStockMember2021-10-122021-10-120001869198lth:RestrictedCommonStockMember2022-01-012022-12-310001869198lth:RestrictedCommonStockMember2021-10-122021-12-310001869198lth:RestrictedCommonStockMember2020-01-012020-12-310001869198lth:RestrictedCommonStockMember2021-01-012021-12-310001869198lth:EquityPlan2015Member2021-12-310001869198lth:EquityPlan2015Member2022-12-310001869198lth:EquityPlan2021Member2021-10-060001869198lth:EquityPlan2021Member2022-01-012022-01-010001869198lth:EquityPlan2021Member2022-01-012022-12-310001869198lth:EquityPlan2021Member2022-12-310001869198us-gaap:EmployeeStockMember2022-12-310001869198us-gaap:EmployeeStockMember2022-01-012022-12-310001869198us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001869198lth:EquityPlan2015Member2021-01-012021-12-310001869198lth:EquityPlan2021Member2021-01-012021-12-310001869198us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001869198lth:ShareBasedPaymentArrangementOptionTimeVestingMember2021-01-012021-12-310001869198lth:ShareBasedPaymentArrangementOptionPerformanceVestingMember2021-01-012021-12-310001869198us-gaap:CostOfSalesMemberus-gaap:EmployeeStockOptionMember2022-01-012022-12-310001869198us-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:EmployeeStockOptionMember2022-01-012022-12-310001869198us-gaap:EmployeeStockOptionMemberus-gaap:OtherOperatingIncomeExpenseMember2022-01-012022-12-310001869198us-gaap:CostOfSalesMemberus-gaap:EmployeeStockOptionMember2021-01-012021-12-310001869198us-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:EmployeeStockOptionMember2021-01-012021-12-310001869198us-gaap:EmployeeStockOptionMemberus-gaap:OtherOperatingIncomeExpenseMember2021-01-012021-12-310001869198us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001869198us-gaap:RestrictedStockUnitsRSUMember2021-12-310001869198us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001869198us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001869198us-gaap:RestrictedStockUnitsRSUMember2022-12-310001869198lth:RestrictedStockUnitsTimeVestedMember2022-01-012022-12-310001869198us-gaap:PerformanceSharesMember2022-01-012022-12-310001869198lth:FourRatableAnnualInstallmentsMember2022-12-310001869198lth:TwoRatableAnnualInstallmentsMember2022-12-310001869198lth:OneRatableAnnualInstallmentsMember2022-12-310001869198us-gaap:RestrictedStockUnitsRSUMemberlth:EquityPlan2015Member2021-01-012021-12-310001869198us-gaap:RestrictedStockUnitsRSUMemberlth:EquityPlan2021Member2021-01-012021-12-310001869198us-gaap:RestrictedStockUnitsRSUMembersrt:ChiefExecutiveOfficerMemberlth:EquityPlan2015Member2021-01-012021-12-310001869198us-gaap:RestrictedStockUnitsRSUMemberlth:EmployeesAndOtherParticipantsOtherThanCEOMemberlth:EquityPlan2015Member2021-01-012021-12-310001869198us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-3100018691982020-03-152020-12-310001869198us-gaap:RestrictedStockUnitsRSUMembersrt:ChiefExecutiveOfficerMemberlth:EquityPlan2015Member2022-01-012022-12-310001869198us-gaap:RestrictedStockUnitsRSUMembersrt:ChiefExecutiveOfficerMemberlth:EquityPlan2015Member2020-12-310001869198us-gaap:RestrictedStockUnitsRSUMemberlth:EmployeesAndOtherParticipantsOtherThanCEOMemberlth:EquityPlan2015Member2021-04-012021-06-300001869198us-gaap:RestrictedStockUnitsRSUMemberlth:EmployeesAndOtherParticipantsOtherThanCEOMemberlth:EquityPlan2015Member2022-04-042022-04-040001869198us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:RestrictedStockUnitsRSUMemberlth:EquityPlan2021Member2022-04-042022-04-040001869198us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CostOfSalesMember2022-01-012022-12-310001869198us-gaap:RestrictedStockUnitsRSUMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-12-310001869198us-gaap:RestrictedStockUnitsRSUMemberus-gaap:OtherOperatingIncomeExpenseMember2022-01-012022-12-310001869198us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CostOfSalesMember2021-01-012021-12-310001869198us-gaap:RestrictedStockUnitsRSUMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-12-310001869198us-gaap:RestrictedStockUnitsRSUMemberus-gaap:OtherOperatingIncomeExpenseMember2021-01-012021-12-3100018691982018-08-272018-08-2700018691982018-08-2700018691982019-07-032019-07-030001869198us-gaap:AdditionalPaidInCapitalMember2021-08-012021-08-310001869198lth:StockholderNotesReceivableMember2021-08-012021-08-310001869198us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001869198us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001869198us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001869198us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001869198us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001869198us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001869198us-gaap:RestrictedStockMember2022-01-012022-12-310001869198us-gaap:RestrictedStockMember2021-01-012021-12-310001869198us-gaap:RestrictedStockMember2020-01-012020-12-310001869198us-gaap:EmployeeStockMember2022-01-012022-12-310001869198us-gaap:EmployeeStockMember2021-01-012021-12-310001869198us-gaap:EmployeeStockMember2020-01-012020-12-3100018691982020-08-072020-08-0700018691982020-07-012020-09-300001869198srt:AffiliatedEntityMemberlth:RelatedPartySaleLeasebackTransactionsMemberlth:SaleLeasebackTransactionOneMember2020-01-012020-12-310001869198srt:AffiliatedEntityMemberlth:RelatedPartySaleLeasebackTransactionsMemberlth:SaleLeasebackTransactionOneMember2022-01-012022-12-310001869198srt:AffiliatedEntityMemberlth:RelatedPartySaleLeasebackTransactionsMemberlth:SaleLeasebackTransactionOneMember2021-01-012021-12-310001869198srt:AffiliatedEntityMemberlth:RelatedPartySaleLeasebackTransactionsMemberlth:SaleLeasebackTransactionTwoMember2019-01-012019-12-310001869198srt:AffiliatedEntityMemberlth:RelatedPartySaleLeasebackTransactionsMemberlth:SaleLeasebackTransactionTwoMember2022-01-012022-12-310001869198srt:AffiliatedEntityMemberlth:RelatedPartySaleLeasebackTransactionsMemberlth:SaleLeasebackTransactionTwoMember2021-01-012021-12-310001869198srt:AffiliatedEntityMemberlth:RelatedPartySaleLeasebackTransactionsMemberlth:SaleLeasebackTransactionTwoMember2020-01-012020-12-310001869198lth:SaleLeasebackTransactionThreeMembersrt:AffiliatedEntityMemberlth:RelatedPartySaleLeasebackTransactionsMember2018-01-012018-12-310001869198lth:SaleLeasebackTransactionThreeMemberlth:EntityChiefExecutiveOfficerMemberlth:LimitedLiabilityCompanySaleLeasebackTransactionMember2018-01-012018-12-310001869198lth:SaleLeasebackTransactionThreeMembersrt:AffiliatedEntityMemberlth:RelatedPartySaleLeasebackTransactionsMember2022-01-012022-12-310001869198lth:SaleLeasebackTransactionThreeMembersrt:AffiliatedEntityMemberlth:RelatedPartySaleLeasebackTransactionsMember2021-01-012021-12-310001869198lth:SaleLeasebackTransactionThreeMembersrt:AffiliatedEntityMemberlth:RelatedPartySaleLeasebackTransactionsMember2020-01-012020-12-310001869198lth:SaleLeasebackTransactionFourMembersrt:AffiliatedEntityMemberlth:RelatedPartySaleLeasebackTransactionsMember2017-01-012017-12-310001869198lth:SaleLeasebackTransactionFourMembersrt:AffiliatedEntityMemberlth:RelatedPartySaleLeasebackTransactionsMember2022-01-012022-12-310001869198lth:SaleLeasebackTransactionFourMembersrt:AffiliatedEntityMemberlth:RelatedPartySaleLeasebackTransactionsMember2021-01-012021-12-310001869198lth:SaleLeasebackTransactionFourMembersrt:AffiliatedEntityMemberlth:RelatedPartySaleLeasebackTransactionsMember2020-01-012020-12-310001869198lth:GeneralPartnershipShoppingCenterLeaseMemberlth:RelatedPartyLeasingArrangementsMembersrt:AffiliatedEntityMember2003-10-012003-10-310001869198lth:WoodburyLeaseMember2022-01-012022-12-310001869198lth:WoodburyLeaseMember2021-01-012021-12-310001869198lth:WoodburyLeaseMember2020-01-012020-12-310001869198lth:PreviousWoodburyLeaseMember2020-01-012020-12-310001869198lth:RelatedPartyLeasingArrangementsMembersrt:AffiliatedEntityMember2022-01-012022-12-310001869198lth:RelatedPartyLeasingArrangementsMembersrt:AffiliatedEntityMember2021-01-012021-12-310001869198lth:RelatedPartyLeasingArrangementsMembersrt:AffiliatedEntityMember2020-01-012020-12-310001869198srt:AffiliatedEntityMemberlth:LifetimeMemberlth:RelatedPartyAircraftAgreementMember2022-10-310001869198srt:AffiliatedEntityMemberlth:RelatedPartyAircraftAgreementMember2022-10-012022-10-310001869198srt:AffiliatedEntityMemberlth:RelatedPartyAircraftAgreementMember2018-03-012018-03-310001869198us-gaap:ImmediateFamilyMemberOfManagementOrPrincipalOwnerMemberlth:RelatedPartyDirectorServicesMember2022-01-012022-12-310001869198us-gaap:ImmediateFamilyMemberOfManagementOrPrincipalOwnerMemberlth:RelatedPartyDirectorServicesMember2021-01-012021-12-310001869198us-gaap:ImmediateFamilyMemberOfManagementOrPrincipalOwnerMemberlth:RelatedPartyDirectorServicesMember2020-01-012020-12-310001869198us-gaap:SubsequentEventMember2023-02-012023-02-280001869198srt:ParentCompanyMember2022-01-012022-12-310001869198srt:ParentCompanyMemberus-gaap:CostOfSalesMember2022-01-012022-12-310001869198srt:ParentCompanyMemberlth:GeneralAdministrativeAndMarketingMember2022-01-012022-12-310001869198srt:ParentCompanyMemberus-gaap:OtherOperatingIncomeExpenseMember2022-01-012022-12-310001869198srt:ParentCompanyMember2021-01-012021-12-310001869198srt:ParentCompanyMemberus-gaap:CostOfSalesMember2021-01-012021-12-310001869198srt:ParentCompanyMemberlth:GeneralAdministrativeAndMarketingMember2021-01-012021-12-310001869198srt:ParentCompanyMemberus-gaap:OtherOperatingIncomeExpenseMember2021-01-012021-12-310001869198srt:ParentCompanyMember2020-01-012020-12-310001869198srt:ParentCompanyMember2022-12-310001869198srt:ParentCompanyMember2021-12-310001869198srt:ParentCompanyMemberlth:CenterMember2022-01-012022-12-310001869198srt:ParentCompanyMemberlth:CenterMember2021-01-012021-12-310001869198srt:ParentCompanyMemberlth:CenterMember2020-01-012020-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One) | | | | | |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2022

OR

| | | | | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-40887

Life Time Group Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 47-3481985 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

2902 Corporate Place

Chanhassen, Minnesota 55317

(952) 947-0000

(Address of principal executive offices, including zip code and Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| Common stock, par value $0.01 per share | LTH | The New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes x No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Accelerated filer | x |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No x

As of June 30, 2022, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $378.1 million (based upon the closing sale price of the common stock on that date on the NYSE).

As of March 6, 2023, the registrant had 194,791,585 shares of common stock outstanding, par value $0.01 per share.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the Annual Meeting of Stockholders to be held on April 26, 2023, are incorporated by reference into Part III, Items 10-14 of this Annual Report on Form 10-K. The Proxy Statement will be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

TABLE OF CONTENTS

Cautionary Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K (this “Annual Report”) includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which are subject to the “safe harbor” created by those sections. Forward-looking statements include all statements that are not historical facts, including statements reflecting our current views with respect to, among other things, our plans, strategies and prospects, both business and financial, including our financial outlook, possible or assumed future actions, opportunities for growth and margin expansion, consumer demand, industry and economic trends, business strategies, events or results of operations. These forward-looking statements are included throughout this Annual Report, including in the sections entitled “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in the section entitled “Risk Factors.” These statements may be preceded by, followed by or include the words “anticipate,” “assume,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “future,” “will,” “seek,” “foreseeable,” the negative version of these words or similar terms and phrases. In addition, any statements or information that refer to expectations, beliefs, plans, projections, objectives, performance or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking.

The forward-looking statements contained in this Annual Report are based on management’s current beliefs and assumptions and are not guarantees of future performance. The forward-looking statements are subject to various risks, uncertainties, assumptions or changes in circumstances that are difficult to predict or quantify. Actual results may differ materially from these expectations due to numerous factors, many of which are beyond our control, including as summarized immediately below under “—Summary Risk Factors” and as detailed under the section entitled “Risk Factors” in this Annual Report, as such risk factors may be updated from time to time in our periodic filings with the Securities and Exchange Commission, or SEC, and are accessible on the SEC’s website at www.sec.gov.

Any forward-looking statements made by us in this Annual Report speak only as of the date of this Annual Report and are expressly qualified in their entirety by the cautionary statements included in this Annual Report. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, investments or other strategic transactions we may make. Except as required by law, we do not have any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements, whether as a result of new information, future events or otherwise.

Summary Risk Factors

We are subject to a number of risks, including risks that may prevent us from achieving our business objectives or that may adversely affect our business, financial condition, results of operations, cash flows and prospects. You should carefully consider the risks discussed in the section entitled “Risk Factors,” including the following risks, before investing in our common stock:

Risks Relating to Our Business Operations and Competitive Environment

•our ability to attract and retain members and to optimize annual revenue per center membership;

•competition in the health, fitness and wellness industry;

•the environments in which we operate, including with respect to the macroeconomy, the political climate, global pandemics or other health crises, severe weather, natural disasters, hostilities, gun violence and social unrest;

•rising costs related to our business, including construction of new centers, employees and maintenance and operation of our existing centers, and our inability to pass these cost increases through to our members;

•seasonal and quarterly variations in our revenues and results of operations;

•our dependence on third-party suppliers for equipment and certain products and services;

Risks Relating to Our Brand

•a deterioration in the quality or reputation of our brand or the health, fitness and wellness industry;

•risks relating to social media platforms and our use of email, text messaging and social media marketing;

•our inability to protect and enforce our intellectual property rights or defend against intellectual property infringement suits against us by third parties;

Risks Relating to the Growth of Our Business

•our inability to identify and acquire suitable sites for centers;

•potential negative impacts resulting from the opening of new centers, including in our existing markets;

•increased investments in future centers in wealthier demographic areas or increased construction and development costs and the risk that the level of return will not meet our expectations;

•delays in new center openings;

•strains on our management, employees, information systems and internal controls;

•costs we may incur in the development and implementation of new businesses or strategies with no guarantee of success;

•risks relating to acquisitions and investments, including our inability to acquire or invest in suitable businesses or, if we do acquire them, risks relating to asset impairment or the integration of the business into our own;

Risks Relating to Our Technological Operations

•our ability to deliver connected and digital experiences and to adapt to significant and rapid technological changes;

•our inability to properly maintain the operations, integrity and security of our systems and data or the data of our members, guests and employees, to comply with applicable privacy laws, or to strategically implement, upgrade or consolidate existing information systems;

•disruptions and failures involving our information systems;

•risks related to automated clearing house (“ACH”), credit card, debit card and digital payments we accept;

Risks Relating to Our Capital Structure and Lease Obligations

•our ability to generate cash flow to service our substantial debt and lease obligations;

•our ability to operate our business under the restrictions in our senior secured credit facilities, indentures and leases that limit our current and future operating flexibility;

•our ability to obtain additional capital;

Risks Relating to Our Human Capital

•our inability to retain our key employees, hire additional highly qualified employees or optimize our support structure;

•labor shortages or increased labor costs;

•attempts by labor organizations to organize groups of our employees or changes in labor laws;

Risks Relating to Legal Compliance and Risk Management

•our ability to comply with extensive governmental laws and regulations, and changes in these laws and regulations;

•claims related to our health, fitness and wellness-related offerings;

•our inability to maintain the required level of insurance coverage on acceptable terms or at an acceptable cost;

•claims related to construction or operation of our centers and in the use of our premises, facilities, equipment, services, activities or products;

Risks Relating to Ownership of Our Common Stock

•significant changes to our share price and a liquid trading market for our common stock may not develop;

•potential conflicts of interest between the private equity investment funds that control us and our public stockholders;

•other risks relating to ownership of our common stock;

•other factors beyond our control; and

•other factors set forth under “Risk Factors” in this Annual Report.

PART I

Item 1. BUSINESS

Life Time Group Holdings, Inc. (collectively with its direct and indirect subsidiaries, “Life Time,” “we,” “our,” “us,” or the “Company”) is a holding company incorporated in the state of Delaware. Life Time Group Holdings, Inc. common stock trades on the New York Stock Exchange (“NYSE”) under the symbol “LTH.”

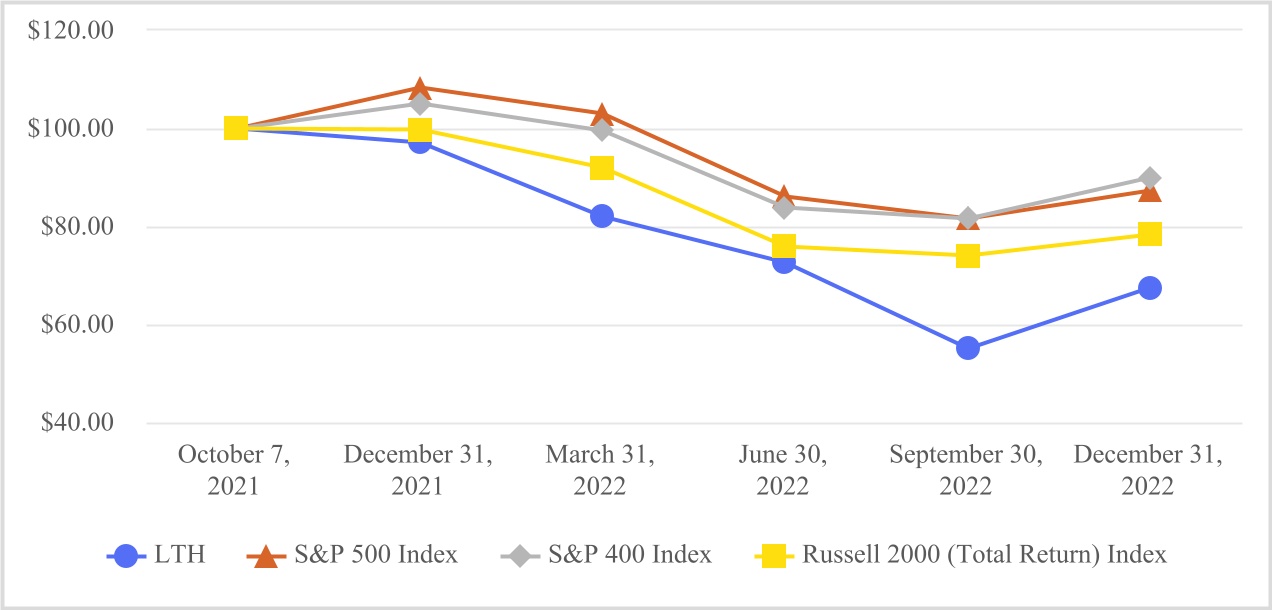

Initial Public Offering

On October 12, 2021, Life Time Group Holdings, Inc. consummated its initial public offering (“IPO”) of 39.0 million shares of its common stock at a public offering price of $18.00 per share, resulting in total gross proceeds of $702.0 million before deducting the underwriting discounts and other offering expenses. The shares of its common stock began trading on the NYSE under the symbol “LTH” on October 7, 2021. A registration statement on Form S-1 relating to the offering of these securities was declared effective by the SEC on October 6, 2021. Additionally, on November 1, 2021, Life Time Group Holdings, Inc. consummated the sale of nearly 1.6 million additional shares of its common stock at the IPO price of $18.00 per share pursuant to the partial exercise by the underwriters of their over-allotment option, resulting in total gross proceeds of approximately $28.4 million before deducting the underwriting discounts and commissions. For more information on the IPO, including with respect to our use of proceeds, see Note 1, Nature of Business and Basis of Presentation—Initial Public Offering, to our consolidated financial statements included in Part II, Item 8 of this Annual Report.

Who We Are

Life Time, the “Healthy Way of Life Company,” is a leading lifestyle brand offering premium health, fitness and wellness experiences to a community of nearly 1.4 million individual members, who together comprise more than 776,000 memberships, as of December 31, 2022. Since our founding over 30 years ago, we have sought to continuously innovate ways for our members to lead healthy and happy lives by offering them the best places, programs and performers. We deliver high-quality experiences through our omni-channel physical and digital ecosystem that includes more than 160 centers—distinctive, resort-like athletic country club destinations—across 29 states in the United States and one province in Canada. Our track record of providing differentiated experiences to our members has fueled our strong, long-term financial performance and has driven our growth as we have emerged from the COVID-19 pandemic. In 2022, we generated $1,823 million of revenue, a net loss of $2 million and $282 million in Adjusted EBITDA. In 2021, a year in which we experienced an initial recovery from the impacts of COVID-19, we generated $1,318 million of revenue, a net loss of $579 million and $80 million in Adjusted EBITDA. In 2020, which was significantly impacted by the COVID-19 pandemic due to the closure of our clubs by governmental authorities, we generated $948 million of revenue, a net loss of $360 million and $(63) million in Adjusted EBITDA. In 2019, the year before the adverse impacts of the pandemic, we generated $1,900 million of revenue, net income of $30 million and $438 million in Adjusted EBITDA.

Our luxurious athletic country clubs, which are located in both affluent suburban and urban locations, total approximately 16 million square feet in the aggregate. We offer expansive fitness floors with top-of-the-line equipment, spacious locker rooms, group fitness studios, indoor and outdoor pools and bistros, indoor and outdoor tennis courts, pickleball courts, basketball courts, LifeSpa, LifeCafe and our childcare and Kids Academy learning spaces. Our premium service offerings are delivered by over 34,000 Life Time team members, including over 8,800 certified fitness professionals, ranging from personal trainers to studio performers. Our members are highly engaged and draw inspiration from the experiences and community we have created. We believe this engagement and inspiration has fueled our recovery as we have implemented several strategic initiatives to further enhance our member experiences and drive significant increases in center usage and higher center memberships as we have emerged from the pandemic and approach or exceed our 2019 pre-pandemic performance levels. For example, we had 124 average visits per membership to our centers in 2022, 113 average visits per membership to our centers in 2021 and 69 average visits per membership to our centers in 2020 despite the COVID-19 pandemic. We had 108 average visits per membership to our centers in 2019. Similarly, our average revenue per center membership increased to $2,528 in 2022 compared to $2,098 and $1,317 in 2021 and 2020, respectively, and compared to $2,172 in 2019.

The table below displays the wide assortment of amenities, services, activities and events found at our centers:

| | | | | | | | | | | | | | |

| Amenities | | Services | | Activities and Events |

Indoor and Outdoor Pools Group Fitness Studios Cycle Studios Yoga & Pilates Studios Indoor and Outdoor Tennis Courts Pickleball Courts LifeCafe with Poolside Service Bar and Lounge with Wi-Fi Free Weight and Resistance Equipment Cardiovascular Equipment Steam Room and Sauna Racquetball and Squash Spaces Locker Rooms Child Center and Kids Academy Basketball/Volleyball Courts | | Dynamic Personal Training Small Group Training ARORA Weight Loss Coaching Nutrition Coaching LifeSpa and Medi-spa Physical Therapy and Chiropractic Assessments and Lab Testing Sport Specific Coaching Endurance Coaching Swim Lessons and Team Coaching Towel and Locker Service | | Athletic Leagues and Tournaments Kids’ Birthday Parties Summer and Vacation Camps for Kids Sports Training Camps Athletic Events Social Events Outdoor Group Runs Outdoor Group Cycle Rides Swim Meets Charity Events |

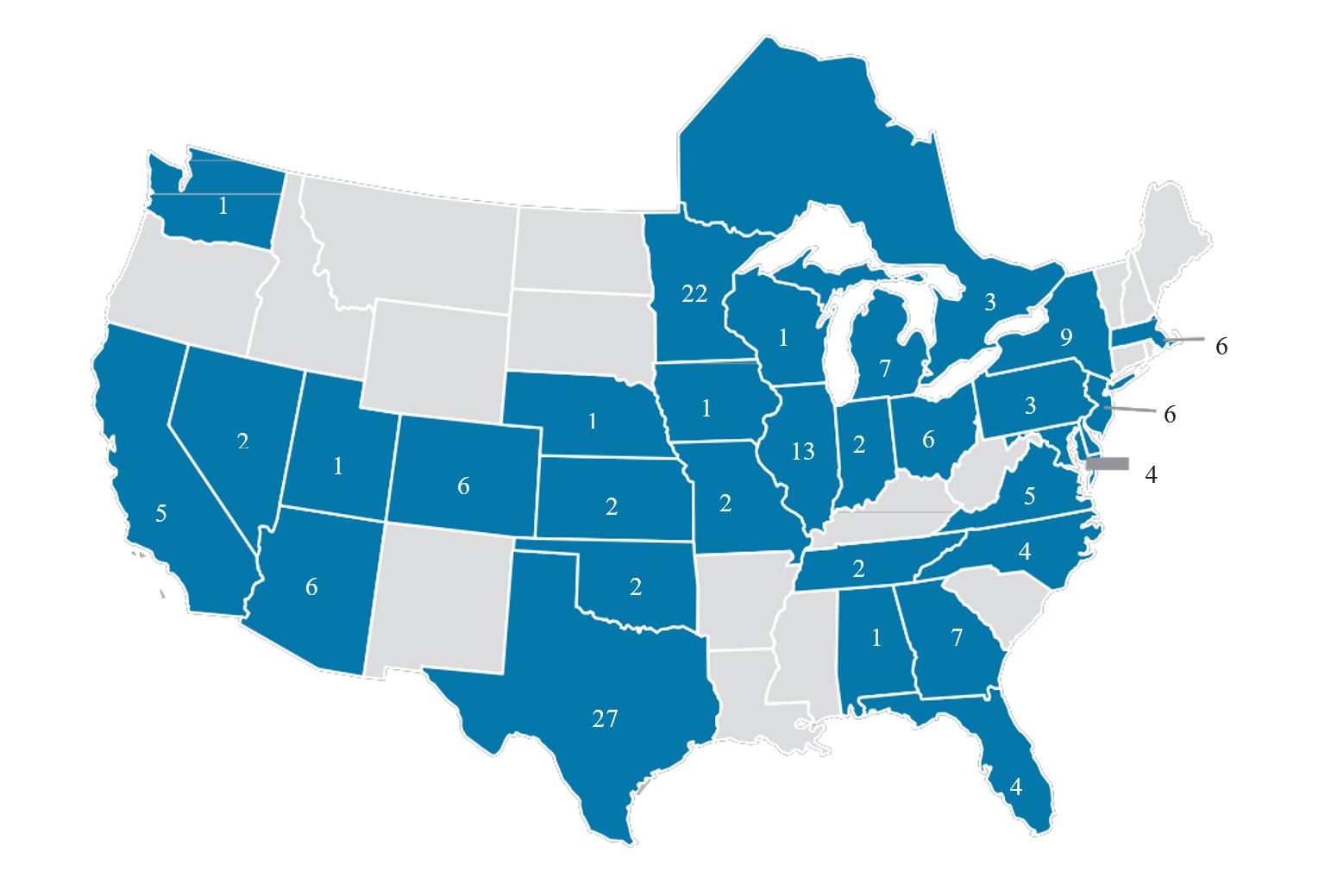

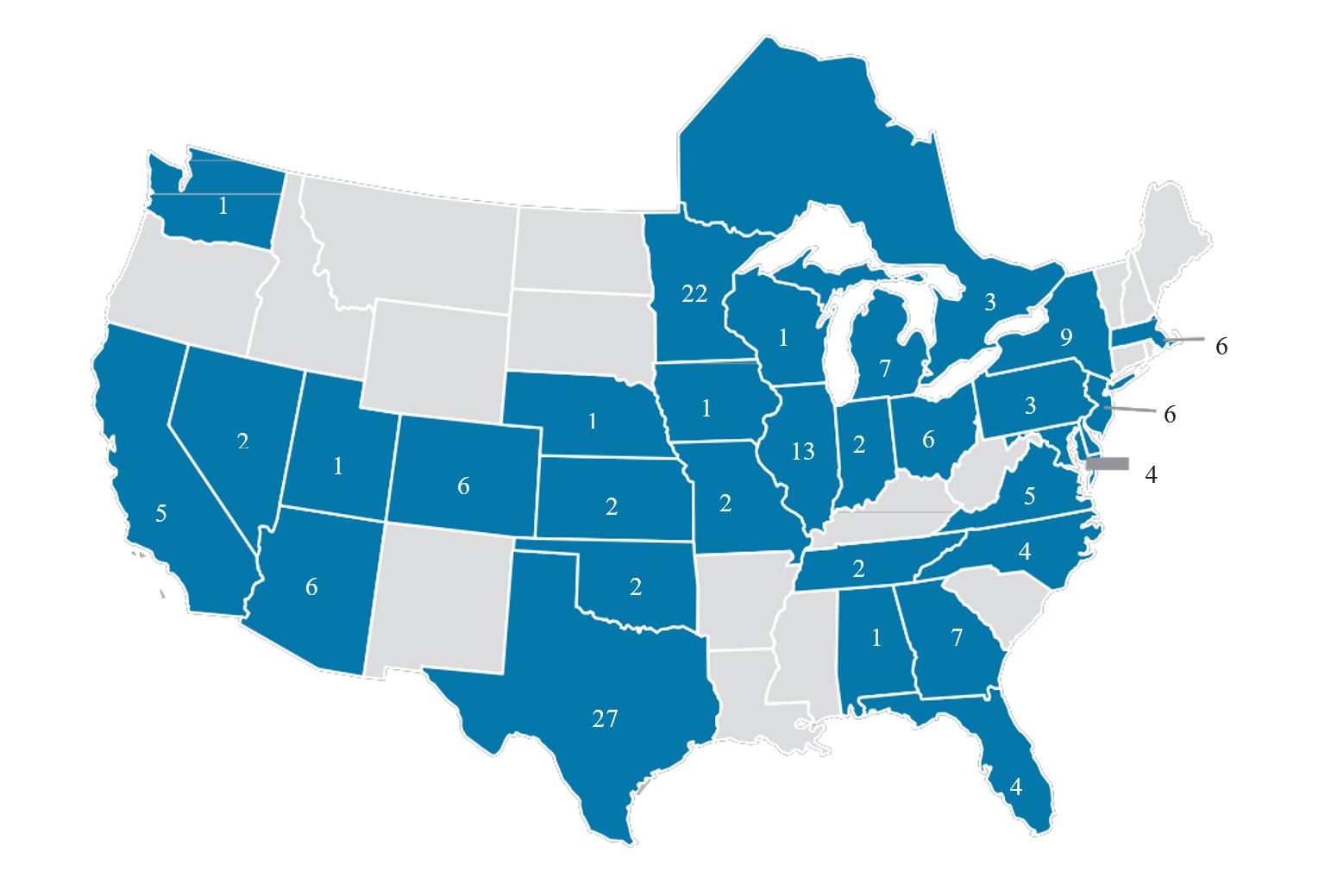

Our footprint of athletic country clubs as of December 31, 2022:

We believe that no other company in the United States delivers the same quality and breadth of health, fitness and wellness experiences that we deliver, which enabled us to consistently grow our annual membership dues and in-center revenues for 20 consecutive years, prior to the impact of the COVID-19 pandemic. As detailed below, we have been strategic in building our business back from the pandemic with the intent to return to consistent annual growth in our membership dues and in-center revenue. As of December 31, 2022, 2021 and 2020, our recurring membership dues and enrollment fees represented 71%, 71% and 70%, respectively, of our total Center revenue, while our in-center revenue, consisting of Dynamic Personal Training, LifeCafe, LifeSpa, Life Time Swim and Life Time Kids, among other services, represented 29%, 29% and 30%, respectively, of our total Center revenue.

Our Growth Strategies and Member Experience Initiatives

We have built a strong foundation with an engaged membership base in pursuit of a healthy way of living. We are now executing on several offensive strategies to grow our business and drive our memberships and revenue per center membership. We are elevating our member experiences through new and improved in-center service offerings, types of memberships, concierge-type member services and omni-channel offerings. We are also expanding the number of our centers in an asset-light model that targets higher income members, higher average annual revenue per center membership and higher returns on invested capital. With the strong recovery of our membership dues revenue, we have also been able to focus on margin expansion. We believe we have opportunities to continue to expand margins as we benefit from higher dues revenue and as we continue to optimize the roll-out of our strategic initiatives and improve the efficiency of our club operations and corporate office.

Increase Revenue per Center Membership

We believe we will be able to continue to increase revenue from our members and grow our membership base by continuing to execute on the following initiatives that enhance our member experiences and brand awareness, add new members and retain current members longer:

•Expand and elevate in-center service offerings that generate incremental revenue. We continue to evolve our premium lifestyle brand in ways that elevate and broaden our member experiences and allow our members to integrate health, fitness and wellness into their lives with greater ease and frequency. Our offerings cater to all types of interests and levels and drive increased center usage and spend by members.

◦Our strategic initiatives, including pickleball, Dynamic Personal Training, small group training such as Alpha, GTX and Ultra Fit, and our ARORA community focused on members aged 55 years and older, are driving significant increases in unique participants or total sessions in these areas.

◦Our shift from a sales-driven culture to delivering a concierge-type experience to our members is enhancing how we interact with prospective and existing members.

◦Our new membership offerings, including our signature membership that includes unlimited small group training and priority registrations, are driving broader appeal, higher memberships and longer member retention.

•Optimize revenue per Center membership. During the pandemic, we came to believe that we had been under-valuing the experiences delivered to our engaged members and that certain members would likely not return following the pandemic. We thus began to implement a new pricing strategy coming out of the pandemic. As we continued to enhance and broaden the premium experiences for our members, we strategically increased our membership dues across most of our new and existing centers, particularly for our new member join rates. New members are thus joining at higher membership dues rates and are incrementally more profitable than the members we lose. As expected, our total center memberships have not fully recovered to their 2019 pre-pandemic levels, but for the first time in January 2023, our membership dues revenue exceeded our January 2020 pre-pandemic membership dues revenue for centers opened at the end of 2019. We believe we can continue to refine our pricing, and transition existing memberships to higher membership prices or tiers, as we deliver exceptional experiences and find the optimal balance among memberships per center, the member experience and financial returns for each center. We expect average revenue per center membership to continue to increase compared to the prior year as we add new members and open new centers in increasingly affluent markets. We also expect our revenue to grow as our mature centers continue to ramp in their performance after the adverse effects from the COVID-19 pandemic.

Expanded National Footprint and Strategic Focus on Locations in Affluent Metropolitan Statistical Areas

We believe we have significant whitespace opportunity for our premium athletic country clubs across the United States and Canada, as well as internationally. Over the last five-plus years, we have expanded our footprint on the East and West coasts, and increased our presence in premium, urban and coastal areas such as Boston, Chicago, New York City, Florida and California. Our new center expansion initiatives are focused on strategic locations that will generate higher average dues, higher in-center revenue per membership and higher revenue per square foot. Our geographic and upscale expansion has been enabled by our flexible center formats, which can be modified to accommodate traditional suburban, vertical residential, urban and mall/retail locations.

We opened 10, six and three new centers in 2022, 2021 and 2020, respectively, and plan to open 18 to 20 new centers over the next two years in increasingly affluent areas. Our new centers historically have ramped to maturity over four years with a high level of consistency. As we open new centers each year and as our new centers ramp to maturity, we believe this ramping club dynamic will provide further support and predictability to our overall revenue and earnings growth.

We also intend to supplement our organic growth through acquisitions. We have acquired, and expect to continue to acquire, centers as well as events and services that complement our offerings. Our acquisitions can be single assets or portfolios of assets. We take a disciplined approach to sourcing, acquiring and integrating high quality assets and/or locations and complementary businesses that can help us continue to expand into new geographic areas, acquire key talent and offer new services and experiences. Our post-acquisition integration process often involves significant investments in both the acquired physical assets and human capital to improve each acquired site and to rebrand the look and feel of the center to create the Life Time brand experience for our members.

Asset-light, Flexible Real Estate Strategy

Approximately 65% of our centers are now leased, including approximately 90% of our new centers opened within the last five years, versus a predominantly owned real estate strategy prior to 2015. Our focus on a flexible real estate strategy has enabled us to develop a business model that targets a new center return on invested capital, after sale-leaseback proceeds or construction reimbursements, of over 40%, which is more than double historical trends before implementing this strategy. This strategy has also allowed us to grow the number of centers in a more cost-effective manner and to enter attractive urban and coastal markets with premium centers where the price of real estate had historically been a deterrent to entry.

Expanded Memberships and Omni-Channel Membership Offerings

We believe the importance of health, fitness and wellness coupled with the structural shift of consumer preferences toward experiential and proactive health and wellness spending creates new opportunities for us to leverage our “Healthy Way of Life” lifestyle brand. As our business model evolves and our membership base grows, we expect to leverage our brand reputation and deep understanding of the member experience to add a growing portfolio of products and services to our omni-channel platform. For example, we are leveraging our asset base to add pickleball courts across the country with the goal of becoming the largest pickleball provider in the United States. We are also focused on tapping into a growing active aging market with our ARORA programming and services. While our operations are predominantly in the United States today, we also believe that we can leverage our brand reputation to expand internationally.

Our enhanced digital platform is delivering a true omni-channel experience for our members, including live streaming fitness classes, remote goal-based personal training, nutrition and weight loss support and curated award-winning health, fitness and wellness content. In addition, our members are able to purchase a wide variety of equipment, wearables, apparel, beauty products and nutritional supplements via our digital health store. We are continuing to invest in our digital capabilities, including our integrated digital app, in order to strengthen our relationships with our members and more comprehensively address their health, fitness and wellness needs so that they can remain engaged and connected with Life Time at any time or place.

We are also expanding our “Healthy Way of Life” ecosystem in response to the desire of our members to holistically integrate health and wellness into every aspect of their daily lives. In 2018, we launched Life Time Work, an asset-light branded co-working model, which offers premium work spaces in close proximity to our athletic country clubs and integrates ergonomic furnishings and promotes a healthy working environment. As of December 31, 2022, we had 11 Life Time Work locations in operation, with plans to open more in the coming years. Life Time Work members also generally receive access to all of our resort-like athletic country club destinations across the United States and Canada. Additionally, we have opened our first two Life Time Living locations, which offer luxury wellness-oriented residences in close proximity to one of our athletic country clubs. Our Life Time Living offering is generating interest from new property developers and presenting opportunities for new center development that we have not previously had. While we are in the early stages of capitalizing on this opportunity, we believe integrating how and where consumers live, work, move and play is a promising opportunity that Life Time is uniquely positioned to capture. As we expand our footprint with new centers and nearby work and living spaces, as well as strengthen our digital capabilities, we expect to continue to grow our omni-channel platform to support the “Healthy Way of Life” journey of our members wherever they are in the United States and Canada.

Our Competitive Strengths

We believe that the following strengths power our brand and business model:

Authentic, Premium “Healthy Way of Life” Brand

We have built Life Time into a premier health, fitness and wellness lifestyle brand, earning the trust of our members for over 30 years to make their lives healthier and happier. We believe that consumers equate our brand with the uncompromising quality, luxury and “Healthy Way of Life” experiences that Life Time offers. We have built this credibility and robust brand equity through our continuous focus on high quality member experiences delivered through what we believe to be the best programs with the best performers in the best places. We believe our brand loyalty will allow us to continue to grow our core business as well as expand our omni-channel platform in digital, work, living and other health, fitness and wellness experiences.

Differentiated and Uncompromising Experiences

Our athletic country clubs, together with our omni-channel platform, offer members an exceptional breadth of physical and digital experiences that meet or exceed their expectations:

•Full Suite of Comprehensive Offerings: Life Time offers an expansive array of amenities, services and activities, thereby enabling members to enjoy a “Healthy Way of Life” across a diverse and varied set of offerings. Whether taking advantage of our state-of-the-art fitness equipment, playing pickleball, engaging with our Dynamic Personal Training, small group training or ARORA community, partaking in summer camp for kids, competing in one of our sports leagues or relaxing in one of our pools or award-winning spas, Life Time members can enjoy a full end-to-end experience that enables an entire family to grow and develop, regardless of where they are in their health and wellness journey.

•World-Class Talent: We recruit, hire and certify those whom we believe are the best fitness professionals in the industry to empower, educate and entertain our members. In addition, to enhance our member experiences and drive consistency in our hospitality and services, we have a strong focus on team member culture, training and certification.

•Passionate Culture: Our focus on engagement among team members attracts and fosters our multi-generational member base. We value diversity, equity and inclusion at Life Time and strive to create a welcoming and inclusive culture. In addition, we foster community engagement through a wide range of events and activities, from parent-child dances, pool parties, charity runs and aged 55+ coffee hours to other social events and multi-day athletic events. During 2022, we organized approximately 11,170 events and served as a social and community hub for our members.

•Digital Offerings: Life Time Digital enables our members to experience many of our best offerings at their fingertips at any time and wherever they are located in the United States or Canada.

Loyal and Engaged Multi-Generational Membership Base with Attractive Demographics

Life Time’s breadth of premium services and offerings attracts people of all ages who want to lead healthier, happier lives. The power of our lifestyle brand, attractive member demographics, breadth of amenities and services and high utilization of our centers allow us to build deeply meaningful connections with our members, which are difficult for others in our industry to replicate fully. We have something for every generation, from young children attending our swim lessons and Kids Academy classes, teenagers engaged in our sports and agility training, adults engaged in our Dynamic Personal Training and small group training or more senior adults engaged in our ARORA community to members of all ages participating in pickleball, our iconic athletic events and a variety of our other in-center activities.

Our member base is primarily made up of members in affluent suburban and urban locations. We believe our membership base has a discretionary spending level that, on average, is less susceptible to adverse economic conditions. As of December 31, 2022, our members had a median household income of $143,000, 80% owned a home and approximately 60% of our members are part of a couples or family membership, and these members typically engage more fully within our centers. Approximately 58% of our members had at least a college education. Additionally, our gender mix is balanced and approximately 44% of our members are under 35 years of age and approximately 82% are under 55 years of age.

Flexible Real Estate Strategy with Nationwide Footprint

We have a diversified portfolio of over 160 resort-like athletic country club destinations that are primarily located in affluent markets across 29 states and one Canadian province. Over the last five years, we have transitioned to an asset-light strategy through sale-leaseback transactions and have adopted more strategic and flexible center formats that can be modified to

accommodate various settings, including traditional suburban, vertical residential, urban and mall/retail locations. Our focus on a flexible real estate strategy since 2015 has enabled us to develop a business model that targets a new center return on invested capital, after sale-leaseback proceeds or construction reimbursements, of over 40%, which is more than double historical trends before implementing this strategy. This strategy has also allowed us to grow the number of centers in a more cost-effective manner and enter attractive urban and coastal markets with premium centers where the price of real estate had historically been a deterrent to entry. We also benefit from our in-house architecture, design and construction expertise that allows us to create operationally efficient centers. This internal expertise has also helped us control the cost and pace of capital expenditures, including in determining when to begin construction on a new location after we have purchased the land as we balance the timing of our growth with any inflationary, labor or supply pressures, and has also ensured a consistent feel across our centers.

We have developed a disciplined and sophisticated process to evaluate markets and specific sites in those markets where we may want to build new centers. This dynamic process is based upon demographic, psychographic and competitive criteria generated from profiles of our most successful centers, and we continue to refine these criteria based upon the performance of our centers. We believe that the presence of a Life Time center benefits landlords and property developers and the value of the underlying property and surrounding neighborhoods. We are seeing the demand for our brand that this benefit creates. We seek to leverage this halo effect of our brand, as well as long-term relationships with landlords and property developers, to achieve favorable lease or development agreements and increased construction reimbursements to support our capital light expansion.

Recurring Revenue Model with Consistent Growth

Membership dues from our network of members create a recurring and relatively predictable revenue stream that has proven to be resilient for over 30 years and across economic cycles. Membership dues and enrollment fees provide our largest source of revenue, representing 71%, 71% and 70% of our total Center revenue in 2022, 2021 and 2020, respectively.

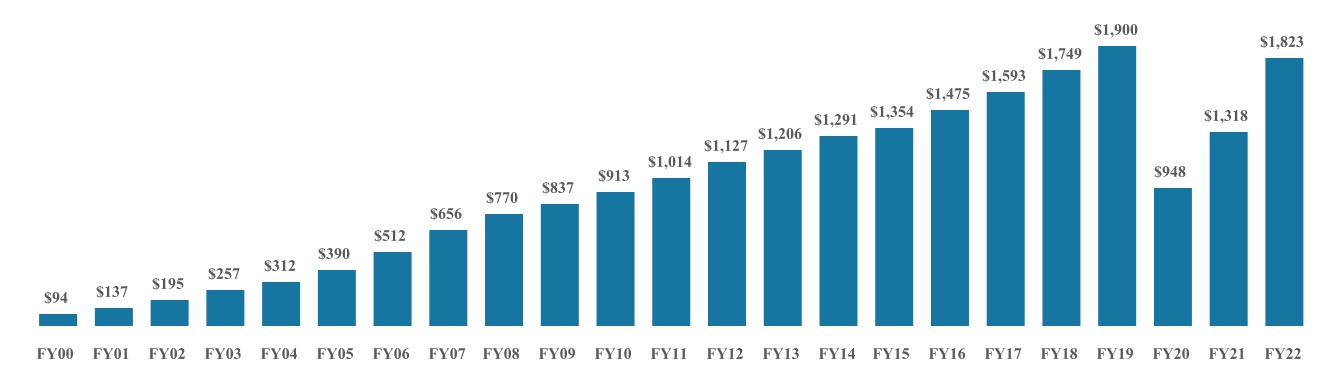

We grew from $137 million, $4 million and $36 million in revenue, net income and Adjusted EBITDA, respectively, in 2001 to $1,900 million, $30 million and $438 million in revenue, net income and Adjusted EBITDA, respectively, in 2019. During that time period, we did not have a year-over-year decline in revenue or Adjusted EBITDA. While revenue, net income (loss) and Adjusted EBITDA did decline in 2020 to $948 million, $(360) million and $(63) million, respectively, due to the closure of our centers by governmental authorities during the COVID-19 pandemic, we saw a recovery during 2021 as we re-opened our centers and began to emerge from the pandemic with revenue, net loss and Adjusted EBITDA of $1,318 million, $(579) million and $80 million, respectively. During 2022, we continued our recovery as we executed on several growth and pricing initiatives and generated $1,823 million, $(2) million and $282 million in revenue, net loss and Adjusted EBITDA, respectively.

Passionate, Visionary, Founder-Led Management Team with Deep Industry Experience

Our unwavering commitment to excellence and a “Healthy Way of Life” culture is driven by our passionate management team, under the leadership of Bahram Akradi, our founder, Chairman and Chief Executive Officer. Life Time was founded by Mr. Akradi in 1992 with a goal of helping people achieve their health, fitness and wellness goals by delivering entertaining, educational and innovative experiences with uncompromising quality and unparalleled service. From the very beginning, Mr. Akradi has led the Company with a focus on serving members’ needs first and a belief that business results would naturally follow.

By building a strong and highly experienced executive leadership team, Life Time has continued to grow and consistently deliver exceptional experiences. Our executive leadership includes:

•Eric Buss, Executive Vice President & Chief Administrative Officer. Mr. Buss has been with Life Time for over 20 years and has served as a key executive leader in a variety of roles.

•Robert Houghton, Executive Vice President & Chief Financial Officer. Mr. Houghton has been with Life Time since August 2022 and has more than 20 years of leadership experience across various industries, including as Senior Vice President – Finance at United Natural Foods, Inc.

•Parham Javaheri, Executive Vice President & Chief Property Development Officer. Mr. Javaheri joined Life Time in 2004 and has over 20 years of experience in real estate development.

•RJ Singh, Executive Vice President & Chief Digital Officer. Mr. Singh joined Life Time in 2017 and oversees all digital and technology infrastructure, operations and initiatives.

•Jeff Zwiefel, President & Chief Operating Officer. Mr. Zwiefel has been with Life Time for over 20 years and has more than 35 years of experience in the health, fitness and wellness industry.

Our team has an entrepreneurial spirit that we believe makes us highly adaptable, reflects an ownership mentality and allows us to navigate shifts in the health, fitness and wellness landscape, including as a result of the COVID-19 pandemic. We believe the strength of our team, culture and organizational approach position us to continue to grow and deliver strong financial results.

Strong Financial Performance

Our compelling financial profile is distinguished by our long-term track record of consistent revenue growth prior to the COVID-19 pandemic and now as we emerge from the pandemic, growth of new centers in attractive markets, a high percentage of predictable recurring membership dues revenue, increasing revenue per center membership and strong profitability.

•Long-Term Track Record of Revenue Growth. We believe the strength of our brand and the effective execution of our operating strategy have driven our long-term track record of growth. Prior to the impact of COVID-19 in 2020, we grew our revenue each year from 2000 through 2019. Our revenue declined in 2020 due to the closure of our centers by governmental authorities during the COVID-19 pandemic. Since then, our revenue has once again grown strongly as our centers ramp back and we expect to exceed our 2019 revenue.

Revenue ($ in millions)

•Highly Successful New Center Openings. Our asset-light, flexible real estate strategy and compelling center economics have enabled us to successfully open new centers in attractive markets. Since implementing our asset light strategy in 2015, we have opened an average of eight centers per year, excluding centers opened in 2020 during the COVID-19 pandemic.

•Predictable Recurring Membership Dues Revenue. Our membership dues represent a predictable recurring revenue stream that provides stability to our business. Center memberships were approximately 725,200 as of December 31, 2022, a net increase of approximately 76,000 from 2021 as we continued to recover from the COVID-19 pandemic and execute our strategic and pricing initiatives. The percentage of that increase attributable to net new members was approximately 73%, or 55,000 memberships. While our Center memberships have not fully recovered to their pre-pandemic levels of 2019, we believe we are building back a stronger and more engaged membership base. With this membership base and our enhanced premium services and pricing strategy, for the first time in January 2023, our membership dues revenue exceeded our January 2020 pre-pandemic membership dues revenue for centers opened at the end of 2019. The proportion of our total Center revenue generated by the resulting recurring membership dues and enrollment fees was 71%, 71% and 70% in 2022, 2021 and 2020, respectively.

•Increasing Average Revenue Per Center Membership. Between 2015 and 2019, we grew our average revenue per center membership from $1,883 in 2015 to $2,172 in 2019, a testament to the significant value that our members place on engaging with Life Time. Due to the closure of our centers by governmental authorities during the COVID-19 pandemic, average revenue per center membership fell to $1,317 in 2020. As we have emerged from the pandemic and implemented our strategic initiatives to further enhance our member experiences and drive significant increases in center usage and higher center memberships, we have grown our average revenue per center membership to $2,098 in 2021 and $2,528 in 2022.

•Strong Profitability. We have historically maintained a highly profitable business model, achieving a 1.6% net income margin and 23.0% Adjusted EBITDA margin in 2019. These metrics were impacted by the COVID-19 pandemic in 2020, falling to a (38.0)% net loss margin and (6.6)% Adjusted EBITDA margin in 2020 and a (44.0)% net loss margin and 6.1% Adjusted EBITDA margin in 2021. These metrics improved to (0.1)% net loss margin and

15.5% Adjusted EBITDA margin in 2022. With the strong recovery of our membership dues revenue, we have been able to focus on margin expansion. We believe we have opportunities to continue to expand margins as we benefit from higher dues revenue and as we continue to optimize the roll-out of our strategic initiatives and improve the efficiency of our club operations and corporate office. As we execute our asset-light real estate strategy, our rent expense, which includes both cash and non-cash rent expense, will continue to increase and impact our Adjusted EBITDA margins and the comparability of our results of operations. Rent expense was $166.0 million, $186.3 million, $209.8 million and $245.2 million for the years ended 2019, 2020, 2021 and 2022, respectively.

Impact of COVID-19 on Our Financial Performance

On March 16, 2020, we closed all of our centers based on orders and advisories from federal, state and local governmental authorities responding to the spread or threat of the spread of COVID-19. While our centers were closed, we did not collect monthly access membership dues or recurring product charges from our members. We re-opened our first center on May 8, 2020 and continued to re-open our centers in accordance with evolving state and local governmental guidance.

After the onset of the COVID-19 pandemic, we prioritized the health and safety of our members and team members by developing and implementing robust COVID-19 operating protocols, while taking appropriate steps to ensure our financial stability, including by reducing operating expenses, delaying capital investments and securing additional debt financing. The performance of our centers has improved significantly as our centers have ramped back from the adverse impacts of COVID-19. Our improvement has varied depending on various factors, including how early we were able to re-open them, whether we were required to close them again, their geographic location and applicable governmental restrictions. Similar to how our new centers historically have ramped to maturity over four years, we believe our centers continue to ramp in their performance as we emerge from the pandemic.

Number of Centers. While our new center construction and growth was slowed as a result of the COVID-19 pandemic, we have successfully opened 19 new centers since the end of 2019 through December 31, 2022, 17 of which opened after the onset of the pandemic. We have also continued our real estate development efforts after initially suspending them during the pandemic, and had 12 centers under construction as of December 31, 2022. We opened 10 new centers in 2022 and we plan to open 18 to 20 new centers over the next two years.

Revenue and Net Loss. As a result of the COVID-19 pandemic, our total revenue fell to $948 million for 2020. This revenue loss resulted in a net loss of approximately $360 million in 2020. Our results began to recover in 2021 and we generated $1,318 million in total revenue and a net loss of approximately $579 million. Our results further improved in 2022 and we generated $1,823 million in total revenue and a net loss of approximately $2 million, which included tax-effected expenses of $25.5 million related to non-cash share-based compensation expense.

Memberships. We define memberships for our centers as Center memberships and Digital On-hold memberships (as further detailed below under “—Our Membership Offering”). Both Center memberships and Digital On-hold memberships include Life Time Digital. As a result of the COVID-19 pandemic, Center memberships declined to approximately 501,000 at the end of 2020 as we experienced more conversions of Center memberships to Digital On-hold memberships as well as a higher level of membership terminations. However, we saw significant improvement in our Center membership numbers during 2021 and 2022 and had approximately 649,400 Center memberships as of December 31, 2021, due in large part to the conversion of Digital On-hold memberships back to Center memberships, and approximately 725,200 Center memberships as of December 31, 2022 due in large part to new members.

Our Membership Offering

We define a membership for our centers in two ways: Center memberships and Digital On-hold memberships. As of December 31, 2022, we had a total of 776,676 total memberships, comprised of 725,206 Center memberships and 51,470 Digital On-hold memberships. We also have Digital memberships that we began to offer in December 2020 for direct-to-consumer memberships that do not provide access to our centers.

Center Memberships. We offer a variety of convenient month-to-month memberships with no long-term contracts. Each Center membership is defined as one or more adults, plus any juniors under the age of 14.

•Base Memberships. We offer base memberships that provide one or more individuals 14 years of age or older general access (with some amenities excluded) to a selected home center and all centers with the same or lower base monthly dues rate. Our optimized pricing for a Center membership is determined center-by-center based on a variety of factors, including geography, market presence, demographic nature, population density, competition, initial investment in the center and available services and amenities. Among our base memberships, our standard multi-center access

memberships include general access to our centers, including the locker rooms (with locker and towel service), fitness floor, any child center and other benefits such as the Life Time app. Our signature multi-center access memberships provide the benefits of a standard membership along with certain products, services or spaces that would otherwise be accessible only upon payment of additional dues or fees, such as small group training and court time for certain racquet sports at certain centers. Certain of our centers are accessible only with a signature membership.

•Junior Memberships. We offer junior memberships (as an add-on to a base membership) that provide one or more children 13 years of age or younger access to the child center, pools and gymnasiums at designated times, drop-off events and Kids Academy, which includes more in-depth programming focused on activity, learning and fitness. Junior memberships currently cost $20 to $100 per month depending upon the center. We do not count junior memberships as incremental in our membership count since they are already part of the Center membership.

•Other Memberships and Products. We offer several other recurring memberships and access-related products at select centers, including a Tennis Membership that bundles a base membership with tennis and a Pool Pass that provides access to the outdoor pool area at select centers.

Digital On-hold Memberships. We offer Digital On-hold memberships for members who do not currently wish to access our centers, but still want to maintain certain member benefits, including our Life Time Digital membership, and the right to convert back to a Center membership without paying an enrollment fee. The majority of our Digital On-hold memberships cost $15 per month.

Digital Memberships. We launched Life Time Digital direct-to-consumer in December 2020 to bring our “Healthy Way of Life” programs, services and content to consumers virtually. Life Time Digital features include live streaming fitness classes, remote goal-based personal training, nutrition and weight loss support, curated award-winning health and fitness and wellness content. Currently, our digital membership is included with both our Center and Digital On-hold memberships at no additional charge or it can be purchased separately as a digital-only membership. We currently report our Digital memberships within our Digital On-hold membership totals.

Human Capital

As of December 31, 2022, we employed over 34,000 Life Time team members, including 26,000 part-time employees and over 8,800 certified fitness professionals, ranging from personal trainers to studio performers. On average, our centers are generally staffed with approximately 180 to 240 full-time and part-time employees depending on center activity levels.

Our team members are at the heart of our Company. Since our founding in 1992, we have believed that creating and sustaining a trusted community requires a high level of passion and commitment from our team. Our team members are dedicated to providing the best programs and experiences in the best facilities, and we know this happens by hiring and inspiring the best people. By consistently delivering extraordinary experiences, we have built a highly trusted, premium lifestyle brand that embraces all aspects of healthy living, healthy aging and healthy entertainment. We call this collective approach and lens to physical, mental and social well-being “Healthy Way of Life” (“HWOL”).

To build our HWOL brand, we aim to recruit, train, promote and empower team members through our culture of care and such initiatives as the Life Time Inclusion Council and Life Time University. Our culture of care encourages our team members to live out HWOL in their personal and professional lives. We believe in supporting our team members throughout their journey from casting, onboarding, training, certification, career-path planning and employee resource or affinity groups. We also offer numerous supportive programs, including education, training and surveys.

Diversity, Equity and Inclusion at Life Time

At Life Time, we are committed to inspiring healthy, happy lives for everyone in our communities. We aspire to create healthy environments and workspaces that recognize, empower and celebrate the unique talents, backgrounds and perspectives of individuals so team members feel welcomed, respected, supported and valued. We believe inclusion is at the heart of our team members’ and members’ sense of belonging, and so our diversity, equity and inclusion (“DEI”) efforts are focused on making Life Time “A Place for Everyone.”

To help create “A Place for Everyone” at Life Time, we created the Life Time Inclusion Council, which is comprised of a small group of core team members, along with a larger group of ambassadors representing each of our club locations and many corporate divisions. Our inclusion council works through committees to identify and incubate areas for growth within our organization with respect to DEI. Among other initiatives, Life Time has supported mentoring, coaching, engagement forums, inclusive leadership feedback and DEI learning.

Development and Training

Our recruiting and talent acquisition teams seek diverse and highly skilled team members who promote a friendly and inviting environment and uphold consistency in performance and excellence in hospitality. Through this casting, we select team members whom we believe are the best fitness professionals in the industry to empower, educate and entertain our members. Additionally, all center team members are required to participate in a training and certification program that is specifically designed for their role and in education that promotes health and safety and reinforces our non-discrimination and anti-harassment policies. We also provide comprehensive training through our Life Time Education platform that is comprised of both an externally licensed school branded as Life Time Academy (“LTA”) and an internal team member education and certification division that we call Life Time University (“LTU”). LTA offers a certification for entry-level professionals to prepare for a career with Life Time or within the health, fitness and wellness industry. LTU delivers certification, learning, education and development opportunities for all team members. Life Time Education supports the culture of Life Time through programs in service, inclusion and diversity and personal and professional growth. Team members also receive ongoing mentoring and continuing education, and we require an annual re-certification before any team member is permitted to work or to advance to other positions within our Company.

Our personal trainers, registered dietitians, massage therapists and cosmetologists are required to maintain a professional license or one of their industry’s top certifications.

Compensation and Benefits

We believe that supporting our team members to be successful in their roles enables them to provide extraordinary experiences to our members. We offer a wide range of benefits designed to holistically support our team members in all areas of their lives. In addition to paid time off, paid sick leave, parental leave, adoption assistance, subsidized medical, dental and vision insurance, company paid life insurance, short and long-term disability, and a center membership, we also provide:

•Employee Assistance Program – Offers confidential assistance with personal, legal, work, financial and other life issues on a 24-hours-a-day, 7-days-a-week basis; and