EX-99

Published on January 31, 2023

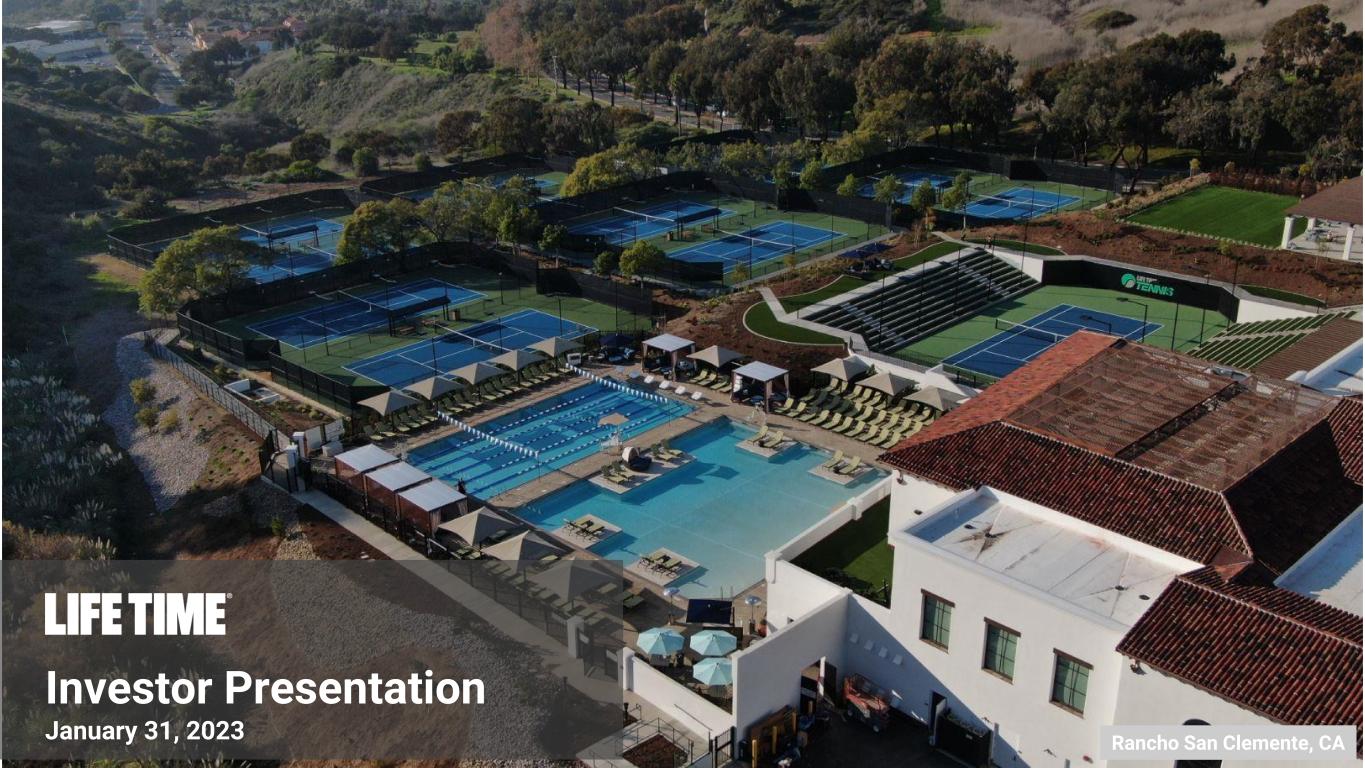

Investor Presentation January 31, 2023 Rancho San Clemente, CA

2 Legal Disclaimer Forward-Looking Statements This presentation includes “forward-looking statements” within the meaning of federal securities regulations. Forward-looking statements in this presentation include, but are not limited to, the plans, strategies and prospects, both business and financial, of Life Time Group Holdings, Inc. (“we,” “us” or the “Company”), including its unaudited preliminary financial results for the fourth quarter and full-year fiscal year 2022 and its financial outlook for fiscal year 2023, future performance, opportunities for growth and margin expansion, consumer demand, industry and economic trends and successful signings and closings of sale-leaseback transactions (including the amount, pricing and timing thereof). These statements are based on the beliefs and assumptions of the Company’s management. Forward-looking statements are inherently subject to risks, uncertainties and assumptions. Generally, statements that are not historical facts, including statements concerning the Company’s possible or assumed future actions, business strategies, events or results of operations, are forward-looking statements. These statements may be preceded by, followed by or include the words “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate” or similar expressions. In addition, any statements or information that refer to expectations, beliefs, plans, projections, objectives, performance or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking. Factors that could cause actual results to differ materially from those forward-looking statements included in this presentation include, but are not limited to, risks relating to our business operations and competitive and economic environment, risks relating to our brand, risks relating to the growth of our business, risks relating to our technological operations, risks relating to our capital structure, risks relating to our human capital, risks relating to legal compliance and risk management, risks relating to our financial performance and risks relating to ownership of our common stock and the other important factors discussed under the caption “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, filed with the Securities and Exchange Commission (the “SEC”) on March 10, 2022 (File No. 001-40887), as such factors may be updated from time to time in the Company’s other filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. These and other important factors could cause actual results to differ materially from those indicated by the forward-looking statements made in this presentation. Any forward-looking statement that the Company makes in this presentation speaks only as of the date of such statement. Except as required by law, the Company does not have any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements, whether as a result of new information, future events or otherwise. Non-GAAP Financial Measure This presentation includes Adjusted EBITDA, which is not presented in accordance with the generally accepted accounting principles in the United States (“GAAP”). This non-GAAP financial measure is not based on any comprehensive set of accounting rules or principles and should be considered in addition to, and not as a substitute for or superior to, net income (loss) as a measure of financial performance or any other performance measure derived in accordance with GAAP, and should not be construed as an inference that the Company’s future results will be unaffected by unusual or non-recurring items. In addition, this non-GAAP financial measure should be read in conjunction with the Company’s financial statements prepared in accordance with GAAP. The reconciliation of the Company’s non-GAAP financial measures to the corresponding GAAP measures should be carefully evaluated. Please note that the Company has not provided the most directly comparable GAAP financial measure, or a quantitative reconciliation thereto, for the Adjusted EBITDA forward-looking guidance for 2023 included in this presentation in reliance on the unreasonable efforts exception provided under Item 10(e)(1)(i)(B) of Regulation S-K. Providing the most directly comparable GAAP financial measure, or a quantitative reconciliation thereto, cannot be done without unreasonable effort due to the inherent uncertainty and difficulty in predicting certain non-cash, material and/or non-recurring expenses or benefits; legal settlements or other matters; and certain tax positions. The variability of these items could have an unpredictable, and potentially significant, impact on our future GAAP financial results. Preliminary Financial Results The preliminary financial results described herein are unaudited, based upon estimates, and subject to adjustment based on the completion of the Company’s year-end financial closing procedures. The preliminary financial results have been prepared by management solely on the basis of currently available information. The estimates do not represent, and are not a substitute for, a comprehensive statement of the Company’s financial results for the periods presented, and the Company’s actual results may differ from the estimates as a result of final adjustments, the completion of financial closing procedures, including the annual year-end independent audit review, and other developments after the date of this release. The Company expects to report its full fourth quarter and fiscal year 2022 financial results in March 2023.

3 2022 Preliminary Results McKinney at Craig Ranch, TX

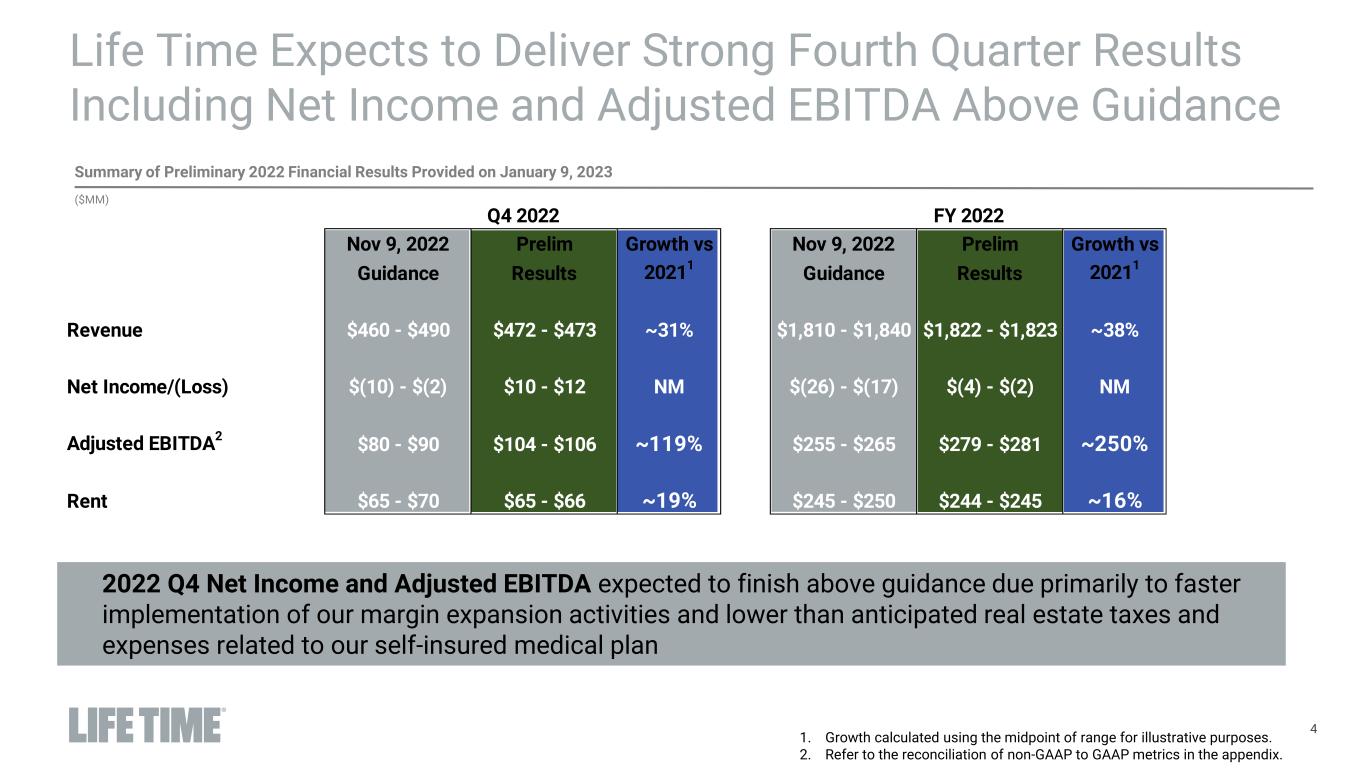

Presentation_08.02.21_v08.pptx 4 Life Time Expects to Deliver Strong Fourth Quarter Results Including Net Income and Adjusted EBITDA Above Guidance Summary of Preliminary 2022 Financial Results Provided on January 9, 2023 ($MM) 2022 Q4 Net Income and Adjusted EBITDA expected to finish above guidance due primarily to faster implementation of our margin expansion activities and lower than anticipated real estate taxes and expenses related to our self-insured medical plan 1. Growth calculated using the midpoint of range for illustrative purposes. 2. Refer to the reconciliation of non-GAAP to GAAP metrics in the appendix. Nov 9, 2022 Prelim Growth vs Nov 9, 2022 Prelim Growth vs Guidance Results 2021 1 Guidance Results 2021 1 Revenue $460 - $490 $472 - $473 ~31% $1,810 - $1,840 $1,822 - $1,823 ~38% Net Income/(Loss) $(10) - $(2) $10 - $12 NM $(26) - $(17) $(4) - $(2) NM Adjusted EBITDA 2 $80 - $90 $104 - $106 ~119% $255 - $265 $279 - $281 ~250% Rent $65 - $70 $65 - $66 ~19% $245 - $250 $244 - $245 ~16% Q4 2022 FY 2022

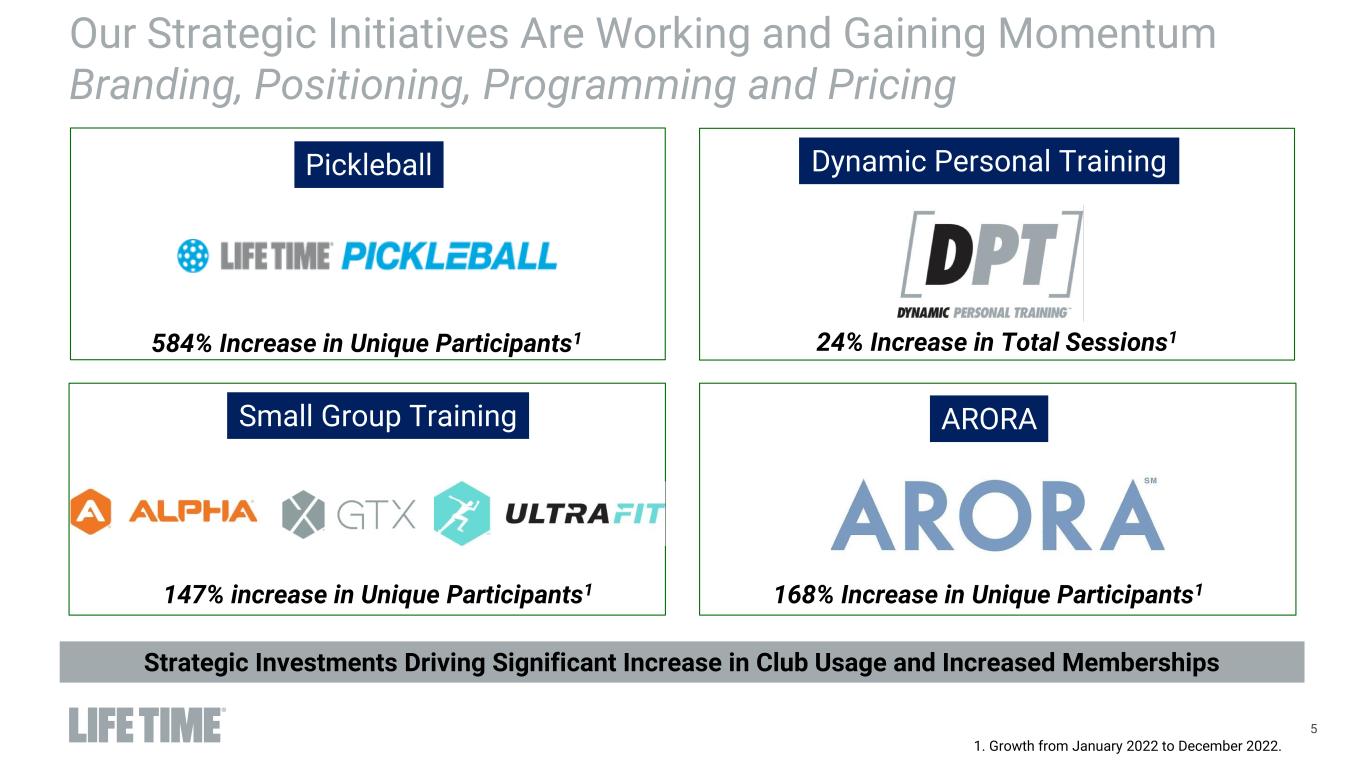

Presentation_08.02.21_v08.pptx 5 Our Strategic Initiatives Are Working and Gaining Momentum Branding, Positioning, Programming and Pricing Pickleball ARORA Dynamic Personal Training Small Group Training 1. Growth from January 2022 to December 2022. 147% increase in Unique Participants1 584% Increase in Unique Participants1 Strategic Investments Driving Significant Increase in Club Usage and Increased Memberships 168% Increase in Unique Participants1 24% Increase in Total Sessions1

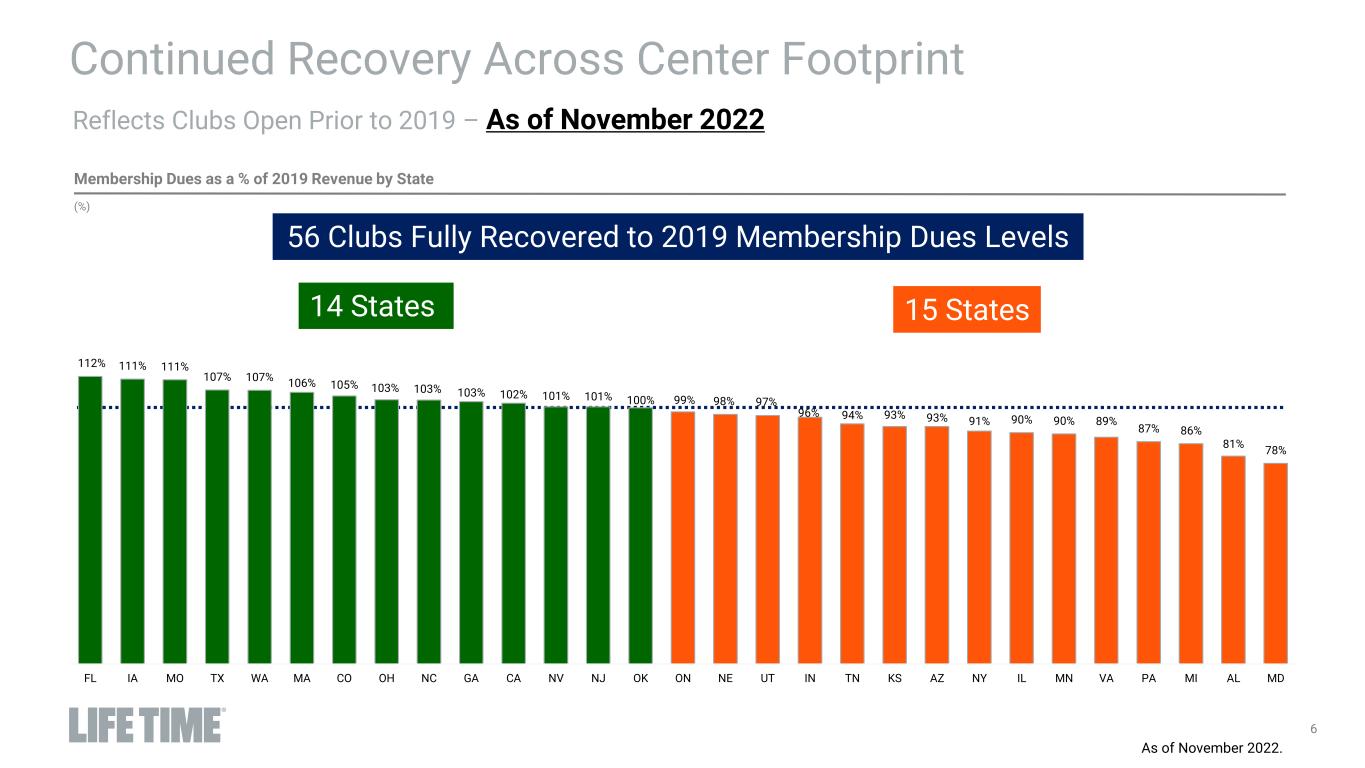

6 Membership Dues as a % of 2019 Revenue by State (%) Reflects Clubs Open Prior to 2019 – As of November 2022 Continued Recovery Across Center Footprint As of November 2022. 14 States 15 States 56 Clubs Fully Recovered to 2019 Membership Dues Levels 112% 111% 111% 107% 107% 106% 105% 103% 103% 103% 102% 101% 101% 100% 99% 98% 97% 96% 94% 93% 93% 91% 90% 90% 89% 87% 86% 81% 78% FL IA MO TX WA MA CO OH NC GA CA NV NJ OK ON NE UT IN TN KS AZ NY IL MN VA PA MI AL MD

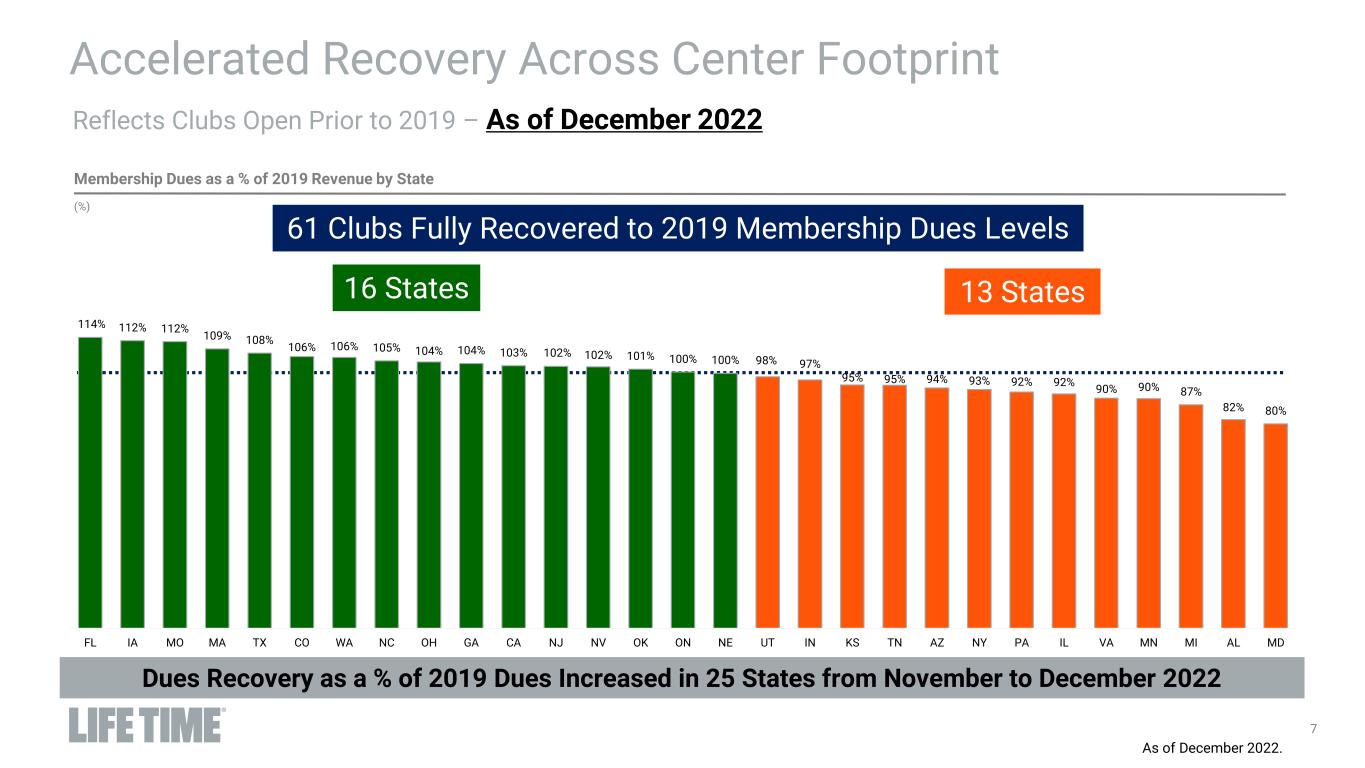

7 Membership Dues as a % of 2019 Revenue by State (%) Reflects Clubs Open Prior to 2019 – As of December 2022 Accelerated Recovery Across Center Footprint As of December 2022. 16 States 13 States 61 Clubs Fully Recovered to 2019 Membership Dues Levels 114% 112% 112% 109% 108% 106% 106% 105% 104% 104% 103% 102% 102% 101% 100% 100% 98% 97% 95% 95% 94% 93% 92% 92% 90% 90% 87% 82% 80% FL IA MO MA TX CO WA NC OH GA CA NJ NV OK ON NE UT IN KS TN AZ NY PA IL VA MN MI AL MD Dues Recovery as a % of 2019 Dues Increased in 25 States from November to December 2022

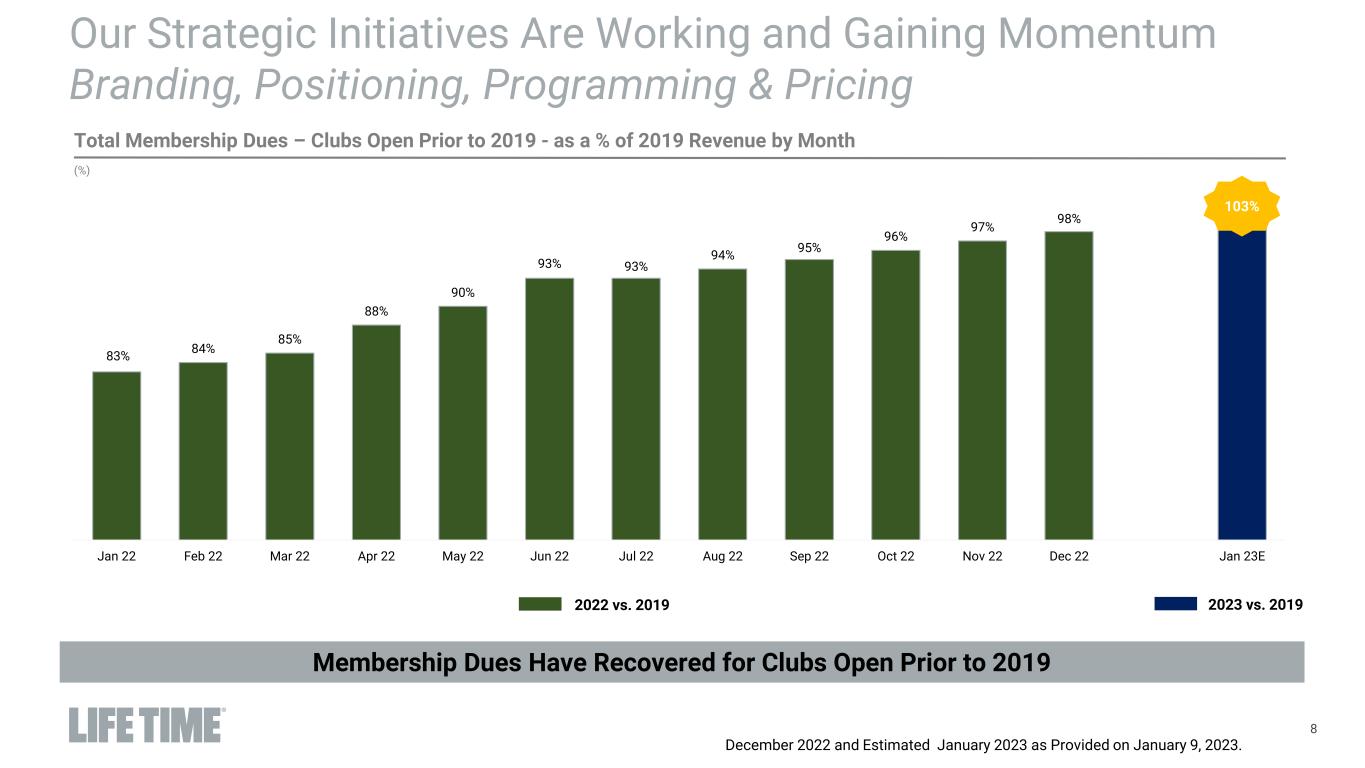

Presentation_08.02.21_v08.pptx 8 Our Strategic Initiatives Are Working and Gaining Momentum Branding, Positioning, Programming & Pricing 83% 84% 85% 88% 90% 93% 93% 94% 95% 96% 97% 98% Jan 22 Feb 22 Mar 22 Apr 22 May 22 Jun 22 Jul 22 Aug 22 Sep 22 Oct 22 Nov 22 Dec 22 Jan 23E Total Membership Dues – Clubs Open Prior to 2019 - as a % of 2019 Revenue by Month (%) Membership Dues Have Recovered for Clubs Open Prior to 2019 103% 2022 vs. 2019 2023 vs. 2019 103% December 2022 and Estimated January 2023 as Provided on January 9, 2023.

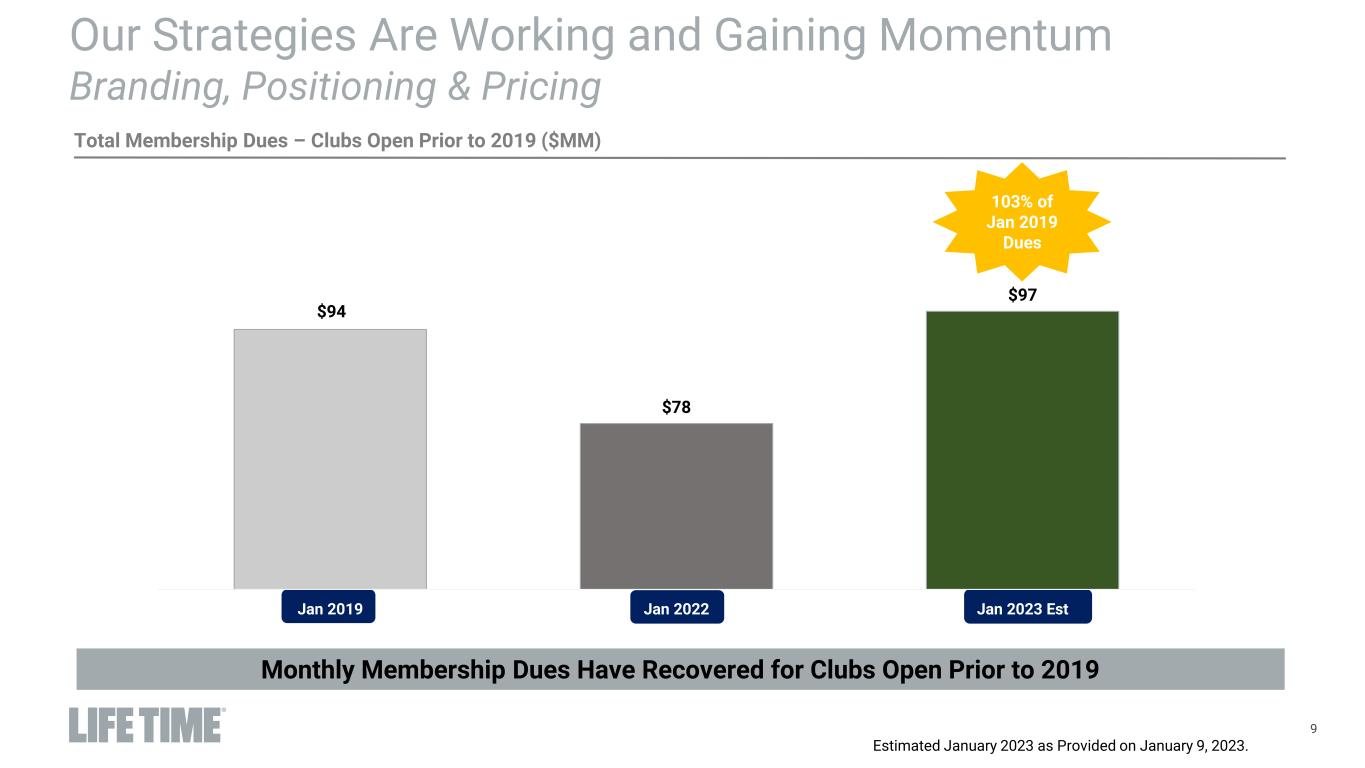

Presentation_08.02.21_v08.pptx 9 Our Strategies Are Working and Gaining Momentum Branding, Positioning & Pricing Total Membership Dues – Clubs Open Prior to 2019 ($MM) Monthly Membership Dues Have Recovered for Clubs Open Prior to 2019 $94 $78 $97 Jan 2019 Jan 2022 Jan 2023 Est 103% of Jan 2019 Dues Estimated January 2023 as Provided on January 9, 2023.

10 2023 Guidance Palm Beach Gardens, FL

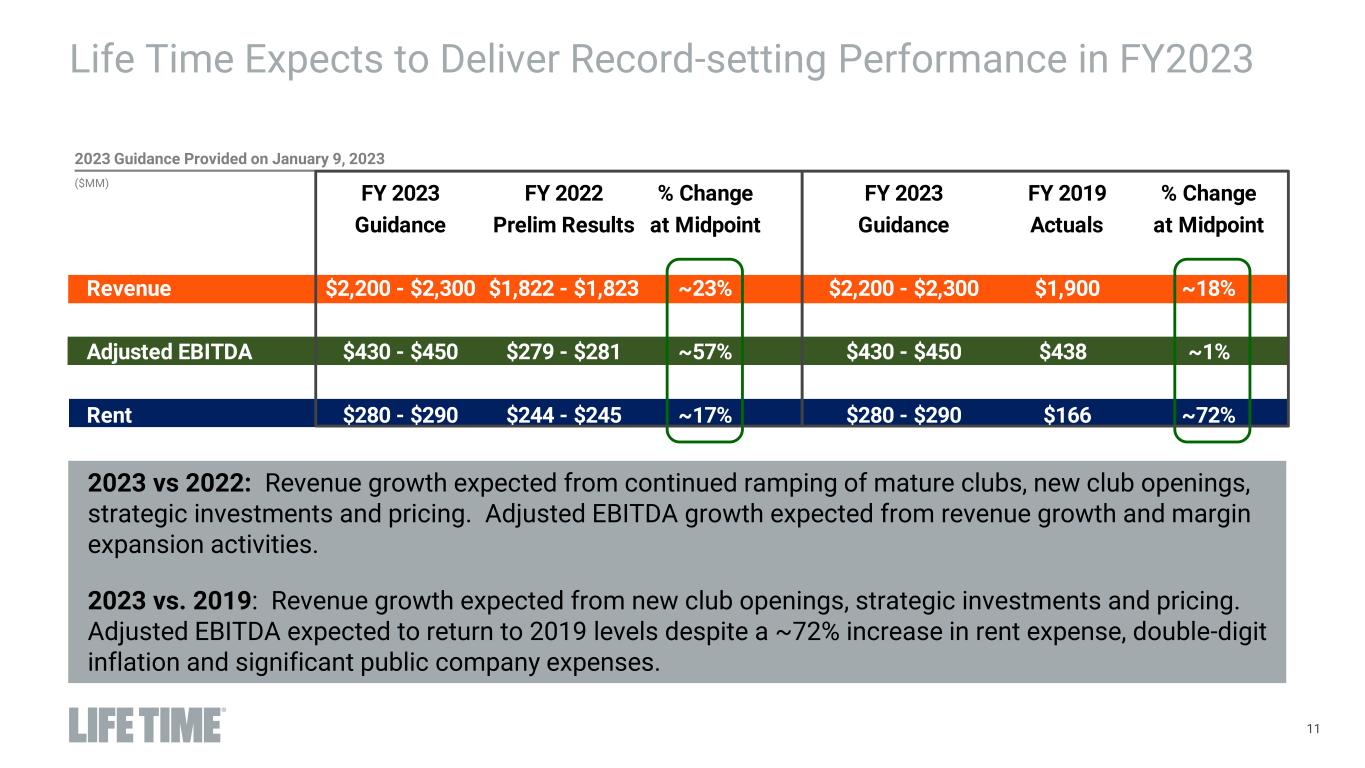

Presentation_08.02.21_v08.pptx 11 ($MM) Life Time Expects to Deliver Record-setting Performance in FY2023 2023 vs 2022: Revenue growth expected from continued ramping of mature clubs, new club openings, strategic investments and pricing. Adjusted EBITDA growth expected from revenue growth and margin expansion activities. 2023 vs. 2019: Revenue growth expected from new club openings, strategic investments and pricing. Adjusted EBITDA expected to return to 2019 levels despite a ~72% increase in rent expense, double-digit inflation and significant public company expenses. FY 2023 FY 2022 % Change FY 2023 FY 2019 % Change Guidance Prelim Results at Midpoint Guidance Actuals at Midpoint Revenue $2,200 - $2,300 $1,822 - $1,823 ~23% $2,200 - $2,300 $1,900 ~18% Adjusted EBITDA $430 - $450 $279 - $281 ~57% $430 - $450 $438 ~1% Rent $280 - $290 $244 - $245 ~17% $280 - $290 $166 ~72% 2023 Guidance Provided on January 9, 2023

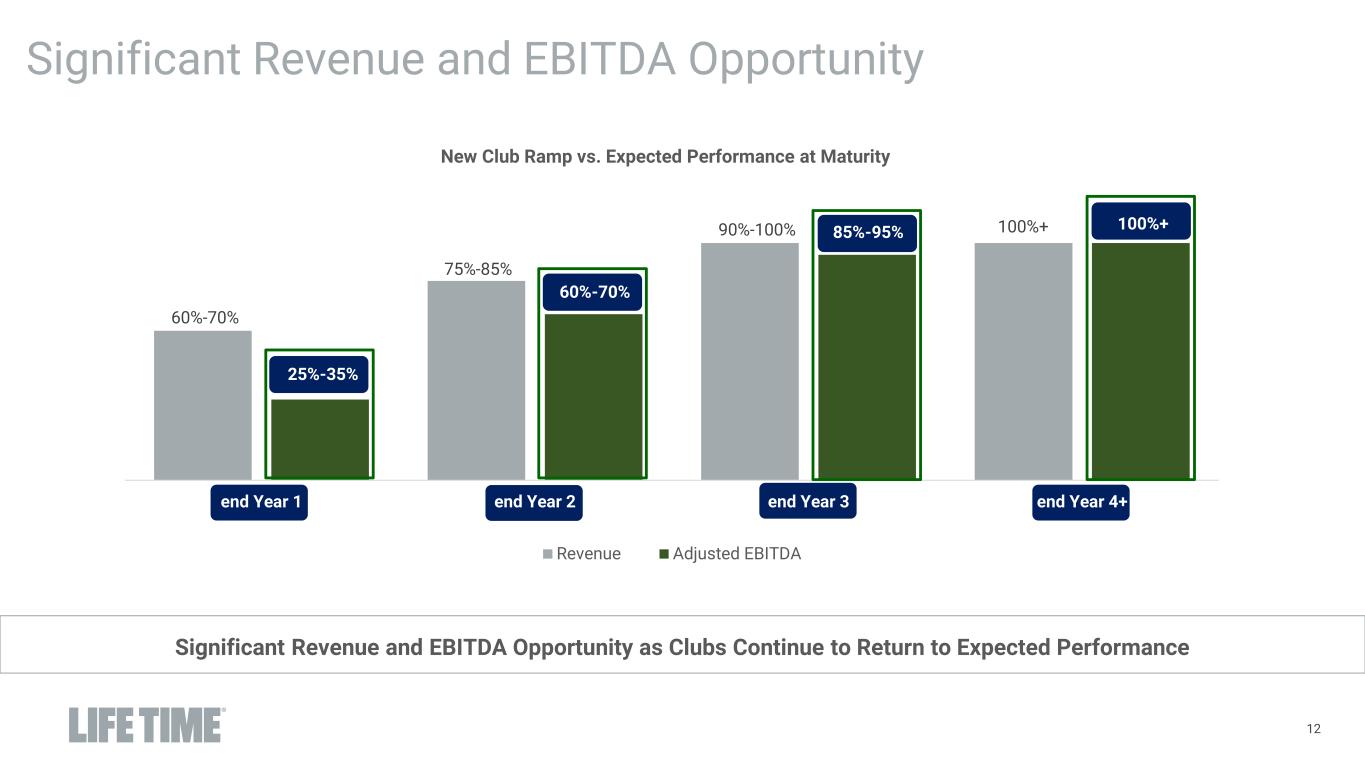

Presentation_08.02.21_v08.pptx 12 end Year 1 end Year 2 end Year 3 end Year 4+ New Club Ramp vs. Expected Performance at Maturity Revenue Adjusted EBITDA 85%-95%90%-100% 60%-70% 75%-85% 25%-35% 60%-70% 100%+ 100%+ 12 Significant Revenue and EBITDA Opportunity Significant Revenue and EBITDA Opportunity as Clubs Continue to Return to Expected Performance

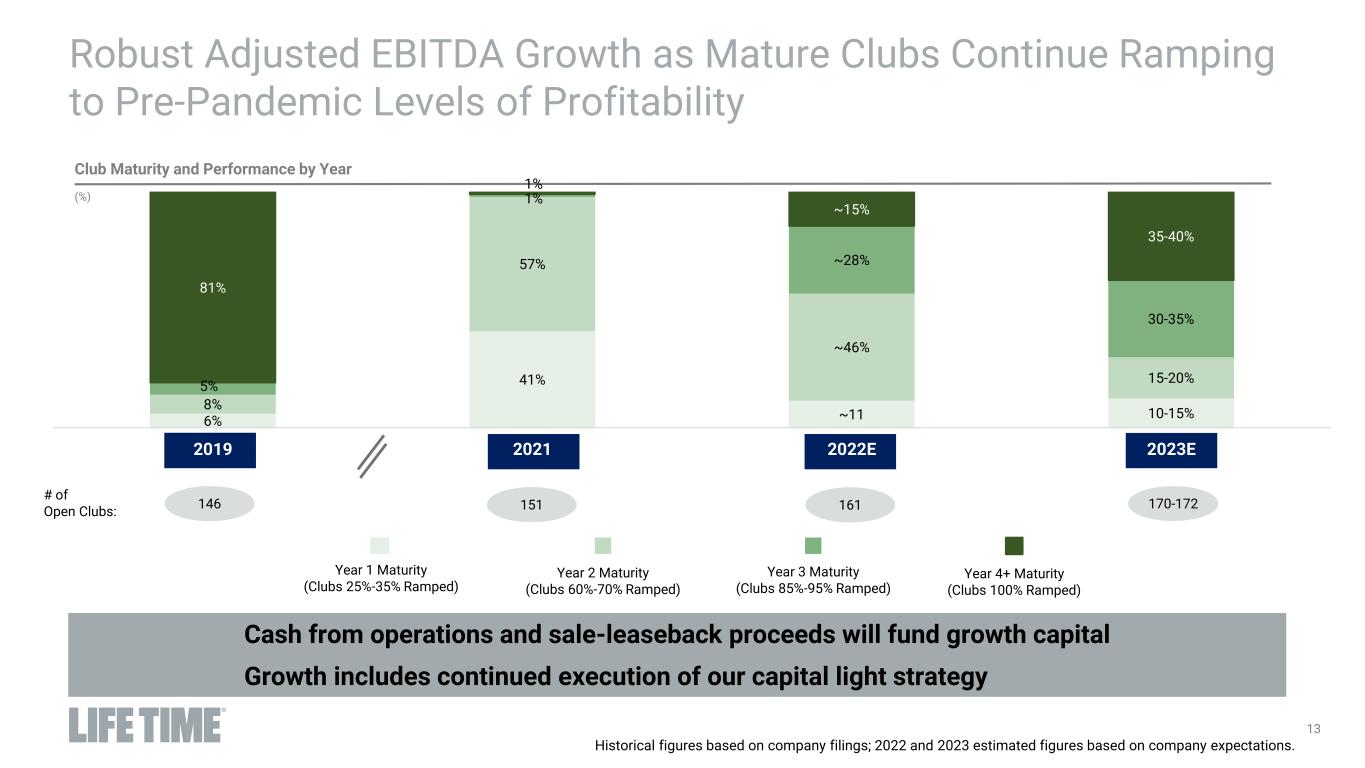

13 Year 2 Maturity (Clubs 60%-70% Ramped) Year 3 Maturity (Clubs 85%-95% Ramped) Year 4+ Maturity (Clubs 100% Ramped) Year 1 Maturity (Clubs 25%-35% Ramped) Robust Adjusted EBITDA Growth as Mature Clubs Continue Ramping to Pre-Pandemic Levels of Profitability Historical figures based on company filings; 2022 and 2023 estimated figures based on company expectations. # of Open Clubs: 146 151 161 170-172 Club Maturity and Performance by Year (%) Cash from operations and sale-leaseback proceeds will fund growth capital Growth includes continued execution of our capital light strategy 6% 41% ~11 10-15% 8% 57% ~46% 15-20% 5% 1% ~28% 30-35% 81% 1% ~15% 35-40% 2019 2021 2022E 2023E

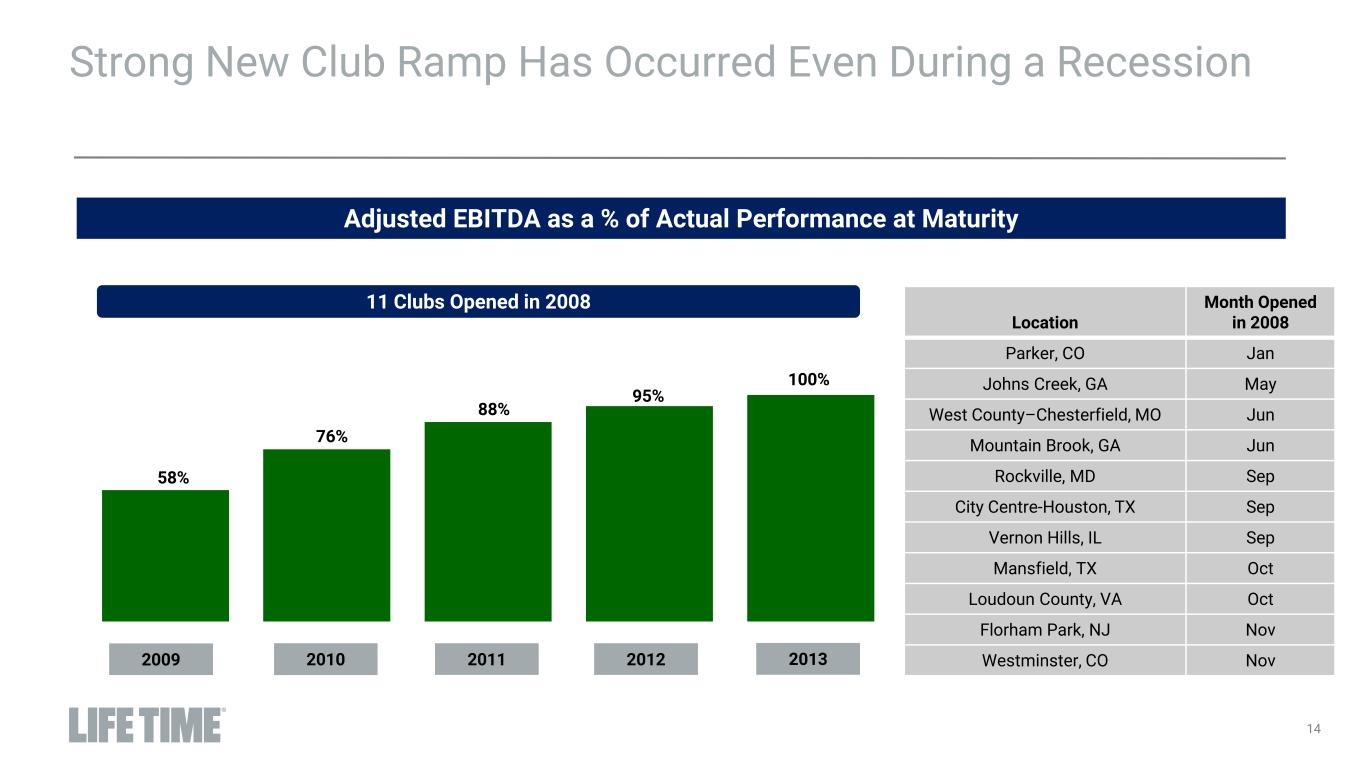

14 58% 76% 88% 2009 2010 20122011 95% 11 Clubs Opened in 2008 100% 2013 Strong New Club Ramp Has Occurred Even During a Recession Adjusted EBITDA as a % of Actual Performance at Maturity Location Month Opened in 2008 Parker, CO Jan Johns Creek, GA May West County–Chesterfield, MO Jun Mountain Brook, GA Jun Rockville, MD Sep City Centre-Houston, TX Sep Vernon Hills, IL Sep Mansfield, TX Oct Loudoun County, VA Oct Florham Park, NJ Nov Westminster, CO Nov

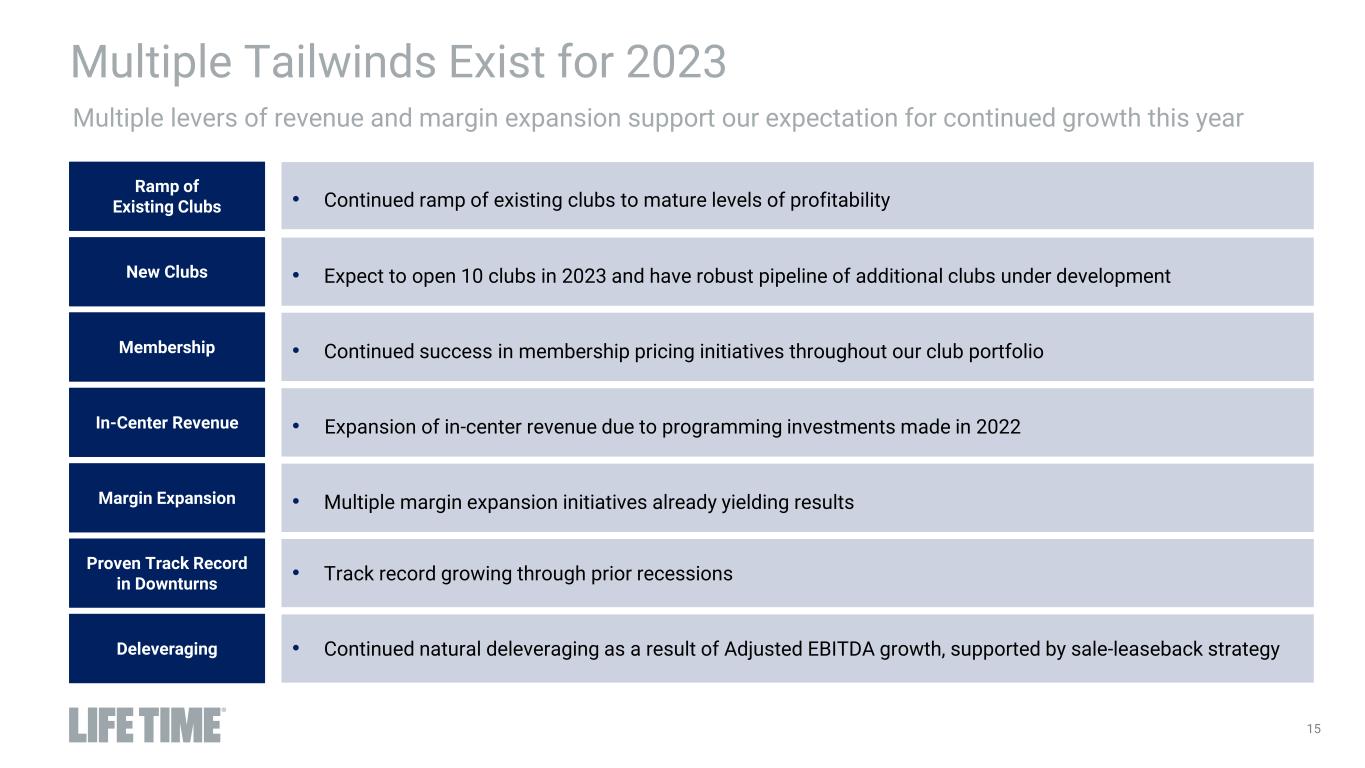

15 Multiple levers of revenue and margin expansion support our expectation for continued growth this year Multiple Tailwinds Exist for 2023 Ramp of Existing Clubs New Clubs Membership Margin Expansion Proven Track Record in Downturns In-Center Revenue Deleveraging • Continued ramp of existing clubs to mature levels of profitability • Expect to open 10 clubs in 2023 and have robust pipeline of additional clubs under development • Continued success in membership pricing initiatives throughout our club portfolio • Multiple margin expansion initiatives already yielding results • Track record growing through prior recessions • Expansion of in-center revenue due to programming investments made in 2022 • Continued natural deleveraging as a result of Adjusted EBITDA growth, supported by sale-leaseback strategy

16 Life Time Is Well Positioned for Future Growth Irvine - Lakeshore, CA

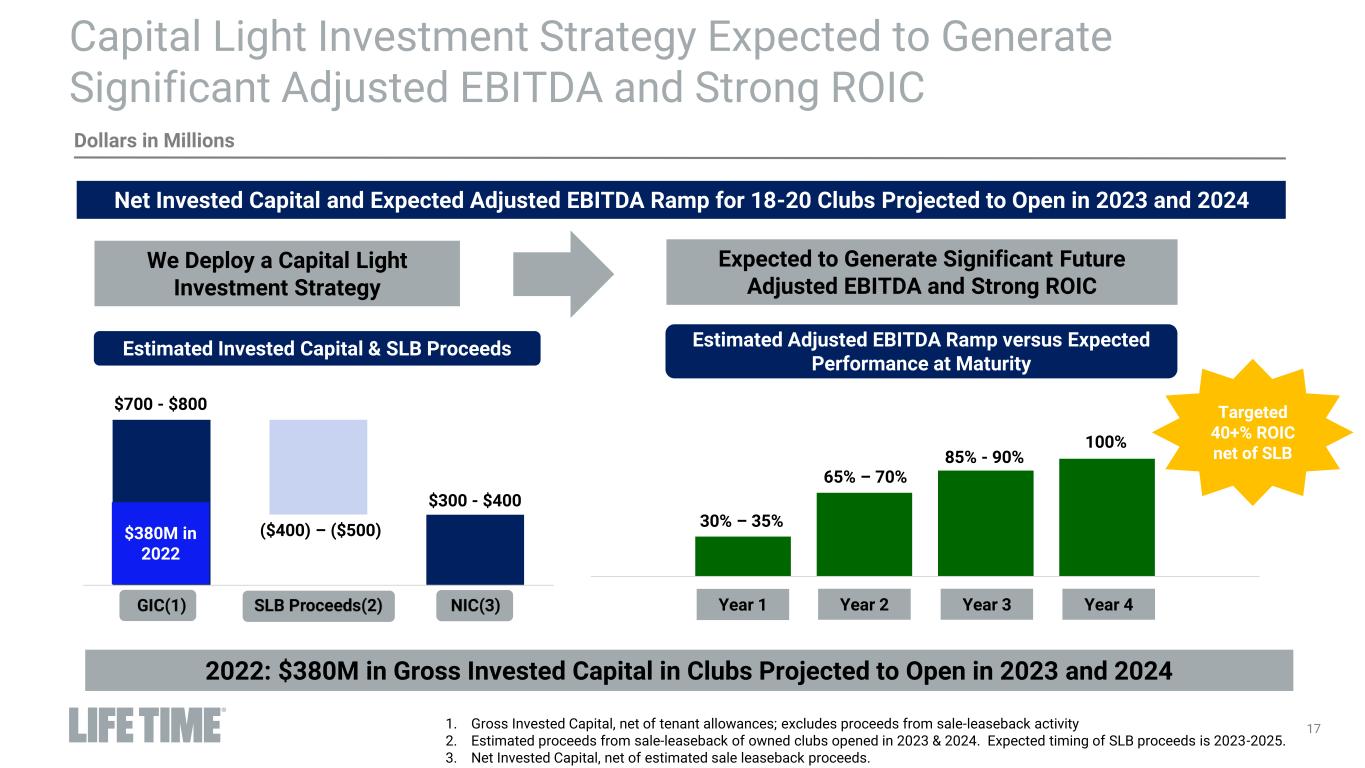

17 Adjusted EBITDA 30% – 35% 65% – 70% 85% - 90% Capital Light Investment Strategy Expected to Generate Significant Adjusted EBITDA and Strong ROIC Dollars in Millions We Deploy a Capital Light Investment Strategy 1. Gross Invested Capital, net of tenant allowances; excludes proceeds from sale-leaseback activity 2. Estimated proceeds from sale-leaseback of owned clubs opened in 2023 & 2024. Expected timing of SLB proceeds is 2023-2025. 3. Net Invested Capital, net of estimated sale leaseback proceeds. $700 - $800 ($400) – ($500) $300 - $400 Year 1 Year 2 Year 4Year 3 Expected to Generate Significant Future Adjusted EBITDA and Strong ROIC 100% Estimated Invested Capital & SLB Proceeds Estimated Adjusted EBITDA Ramp versus Expected Performance at Maturity Net Invested Capital and Expected Adjusted EBITDA Ramp for 18-20 Clubs Projected to Open in 2023 and 2024 Targeted 40+% ROIC net of SLB 2022: $380M in Gross Invested Capital in Clubs Projected to Open in 2023 and 2024 $380M in 2022 $3 in

18 Life Time Has Unique Strategic Position Existing Club Footprint New Club Pipeline Power of Life Time Brand Equity Consistent Track Record • Over 160 locations across North America • 80+ locations in various stages of discussion and development • Over 100 billion brand impressions • 30-year history of consistently delivering revenue and earnings growth Company did not grow revenue and adjusted EBITDA in 2020 due to COVID.

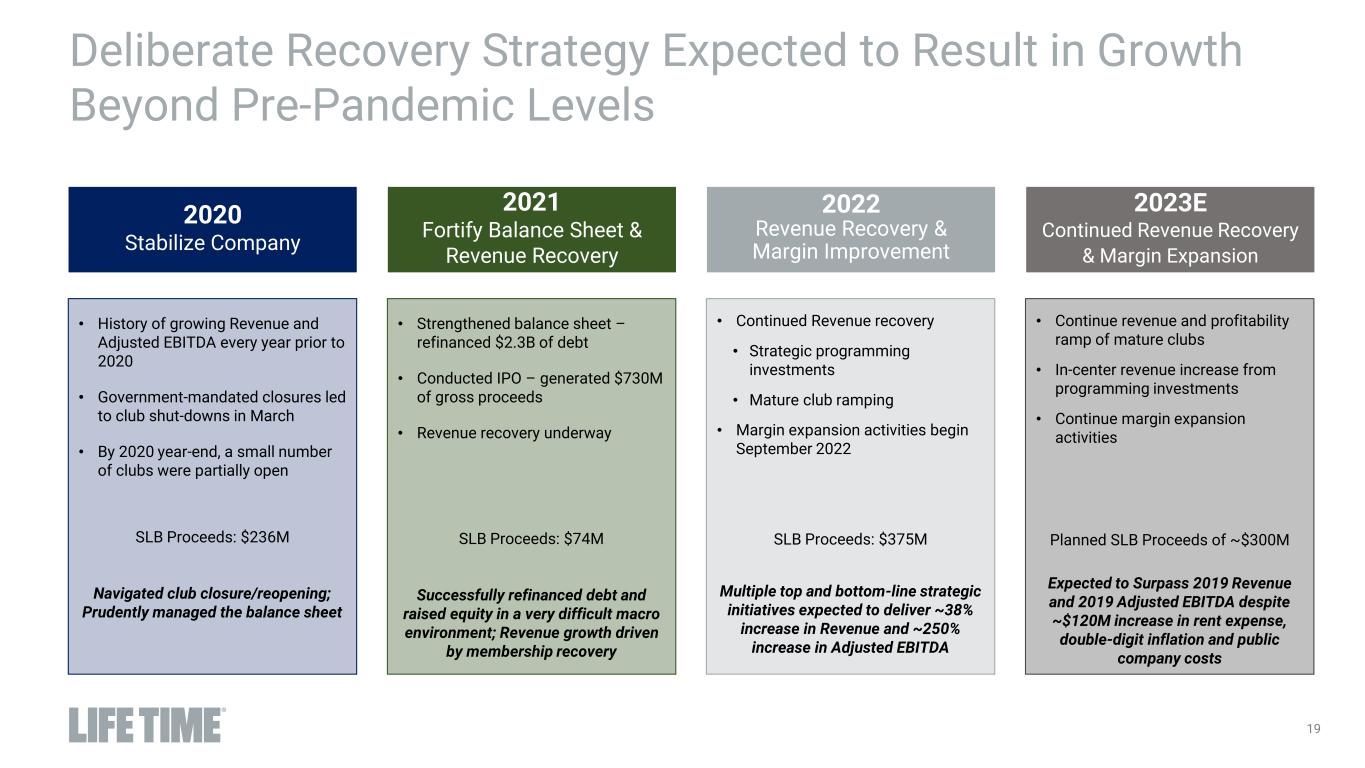

19 • Continue revenue and profitability ramp of mature clubs • In-center revenue increase from programming investments • Continue margin expansion activities Planned SLB Proceeds of ~$300M Expected to Surpass 2019 Revenue and 2019 Adjusted EBITDA despite ~$120M increase in rent expense, double-digit inflation and public company costs • History of growing Revenue and Adjusted EBITDA every year prior to 2020 • Government-mandated closures led to club shut-downs in March • By 2020 year-end, a small number of clubs were partially open SLB Proceeds: $236M Navigated club closure/reopening; Prudently managed the balance sheet • Strengthened balance sheet – refinanced $2.3B of debt • Conducted IPO – generated $730M of gross proceeds • Revenue recovery underway SLB Proceeds: $74M Successfully refinanced debt and raised equity in a very difficult macro environment; Revenue growth driven by membership recovery • Continued Revenue recovery • Strategic programming investments • Mature club ramping • Margin expansion activities begin September 2022 SLB Proceeds: $375M Multiple top and bottom-line strategic initiatives expected to deliver ~38% increase in Revenue and ~250% increase in Adjusted EBITDA 2020 Stabilize Company 2021 Fortify Balance Sheet & Revenue Recovery 2022 Revenue Recovery & Margin Improvement 2023E Continued Revenue Recovery & Margin Expansion Deliberate Recovery Strategy Expected to Result in Growth Beyond Pre-Pandemic Levels

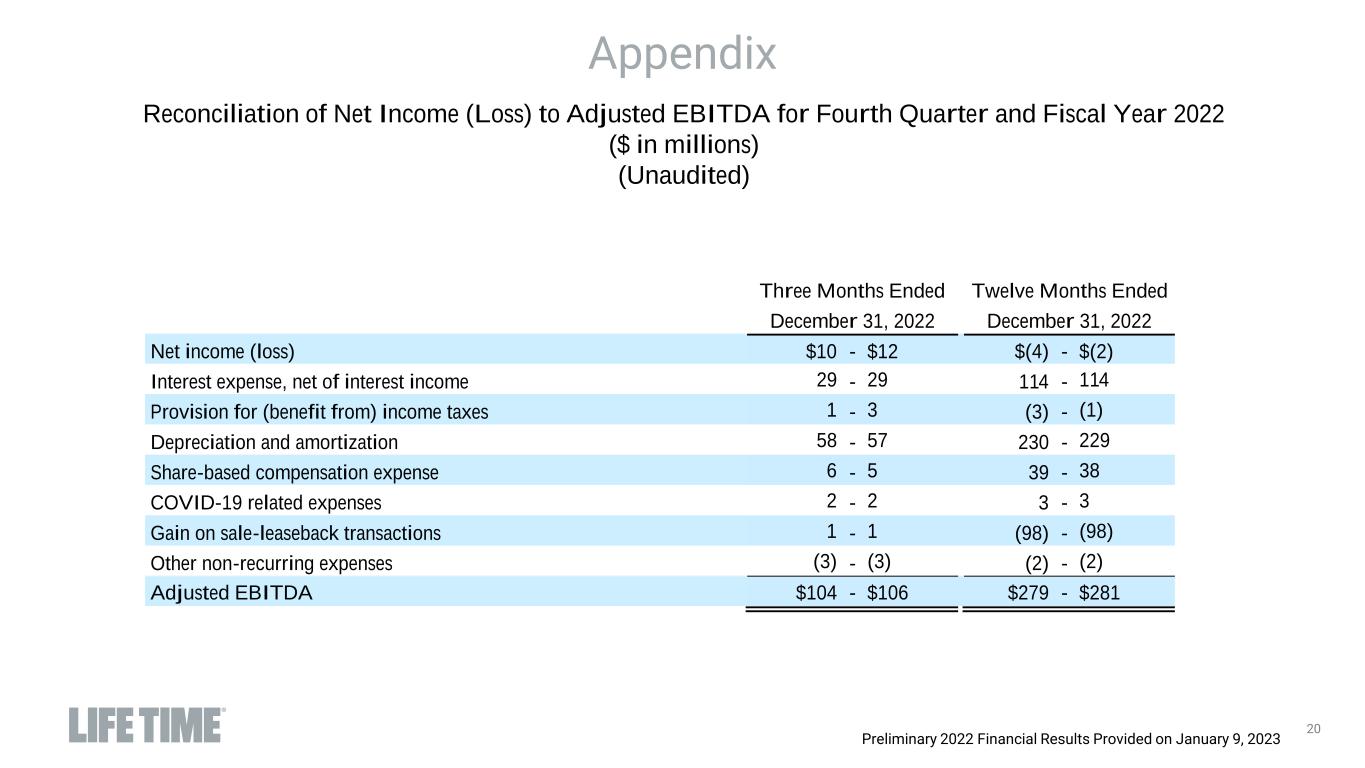

20 Reconciliation of Net Income (Loss) to Adjusted EBITDA for Fourth Quarter and Fiscal Year 2022 ($ in millions) (Unaudited) Three Months Ended Twelve Months Ended December 31, 2022 December 31, 2022 Net income (loss) $10 - $12 $(4) - $(2) Interest expense, net of interest income 29 - 29 114 - 114 Provision for (benefit from) income taxes 1 - 3 (3) - (1) Depreciation and amortization 58 - 57 230 - 229 Share-based compensation expense 6 - 5 39 - 38 COVID-19 related expenses 2 - 2 3 - 3 Gain on sale-leaseback transactions 1 - 1 (98) - (98) Other non-recurring expenses (3) - (3) (2) - (2) Adjusted EBITDA $104 - $106 $279 - $281 Appendix Preliminary 2022 Financial Results Provided on January 9, 2023