0001869198DEF 14AFALSE00018691982023-01-012023-12-31iso4217:USDxbrli:pure00018691982022-01-012022-12-3100018691982021-01-012021-12-310001869198ecd:PeoMemberlth:EquityAwardsReportedValueMember2023-01-012023-12-310001869198ecd:NonPeoNeoMemberlth:EquityAwardsReportedValueMember2023-01-012023-12-310001869198ecd:PeoMemberlth:EquityAwardsGrantedDuringTheYearUnvestedMember2023-01-012023-12-310001869198lth:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2023-01-012023-12-310001869198ecd:PeoMemberlth:EquityAwardsGrantedInPriorYearsUnvestedMember2023-01-012023-12-310001869198lth:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2023-01-012023-12-310001869198lth:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2023-01-012023-12-310001869198lth:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2023-01-012023-12-310001869198ecd:PeoMemberlth:EquityAwardsGrantedInPriorYearsVestedMember2023-01-012023-12-310001869198ecd:NonPeoNeoMemberlth:EquityAwardsGrantedInPriorYearsVestedMember2023-01-012023-12-310001869198ecd:PeoMemberlth:EquityAwardsGrantedInPriorYearsCanceledMember2023-01-012023-12-310001869198lth:EquityAwardsGrantedInPriorYearsCanceledMemberecd:NonPeoNeoMember2023-01-012023-12-31000186919812023-01-012023-12-3100018691981ecd:NonPeoNeoMember2023-01-012023-12-3100018691982ecd:NonPeoNeoMember2023-01-012023-12-3100018691983ecd:NonPeoNeoMember2023-01-012023-12-31

______________________________________________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

______________________________________________________________________________________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

______________________________________________________________________________________________________

Filed by the Registrant x Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | | | | |

| ☐ | | Preliminary Proxy Statement |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ☐ | | Definitive Additional Materials |

| ☐ | | Soliciting Material under § 240.14a-12 |

Life Time Group Holdings, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | | | | | | | | | | |

| x | | No fee required |

| ☐ | | Fee paid previously with preliminary materials |

| ☐ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

___________________________________________________________________________________________________________________________________________________________________________

LETTER FROM OUR FOUNDER, CHAIRMAN AND CHIEF EXECUTIVE OFFICER

We are pleased to invite you to our 2024 annual meeting of stockholders, which will be held virtually by webcast on April 26, 2024, at 9:30 a.m. Central Time. The enclosed notice of annual meeting and proxy statement describe the items of business we will conduct at the meeting and provide information about Life Time, including our practices in the areas of corporate governance and executive compensation. We encourage you to read these materials before you vote your shares.

2023 was an incredible year for Life Time. We achieved our operating and strategic objectives and exceeded our financial goals, including setting record levels of revenue and profitability. We made significant progress on improving our balance sheet. We expanded our portfolio in an asset-light manner with 11 new locations opened. We successfully executed our strategy to deliver premium member experiences and increase member engagement through our strategic programming initiatives that include Dynamic Personal Training, Dynamic Stretch, small group training, pickleball and our ARORA community for 55+ active adults. These initiatives also helped us further differentiate Life Time as a premium, healthy lifestyle company and leisure brand.

We are equally excited about the opportunities we have in 2024. We plan to continue to improve our balance sheet, grow our revenue and profitability and execute our asset-light growth strategy. Our plan remains grounded in our more than 30-year commitment to provide our members with unparalleled offerings that allow them to achieve healthier, happier lives through our comprehensive Healthy Way of Life ecosystem – featuring the best places, people, programs and experiences.

We have operated from the member point of view since the very beginning and remain steadfast in these commitments:

•upholding a culture of care that ensures our team and members are welcomed, supported, recognized and empowered;

•making Life Time a place for everyone with inclusion, diversity and respect as core principles;

•operating in ways that protect the health of our communities and planet; and

•ensuring Life Time continues to be one of the most trusted and loved leisure brands.

We are extremely proud of the company and brand we have built and could not be more excited about the future that lies ahead. Our leadership team, board of directors and I remain as committed as ever to grow long-term value in our company and we believe we are well positioned for success. Thank you for investing in us.

Bahram Akradi

Founder, Chairman and Chief Executive Officer

Life Time Group Holdings, Inc.

LIFE TIME GROUP HOLDINGS, INC.

______________________________________________________________________________________________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON APRIL 26, 2024

______________________________________________________________________________________________________

March 14, 2024

Dear Stockholder:

You are cordially invited to attend the 2024 annual meeting of the stockholders (the “Annual Meeting”) of Life Time Group Holdings, Inc., a Delaware corporation (“we,” “us,” “Life Time” or the “Company”). The Annual Meeting will be held in a virtual meeting format on Friday, April 26, 2024 at 9:30 a.m. (Central Time) for the following purposes:

1. To elect the four nominees for Class III director to serve until the 2027 annual meeting of stockholders and until their successors are duly elected and qualified. The nominees for election are Jimena Almendares, Donna Coallier, John Danhakl and Paul Hackwell.

2. To hold an advisory (non-binding) vote to approve the Company’s named executive officer compensation (referred to as the “Say-on-Pay Vote”).

3. To ratify the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024.

4. To conduct any other business properly brought before the Annual Meeting or any adjournments or postponements thereof.

These items of business are more fully described in the proxy statement accompanying this Notice of Annual Meeting of Stockholders.

The record date for the Annual Meeting is February 28, 2024 (the “Record Date”). Only stockholders of record at the close of business on the Record Date may vote at the Annual Meeting or any adjournments or postponements thereof.

The Annual Meeting will be held in a virtual meeting format only, via the internet, with no physical in-person meeting. You will be able to attend and participate in the Annual Meeting online by visiting

www.virtualshareholdermeeting.com/LTH2024, where you will be able to attend, vote and submit questions via the internet similar to attendance at an in-person meeting. If you plan to participate in the virtual Annual Meeting, please see the Questions and Answers section below for further information.

Your vote is important. Whether or not you plan to attend the Annual Meeting, please vote your shares of common stock by telephone or via the internet promptly. Voting your shares promptly will ensure the presence of a quorum at the Annual Meeting and will save us the expense of further solicitation.

Please vote your shares by following the instructions for voting on the Important Notice Regarding the Internet Availability of Proxy Materials. You may submit your vote by telephone or via the internet, or if you received printed copies of the proxy materials, you may submit your vote by signing, dating and returning your proxy card by mail.

By Order of the Board of Directors

Erik Lindseth

Senior Vice President, General Counsel and Corporate Secretary

Chanhassen, Minnesota

Table of Contents

______________________________________________________________________________________________________

Life Time Group Holdings, Inc.

2902 Corporate Place

Chanhassen, Minnesota 55317

______________________________________________________________________________________________________

PROXY STATEMENT

FOR THE 2024 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON APRIL 26, 2024

______________________________________________________________________________________________________

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why did I receive a one-page notice in the mail regarding the internet availability of proxy materials instead of a full set of proxy materials?

Pursuant to “Notice and Access” rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the internet. Accordingly, we are sending an Important Notice Regarding the Internet Availability of Proxy Materials (the “Notice”) to our stockholders of record. Brokers and other nominees will be sending a similar Notice to all beneficial owners of stock who hold their shares through such broker or nominee. All record and beneficial stockholders will have the ability to access the proxy materials on the website referred to in the Notice free of charge or request to receive a printed set of the proxy materials for the Annual Meeting. Instructions on how to access the proxy materials over the internet or to request a printed copy may be found in the Notice.

We expect that the Notice or, if applicable, this Proxy Statement will be mailed to stockholders on or about March 14, 2024.

Important Notice Regarding the Internet Availability of Proxy Materials for the Annual Meeting

to be held on April 26, 2024 at 9:30 a.m. (Central Time) via the internet

please visit www.virtualshareholdermeeting.com/LTH2024 for more details

This Proxy Statement and our 2023 Annual Report on Form 10-K are available at: www.proxyvote.com.

How do I attend the Annual Meeting?

The 2024 annual meeting of stockholders (the “Annual Meeting”) will be held on Friday, April 26, 2024 at 9:30 a.m. (Central Time). The Annual Meeting will be conducted as a virtual meeting via the internet. Stockholders as of our Record Date may attend, vote and submit questions electronically during the Annual Meeting via live webcast by visiting the virtual meeting platform at www.virtualshareholdermeeting.com/LTH2024. Stockholders will need the 16-digit control number included in the Notice, on the proxy card or in the instructions that accompanied the proxy materials to enter the Annual Meeting. Stockholders may log into the virtual meeting platform beginning at 9:15 a.m. (Central Time) on April 26, 2024. The Annual Meeting will begin promptly at 9:30 a.m. (Central Time) on April 26, 2024. If we determine to make any change to the date, time or procedures of the Annual Meeting, we will announce such changes in advance on our website at https://ir.lifetime.life and file such changes with the SEC as additional proxy materials.

Whether or not you plan to attend the Annual Meeting, we urge you to vote and submit your proxy in advance of the Annual Meeting by one of the methods described in these proxy materials.

Information on how to vote at the Annual Meeting is discussed below.

What if I have technical difficulties during the meeting or trouble accessing the virtual Annual Meeting?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting. If you encounter any difficulties accessing the virtual meeting during check-in or the meeting, please call the technical support number that will be posted on the virtual meeting platform log-in page.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on the Record Date of February 28, 2024 will be entitled to vote at the Annual Meeting. On the Record Date, there were 196,705,443 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If, on February 28, 2024, your shares were registered directly in your name with Life Time’s transfer agent, Equiniti Trust Company, LLC (formerly named American Stock Transfer & Trust Company, LLC), then you are a stockholder of record. As a stockholder of record, you may vote at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy over the telephone or on the internet as instructed below (see “How do I vote?” below) or, if applicable, complete, date, sign and return the proxy card mailed to you to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Other Nominee

If, on February 28, 2024, your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice is being sent to you by the organization that holds your account. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker, bank or other nominee regarding how to vote the shares in your account. The deadline for submitting your voting instructions to your broker, bank or other nominee is listed on the Notice sent to you. You are also invited to attend the Annual Meeting.

What am I voting on?

There are three matters scheduled for a vote:

•Proposal 1: Election of four Class III directors to serve until the 2027 annual meeting of stockholders and until their successors are duly elected and qualified.

•Proposal 2: Approval, in a non-binding advisory vote, of the Company’s named executive officer compensation (referred to as the “Say-on-Pay Vote”).

•Proposal 3: Ratification of the selection of Deloitte & Touche LLP (“Deloitte”) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024.

See “How many votes are needed to approve each proposal and how does the Board recommend I vote?” below for information on how many votes are required to approve each matter, the voting options for each matter, the impact of various voting options on the outcome of the vote and the Board’s recommendation on how stockholders should vote on each matter.

What if another matter is properly brought before the Annual Meeting?

The Board of Directors of the Company (the “Board” or the “Board of Directors”) knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, the persons named in the accompanying proxy will vote the shares for which you grant your proxy on those matters in accordance with their best judgment.

How do I vote?

The procedures for voting depend on whether you are a stockholder of record or a beneficial owner (see “Who can vote at the Annual Meeting” above):

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote by proxy through the internet, vote by proxy over the telephone, vote by proxy using a proxy card provided by us or vote at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Annual Meeting and vote even if you have already voted by proxy. Voting at the Annual Meeting will have the effect of revoking your previously submitted proxy (see “Can I change my vote after submitting my proxy?” below).

| | | | | |

| By Internet | If you received the Notice or a printed copy of the Proxy Materials, then follow the instructions in the Notice or on the proxy card. |

| |

| By Telephone | If you received the Notice or a printed copy of the Proxy Materials, then follow the instructions in the Notice or on the proxy card. |

| |

| By Mail | If you received a printed copy of the Proxy Materials, then complete, sign, date, and mail your proxy card in the enclosed, postage-prepaid envelope. |

| |

In Person (Virtual) | You may also vote in person virtually by attending the Annual Meeting at www.virtualshareholdermeeting.com/LTH2024. |

Beneficial Owner: Shares Registered in the Name of Broker, Bank or Other Nominee

If you hold your shares through a broker, bank or other nominee (that is, in street name), you will receive a Notice from your broker, bank or nominee that includes instructions that you must follow in order to submit your voting instructions and have your shares voted at the Annual Meeting. You may be instructed to obtain a legal proxy from your broker, bank or other nominee and to submit a copy in advance of the Annual Meeting.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of February 28, 2024, the Record Date.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid stockholder meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares entitled to vote are present or represented by proxy at the Annual Meeting. On the Record Date, there were 196,705,443 shares outstanding and entitled to vote. Thus, the holders of at least 98,352,722 shares must be present or represented by proxy at the Annual Meeting to have a quorum.

Your shares will be counted toward the quorum only if you submit a valid proxy by mail, over the phone or through the internet (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote at the Annual Meeting. Abstentions, votes that are withheld and broker non-votes will be counted toward the quorum requirement. If there is no quorum, then either the chair of the Annual Meeting or the holders of a majority in voting power of the stockholders entitled to vote at the meeting that are present at the Annual Meeting or represented by proxy may adjourn the meeting to another date. At any adjourned Annual Meeting at which a quorum is present, any business may be transacted that might have been transacted at the Annual Meeting as originally notified. If the adjournment is for more than 30 days, or if after that adjournment a new record date is fixed for the adjourned Annual Meeting, a notice of the adjourned Annual Meeting shall be given to each stockholder of record entitled to vote at the adjourned Annual Meeting.

What are “broker non-votes”?

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker, bank or other nominee holding the shares as to how to vote on “non-routine” proposals. Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker, bank or other nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker, bank or other nominee can still vote the shares with respect to matters that are considered to be “routine” under applicable rules but cannot vote the shares with respect to “non-routine” matters. On non-routine proposals, any “uninstructed shares” may not be voted by the broker, bank or nominee and are considered to be “broker non-votes.” Only the proposal to ratify the selection of our independent registered public accounting firm is considered a “routine” matter for this purpose, and brokers, banks or other nominees generally have discretionary voting power with respect to such proposal. Brokers, banks and other nominees do not have authority to vote on the election of directors or the Say-on-Pay Vote without voting instruction from the beneficial owner. Broker non-votes will be counted for the purpose of determining whether a quorum is present at the Annual Meeting.

How many votes are needed to approve each proposal and how does the Board recommend I vote?

| | | | | | | | | | | | | | | | | | | | |

Proposal | | Votes Required | Voting Options | Impact of Abstentions, Withheld Votes and Broker Non-Votes | Broker Discretionary Voting Allowed | Board Recommen-dation |

Proposal No. 1: Election of director nominees | | A plurality of the votes cast | “FOR ALL”

“WITHHOLD ALL” “FOR ALL EXCEPT” | None | No | FOR ALL |

Proposal No. 2: Approval, on an advisory (non-binding) basis, of Say-on-Pay Vote | | A majority of the votes cast | “FOR”

“AGAINST”

“ABSTAIN” | None | No | FOR |

Proposal No. 3: Ratification of selection of Deloitte | | A majority of the votes cast | “FOR”

“AGAINST”

“ABSTAIN” | None | Yes | FOR |

A plurality of the votes cast, with regard to the election of directors, means that the four nominees who receive the most “FOR” votes cast by the holders of shares either present at the Annual Meeting or represented by proxy will be elected to our Board. A majority of the votes cast means that the number of votes cast “FOR” a proposal must exceed the number of votes cast “AGAINST” that proposal.

What if I return a proxy card, or otherwise vote, but do not make specific choices?

If you return a signed and dated proxy card, or otherwise vote, without marking voting selections, your shares will be voted as the Board recommends, as set forth in the table above. If any other matter is properly presented at the Annual Meeting, your proxy holder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways before the close of voting for the Annual Meeting:

•You may timely submit another properly completed proxy card with a later date.

•You may grant a subsequent timely proxy by telephone or through the internet.

•You may send a timely written notice that you are revoking your proxy to Life Time’s Secretary at 2902 Corporate Place, Chanhassen, Minnesota 55317; provided, however, if you intend to revoke your proxy by providing such written notice, we advise that you also send a copy via email to investorrelations@lifetime.life.

•You may attend and vote at the Annual Meeting. Simply attending the Annual Meeting will not, by itself, revoke your proxy.

Your most current proxy card or telephone or internet proxy is the one that is counted, so long as it is received by the applicable deadline. If your shares are held by your broker, banker or other nominee, you should follow the instructions provided by your broker, bank or other nominee to change your vote or revoke your proxy.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a Current Report on Form 8-K that we expect to file with the SEC within four business days after the Annual Meeting.

Who is paying for this proxy solicitation?

The accompanying proxy is solicited on behalf of the Board for use at the Annual Meeting. Accordingly, the Company will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone or by other means of communication. Directors and employees of the Company will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other nominees for the cost of forwarding proxy materials to beneficial owners.

How can I access the list of stockholders entitled to vote at the Annual Meeting?

A complete list of stockholders of record on the Record Date will be available by request to investorrelations@lifetime.life for examination at our corporate offices by any stockholder for any purpose germane to the Annual Meeting for a period of 10 days prior to the Annual Meeting. To access the list during the Annual Meeting, please follow instructions you receive via email.

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on each Notice to ensure that all of your shares are voted.

When are stockholder proposals for inclusion in our Proxy Statement for next year’s annual meeting due?

Stockholders wishing to present proposals for inclusion in our proxy statement for the 2025 annual meeting of stockholders (the “2025 Annual Meeting”) pursuant to Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), must submit their proposals so that they are received by us at our principal executive offices no later than November 14, 2024. Proposals should be sent to Life Time’s Secretary at 2902 Corporate Place, Chanhassen, Minnesota 55317.

When are other proposals and stockholder nominations for the 2025 Annual Meeting due?

With respect to proposals and nominations not to be included in our proxy statement pursuant to Rule 14a-8 of the Exchange Act, the Third Amended and Restated Bylaws of Life Time Group Holdings, Inc. (our “Bylaws”) provide that stockholders who wish to nominate a director or propose other business to be brought before the stockholders at an annual meeting of stockholders must notify our Secretary by a written notice, which notice must be received at our principal executive offices not less than 90 days nor more than 120 days prior to the anniversary date of the immediately preceding year’s annual meeting of stockholders.

Stockholders wishing to present nominations for director or proposals for consideration at the 2025 Annual Meeting under these provisions of our Bylaws must submit their nominations or proposals so that they are received at our principal executive offices not earlier than December 27, 2024 and not later than January 26, 2025 in order to be considered. In the event that the 2025 Annual Meeting is to be held on a date that is not within 30 days before or 60 days after the one-year anniversary of the Annual Meeting, then a stockholder’s notice must be received by the Secretary no earlier than 90 days prior to such annual meeting or, if later, no later than the tenth day following the day on which we first make a public announcement of the date of the 2025 Annual Meeting. In addition to satisfying the foregoing requirements, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than the Board’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than February 25, 2025.

Nominations or proposals should be sent in writing to Life Time’s Secretary at 2902 Corporate Place, Chanhassen, Minnesota 55317. A stockholder’s notice to nominate a director or bring any other business before the Annual Meeting or the 2025 Annual Meeting must set forth certain information, which is specified in our Bylaws.

If you have any questions or need assistance in voting your shares, please write to Life Time’s Investor Relations at investorrelations@lifetime.life.

PROPOSAL 1: ELECTION OF DIRECTORS

The Board of Directors is presently divided into three classes with staggered three-year terms. At each annual meeting of stockholders, the successors to the directors whose terms will then expire will be elected to serve from the time of election and qualification until the third annual meeting following their election and until their successors are duly elected and qualified. Class I directors, with a term expiring at the 2025 annual meeting of stockholders, consist of Bahram Akradi, David Landau, Alejandro Santo Domingo and Andres Small; Class II directors, with a term expiring at the 2026 annual meeting of stockholders, consist of Joel Alsfine, Jonathan Coslet, J. Kristofer Galashan and Stuart Lasher; and Class III directors, with a term expiring at the Annual Meeting, consist of Jimena Almendares, Donna Coallier, John Danhakl and Paul Hackwell.

The Nominating and Corporate Governance Committee of the Board of Directors has recommended, and the Board has approved, the nomination of our Class III directors, Jimena Almendares, Donna Coallier, John Danhakl and Paul Hackwell, for re-election for three-year terms expiring at the 2027 annual meeting of stockholders and until their respective successors are duly elected and qualified, or, if sooner, until the director’s death, resignation or removal. Each of these nominees is currently a director of the Company.

Proxies cannot be voted for a greater number of persons than the number of nominees named in this Proxy Statement. If any nominee should become unavailable to serve for any reason, it is intended that votes will be cast for a substitute nominee designated by the Nominating and Corporate Governance Committee and approved by the Board of Directors. We have no reason to believe that any nominee named will be unable to serve if elected.

Nominees for Director and Continuing Directors

The names and ages of the nominees and continuing directors, their length of service with the Company and their Board committee memberships are set forth in the table below.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Name | Age | Director Since | Current Term Expires | Independent | AC | CC | NCG | CAC |

| Nominees | | | | | | | | |

Jimena Almendares | 43 | 2021 | Class III 2024 Annual Meeting | Yes | — | — | — | — |

| Donna Coallier | 60 | 2022 | Class III

2024 Annual Meeting | Yes | C, F | — | — | — |

| John Danhakl* | 67 | 2015 | Class III 2024 Annual Meeting | Yes | — | M | M | — |

| Paul Hackwell | 44 | 2015 | Class III

2024 Annual Meeting | Yes | — | — | M | M |

Continuing Directors | | | | | | | | |

| Bahram Akradi** | 62 | 1992 | Class I

2025 Annual Meeting | No | — | M | C | C |

| David Landau | 58 | 2015 | Class I

2025 Annual Meeting | No | — | M | — | M |

| Alejandro Santo Domingo | 47 | 2019 | Class I

2025 Annual Meeting | Yes | — | — | — | — |

| Andres Small | 43 | 2020 | Class I

2025 Annual Meeting | Yes | M | — | — | — |

| Joel Alsfine | 54 | 2019 | Class II

2026 Annual Meeting | Yes | M, F | — | — | M |

| Jonathan Coslet | 59 | 2015 | Class II

2026 Annual Meeting | Yes | — | M | M | — |

| J. Kristofer Galashan | 46 | 2015 | Class II

2026 Annual Meeting | Yes | — | — | M | M |

| Stuart Lasher | 64 | 2015 | Class II

2026 Annual Meeting | No | — | C | — | M |

* Independent Lead Director

** Chairman of the Board

F: Financial Expert M: Member C: Committee Chair

AC: Audit Committee CC: Compensation Committee NCG: Nominating and Corporate Governance Committee

CAC: Capital Allocation Committee

A brief biography of each nominee is set forth below, which includes information, as of the Record Date, regarding specific and particular experience, qualifications, attributes or skills of each nominee that led the Nominating and Corporate Governance Committee and the Board of Directors to believe that the director should serve on the Board of Directors:

Nominees for Terms Expiring in 2027 (Class III Directors)

| | | | | |

JIMENA ALMENDARES

Age: 43 Independent Director Director since: 2021

| Background |

•Global Chief Digital Officer at Decathlon, a global premier sports retailer, which she joined in August 2023. |

•Product Executive at Facebook, now known as Meta Platforms, Inc., a company that builds technology that helps people connect, find communities, and grow businesses, from 2020 to March 2023. |

•Vice President of Global Expansion at Intuit, Inc., a company that delivers financial management and compliance products and services, from 2018 to 2020. |

•Chief Executive Officer of Intuit Payments, Inc., from 2017 to 2019. |

•Vice President of Payments Segment Leader at Intuit Payments, Inc., from 2017 to 2018. |

•Chief Product Officer of OKCupid, an online dating app, leading the company through its initial public offering as part of the Match Group, from 2014 to 2016. |

Qualifications Ms. Almendares was selected by the Board for her nearly two decades of experience leading cross-functional teams at public companies and growth start-ups and her significant experience with emerging and digital technologies. |

| | | | | |

DONNA COALLIER

Age: 60 Independent Director Director since: 2022 Committees: •Audit (Chair) (Financial Expert)

| Background |

•Partner at PricewaterhouseCoopers, a multinational professional services and accounting firm, from 1998 to 2017. |

•Trustee and Board of Health President for the Township of South Orange Village, New Jersey, from 2019 to 2023, and lead Trustee for the Township’s Community Care & Justice program, from its inception in 2020 to 2023. |

•Previously held roles at the Securities and Exchange Commission, Coopers & Lybrand, and Grant Thornton. |

Qualifications Ms. Coallier was selected by the Board for her significant experience in finance, accounting and strategy with broad leadership roles including as assurance partner and oversight of business units, functions and special project teams across various sectors and practices. |

| | | | | |

JOHN DANHAKL

Age: 67 Independent Lead Director Director since: 2015 Committees: •Compensation •Nominating and Corporate Governance | Background |

•Managing Partner at Leonard Green and Partners, L.P., a private equity investment firm and an affiliate of the Company, which he joined in 1995. |

•Managing Director at Donaldson, Lufkin & Jenrette, from 1990 to 1995. |

•Vice President in corporate finance at Drexel Burnham Lambert, Inc., from 1985 to 1990. |

Qualifications Mr. Danhakl was selected by the Board for his extensive experience serving on the board of directors of public companies and his extensive experience as a board member, investor and financial analyst. |

Other Public Company Board Memberships (Current and Past Five Years) •IQVIA Holdings Inc. (NYSE: IQV) (2016 to present) •Mister Car Wash, Inc. (NYSE: MCW) (2014 to present) |

| | | | | |

PAUL HACKWELL

Age: 44 Independent Director Director since: 2015 Committees: •Nominating and Corporate Governance •Capital Allocation | Background |

•Partner at TPG Global, LLC, a global alternative asset firm and an affiliate of the Company, which he joined in 2006 and where he leads their consumer group. |

•Involved in TPG’s investments in Adare Pharmaceuticals, Anastasia Beverly Hills, Aptalis Pharma, Arden Group (Gelson’s), AV Homes, Norwegian Cruise Line, Playa Hotels & Resorts, Rodan + Fields, Taylor Morrison, Troon Golf and Viking Cruises. |

Qualifications Mr. Hackwell was selected by the Board for his extensive board of director and finance experience. |

Other Public Company Board Memberships (Current and Past Five Years) •AV Homes, Inc. (NASDAQ: AVHI) (2013 to 2018) |

Class I Directors (Terms Expiring in 2025)

| | | | | |

BAHRAM AKRADI

Age: 62 Chairman of the Board Director since: 1992 Committees: •Compensation •Nominating and Corporate Governance (Chair) •Capital Allocation (Chair) | Background |

•Founded the Company in 1992 and has been a director since inception. |

•Chief Executive Officer and Chairman of the Company since May 1996. |

•Over 30 years of experience in healthy way of life initiatives. |

•Co-Founder and Executive Vice President at U.S. Swim & Fitness Corporation from 1984 to 1989. |

•Founder of the Health and Fitness Industry Leadership Council. |

Qualifications Mr. Akradi was selected by the Board for his perspective and the experience he brings as Founder and Chief Executive Officer of the Company. |

Other Public Company Board Memberships (Current and Past Five Years) •Northern Oil & Gas, Inc. (NYSE: NOG) (2017 to present) |

| | | | | |

DAVID LANDAU

Age: 58 Director since: 2015 Committees: •Compensation •Capital Allocation | Background |

•Managing Partner and Co-Founder of LNK Partners, a private equity firm focused on building consumer and retail businesses, which he co-founded in 2005. |

Qualifications Mr. Landau was selected by the Board for his extensive investment, finance and board of director experience. |

|

| | | | | |

ALEJANDRO SANTO DOMINGO

Age: 47 Independent Director Director since: 2019

| Background |

•Senior Managing Director at Quadrant Capital Advisors, Inc., an investment advisory firm, since 2005. |

•Chair of the Wildlife Conservation Society and Fundación Santo Domingo, and a member of the boards of the Metropolitan Museum of Art, Mount Sinai Health System, Channel Thirteen/WENT (PBS), DKMS, Fundación Pies Descalzos and Caracol Televisión S.A. |

Qualifications Mr. Santo Domingo was selected by the Board for his significant investment experience across a variety of industries and in private and public debt and equity securities. |

Other Public Company Board Memberships (Current and Past Five Years) •Anheuser-Busch Inbev (BB: ABI) (2016 to present) •Caracol Televisión S.A. (CB: CARACOL) (2001 to present) •Advanced Merger Partners, Inc. (NYSE: AMPI) (2021 to 2022) •ContourGlobal plc (LON: GLO) (2017 to 2022) •JDE Peet’s N.V. (NA: JDEP) (2013 to 2022) |

| | | | | |

ANDRES SMALL

Age: 43 Independent Director Director since: 2020 Committees: •Audit | Background |

•Managing Director at Partners Group (USA) Inc., a global private markets firm, where he has worked since 2014. |

•Vice President, Advisor to the Chairman at MacAndrews & Forbes, from 2013 to 2014. |

•Various positions including Vice President at CVC International, from 2005 to 2011. |

•Analyst at JPMorgan Chase, from 2002 to 2005. |

Qualifications Mr. Small was selected by the Board for his extensive professional experience, management and business advisory positions. |

Class II Directors (Terms Expiring in 2026)

| | | | | |

JOEL ALSFINE

Age: 54 Independent Director Director since: 2019 Committees: •Audit (Financial Expert) •Capital Allocation | Background |

•Chief Investment Officer of Rugger Management LLC, an advisor to a single family, since 2023. |

•Senior Advisor (inactive) at MSD Capital, L.P., an investment firm that is now called Dell Family Office, since December 2020. |

•Partner of MSD Capital, from 2014 to December 2020. |

•Held various roles at MSD Capital, from 2002 to 2014, before becoming a Partner, focusing on investing in public equity securities and becoming the portfolio manager of a large, concentrated public equity portfolio. |

•Previously worked at TG Capital Corp., a single-family investment office investing across all asset classes, McKinsey & Co. and accounting firm Fisher Hoffman Stride. |

Qualifications Mr. Alsfine was selected by the Board for his extensive capital markets, investment, financial and risk management experience from his executive and consulting roles, as well as his experience serving as a director of various public and private companies and as an analyst focusing on public company equity. |

Other Public Company Board Memberships (Current and Past Five Years) •Asbury Automotive Group Inc. (NYSE: ABG) (2014 to present) •Party City Holdco Inc. (NYSE: PRTY) (2020 to October 2023) •CC Neuberger Principal Holdings II (NYSE: PRPB) (2020 to 2022) |

| | | | | |

JONATHAN COSLET

Age: 59 Independent Director Director since: 2015 Committees: •Compensation •Nominating and Corporate Governance | Background |

•Vice Chairman of TPG Global, LLC, a global alternative asset firm and an affiliate of the Company, which he joined at its inception in 1993. |

•Chief Investment Officer of TPG, from 2008 to 2020. |

•Associate at Donaldson, Lufkin & Jenrette, from 1991 to 1993. |

•Financial Analyst at Drexel Burnham Lambert, from 1987 to 1989. |

Qualifications Mr. Coslet was selected by the Board for his more than 25 years of experience in advising and growing companies, his extensive management and board of director experience and his financial background. |

| Other Public Company Board Memberships (Current and Past Five Years) •Nextracker Inc. (NASDAQ: NXT) (2023 to present) •TPG, Inc. (NASDAQ: TPG) (2021 to present) •Cushman & Wakefield plc (NYSE: CWK) (2018 to present) •IQVIA Holdings Inc. (NYSE: IQV) (2003 to 2020) |

| | | | | |

J. KRISTOFER GALASHAN

Age: 46 Independent Director Director since: 2015 Committees: •Nominating and Corporate Governance •Capital Allocation | Background |

•Partner at Leonard Green and Partners, L.P., a private equity investment firm and an affiliate of the Company, which he joined in 2002. |

•Previously worked in the Investment Banking Division of Credit Suisse First Boston (formerly Donaldson, Lufkin & Jenrette) in its Los Angeles office. |

Qualifications Mr. Galashan was selected by the Board for his extensive experience investing in and supporting high-growth, market-leading companies. |

Other Public Company Board Memberships (Current and Past Five Years) •Mister Car Wash, Inc. (NYSE: MCW) (2014 to present) •The Container Store (NYSE: TCS) (2007 to present) •USHG Acquisition Corp. (NYSE: HUGS) (2021 to 2022) •BJ’s Wholesale Club, Inc. (NYSE: BJ) (2011 to 2019) |

| | | | | |

STUART LASHER

Age: 64 Director since: 2015 Committees: •Compensation (Chair) •Capital Allocation | Background |

•Founder, Chairman and Chief Executive Officer of Quantum Capital Partners, a private investment firm, since 1998. |

•Chairman and Chief Executive Officer of Lifestyle Family Fitness, a fitness chain with 55 locations, from 2010 to 2012. |

•Chief Executive Officer of the PEO division of Paychex, Inc., from 1996 to 1997. |

•Chairman and Chief Executive Officer at National Business Solutions, Inc., a professional employer company he co-founded in 1990 that was acquired by Paychex, Inc. in 1996. |

•Chief Financial Officer at Silk Greenhouse, Inc., from 1986 to 1989. |

•Certified Public Accountant at KPMG Peat Marwick, from 1981 to 1986. |

Qualifications Mr. Lasher was selected by the Board for his extensive experience in accounting and finance and his service as a director of various public and private companies. |

| Other Public Company Board Memberships (Current and Past Five Years) •Northern Oil & Gas, Inc. (NYSE: NOG) (2020 to present) |

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE “FOR” EACH OF THE FOUR CLASS III DIRECTOR NOMINEES.

CORPORATE GOVERNANCE

Corporate Governance Guidelines

We have adopted corporate governance guidelines in accordance with the corporate governance rules of the NYSE, as applicable, that serve as a flexible framework within which the Board of Directors and its committees operate. These guidelines cover a number of areas, including the size and composition of the Board, Board membership criteria and director qualifications, director responsibilities, Board leadership, executive sessions, standing Board committees, communications with the Board, succession planning and risk management.

Board Composition

Our business and affairs are managed by the Board of Directors, which currently has 12 members. In accordance with the Amended and Restated Certificate of Incorporation of Life Time Group Holdings, Inc., effective as of October 12, 2021 (the “Certificate of Incorporation”), and the Stockholders Agreement (as defined below), our directors are divided into three classes serving staggered three-year terms. At each annual meeting of stockholders, the successors to the directors whose terms will then expire will be elected to serve from the time of election and qualification until the third annual meeting following their election. Our directors are divided among three classes as follows:

•the Class I directors are Bahram Akradi, David Landau, Alejandro Santo Domingo and Andres Small, whose terms expire at the 2025 annual meeting of stockholders;

•the Class II directors are Joel Alsfine, Jonathan Coslet, J. Kristofer Galashan and Stuart Lasher, whose terms expire at the 2026 annual meeting of stockholders; and

•the Class III directors are Jimena Almendares, Donna Coallier, John Danhakl and Paul Hackwell, whose terms expire at the Annual Meeting.

Director Nomination Process

Director Qualification Standards and Criteria

The Nominating and Corporate Governance Committee of the Board is responsible for identifying individuals qualified to become members of the Board of Directors consistent with the criteria approved by the Board and ensuring that the Board has the requisite expertise and its members have sufficiently diverse and independent backgrounds. The Nominating and Corporate Governance Committee may solicit recommendations for nominees from other members of the Board and management. Our Nominating and Corporate Governance Committee may also retain professional search firms to identify candidates. While the Nominating and Corporate Governance Committee does not maintain a formal policy for considering nominees, it does take into account the many factors for director qualifications set forth in our corporate governance guidelines as it seeks to identify candidates for director, including persons with a reputation for and record of personal and professional integrity, ethics and values; experience in corporate management or as a board member of other publicly held companies; professional and academic experience relevant to our industry; strength of leadership, advisory skills and business judgment; experience in capital markets and growing businesses; time to devote to Board service; diversity of background and perspective; and relevant social policy concerns. The Board also monitors the mix of specific experience, diversity, qualifications and skills of its directors in order that the Board, as a whole, has the necessary tools to perform its oversight function effectively. Except as detailed immediately below under “—Nomination Rights under the Stockholders Agreement,” the Board does not have a formal policy for considering director candidates recommended by stockholders; however, the Board would generally expect to consider any recommended candidate based on the same considerations set forth above.

Nomination Rights under the Stockholders Agreement

As of October 6, 2021, the Company entered into the Third Amended and Restated Stockholders Agreement (the “Stockholders Agreement”) with, among others, certain affiliates of Leonard Green & Partners, L.P. and its affiliates (“LGP”), TPG Inc. and its affiliates (“TPG”), LNK Partners and its affiliates (“LNK”), LifeCo LLC and its affiliates (“LifeCo”), Partners Group (USA) Inc. and its affiliates (“PG”), JSS LTF Holdings Limited together with any transferee controlled directly or indirectly by Mr. Joseph Yacoub Safra’s family or the J. Safra Group (“J. Safra”), SLT Investors, LLC and its affiliates and Mr. Akradi (collectively, the “Principal Stockholders”).

MSD Capital, L.P. and its affiliates and MSD Partners, L.P. and its affiliates (collectively, “MSD”) had been party to the Stockholders Agreement and was a Principal Stockholder. MSD notified the Company of the termination of its participation under the Stockholders Agreement as of January 30, 2024, at which time it ceased to be a Principal Stockholder.

The Stockholders Agreement provides rights for certain of the Principal Stockholders to nominate directors to the Board of Directors or to designate an individual with board observer rights, subject to certain stock ownership thresholds set forth below. The Stockholders Agreement also provides that directors nominated by the Principal Stockholders may only be removed at the request of the applicable Principal Stockholder that nominated such director in accordance with our Bylaws. In all other cases and at any other time, directors may only be removed for cause by the affirmative vote of the holders of at least a majority of our common stock. Pursuant to the Stockholders Agreement, we are required to appoint to the Board of Directors individuals designated by, and voted for, the Principal Stockholders, which currently include:

•Mr. Akradi, our Founder, Chairman and Chief Executive Officer;

•three individuals nominated by TPG – currently Mr. Coslet, Mr. Hackwell and one vacancy;

•three individuals nominated by LGP – currently Mr. Danhakl, Mr. Galashan and one vacancy;

•one individual nominated by LNK – currently Mr. Landau;

•one individual nominated by LifeCo – currently Mr. Santo Domingo;

•one individual nominated by PG – currently Mr. Small; and

•one individual nominated by Mr. Akradi – currently Mr. Lasher.

Additionally, J. Safra currently has the right to designate one Board observer at all meetings of the Board who also has the right to receive (at the same time as the directors of the Board) all materials sent to the directors on the Board, subject to applicable law and any attorney-client privilege.

When MSD terminated its participation under the Stockholders Agreement, its right to nominate one individual to the Board of Directors ceased. MSD had nominated Mr. Alsfine. Pursuant to the Stockholders Agreement, the Company could have requested that MSD cause Mr. Alsfine to tender his resignation from the Board of Directors. However, the Board believes that Mr. Alsfine is a valuable member of the Board of Directors and decided to not request that he tender his resignation.

The nomination rights described above are subject to the following thresholds:

•so long as TPG (i) has not sold shares of our common stock, through one or more transactions, resulting in TPG receiving aggregate gross proceeds in an amount equal to at least its initial investment in the Company (the “TPG Initial Investment Sell-Down”), then TPG will be entitled to nominate three directors; (ii) has effected the TPG Initial Investment Sell-Down, and owns shares of our common stock greater than or equal to 15% of the then outstanding shares of our common stock, then TPG will be entitled to nominate two directors; (iii) owns less than 15%, but greater than or equal to 10% of the then outstanding shares of our common stock, then TPG will be entitled to nominate one director; and (iv) owns less than 10% of the then outstanding shares of our common stock, then TPG will not be entitled to nominate a director;

•so long as LGP (i) has not sold shares of our common stock, through one or more transactions, resulting in LGP receiving aggregate gross proceeds in an amount equal to at least its initial investment in the Company (the “LGP Initial Investment Sell-Down”), then LGP will be entitled to nominate three directors; (ii) has effected the LGP Initial Investment Sell-Down, and owns shares of our common stock greater than or equal to 15% of the then outstanding shares of our common stock, then LGP will be entitled to nominate two directors; (iii) owns less than 15%, but greater than or equal to 10% of the then outstanding shares of our common stock, then LGP will be entitled to nominate one director; and (iv) owns less than 10% of the then outstanding shares of our common stock, then LGP will not be entitled to nominate a director;

•so long as LNK, LifeCo or PG, as applicable, (i) has not sold shares of our common stock, through one or more transactions, resulting in LNK, LifeCo or PG, as applicable, receiving aggregate gross proceeds in an amount equal to at least its initial investment in the Company (the “Other Stockholder Initial Investment Sell-Down”), then LNK, LifeCo and PG, as applicable, will each be entitled to nominate one director; and (ii) has effected the Other Stockholder Initial Investment Sell-Down, then LNK, LifeCo and PG, as applicable, will not be entitled to nominate a director;

•so long as Mr. Akradi serves as Chief Executive Officer of the Company, then Mr. Akradi will be entitled to nominate himself and one additional director; and if he ceases to serve as Chief Executive Officer, then Mr. Akradi will not be entitled to nominate any director (including himself); and

•so long as J. Safra (i) has not sold shares of our common stock, through one or more transactions, resulting in J. Safra receiving aggregate gross proceeds in an amount equal to at least its initial investment in the Company (the “J. Safra Initial Investment Sell-Down”), then J. Safra shall be entitled to designate one observer at meetings of the Board and to receive (at the same time as the directors of the Company) all materials sent to the directors on the Board of Directors; and (ii) has effected the J. Safra Initial Investment Sell-Down, then J. Safra shall not be entitled to designate any observer to any meetings of the Board, nor shall it have the right to receive any materials sent to the directors on the Board.

Each of the Principal Stockholders has agreed to vote the common stock owned by it or him for each of the Principal Stockholders’ nominees to the Board of Directors.

Director Independence and Controlled Company Exception

Director Independence

Pursuant to the corporate governance listing standards of the NYSE, a director employed by the Company cannot be deemed to be an “independent director.” Each other director will qualify as “independent” only if the Board of Directors affirmatively determines that he or she has no material relationship with us, either directly or as a partner, stockholder or officer of an organization that has a relationship with us. Ownership of a significant amount of our common stock, by itself, does not constitute a material relationship.

The Board of Directors affirmatively determined that each of our directors other than Mr. Akradi, Mr. Landau and Mr. Lasher qualifies as “independent” in accordance with the NYSE rules. In making its independence determinations, the Board of Directors considered and reviewed all information known to it (including information identified through directors’ questionnaires) including the following relationships that the Board of Directors concluded did not impact the applicable director’s independence:

•In June 2020, Life Time borrowed $101.5 million from an investor group that was comprised solely of certain of the Principal Stockholders and MSD or their affiliates. This loan converted to preferred stock in the Company in January 2021, which then converted to common stock in the Company as part of its initial public offering (“IPO”) in October 2021. For each of Messrs. Coslet, Danhakl, Galashan, Hackwell and Small, the amount loaned by their respective employers (or affiliates of their employers) was less than 2% of each such entity’s consolidated gross revenues. Mr. Santo Domingo was not an employee of any LifeCo entity (or its affiliate) that made a portion of the loan, and Mr. Alsfine is no longer an employee of any MSD entity (or its affiliate) that made a portion of the loan.

•Life Time purchases products or services from certain portfolio companies of LGP and TPG in the ordinary course of business. In each case, these purchases were less than 2% of each of such entity’s consolidated gross revenues and none of Messrs. Coslet, Danhakl, Galashan or Hackwell owns 10% or more of their employer or any of their portfolio companies. For more information on these purchases, see “Certain Relationships and Related Person Transactions—Related Person Transactions—Other.”

Controlled Company Exception

The Principal Stockholders collectively continue to beneficially own more than 50% of our common stock and voting power. As a result, the Company is a “controlled company” within the meaning of the NYSE corporate governance standards. As a “controlled company” we may elect not to comply with certain NYSE corporate governance requirements, including:

•that a majority of the Board of Directors consist of independent directors;

•that the Board of Directors have a nominating and corporate governance committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities;

•that the Board of Directors have a compensation committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; and

•that we have an annual performance evaluation of the nominating and corporate governance committee and compensation committee.

We currently do not utilize all of these exceptions, but we do not have a nominating and corporate governance committee or compensation committee that consists entirely of independent directors. We may elect to utilize additional

exceptions for so long as we remain a “controlled company.” Accordingly, you will not have the same protections afforded to stockholders of companies that are subject to all of the NYSE corporate governance requirements.

In the event that we cease to be a controlled company within the meaning of these rules, we will be required to comply with these provisions after specified transition periods, including having at least a majority of independent members on each such committee within 90 days of the date of our status change and having such committees be fully independent within one year of the date of our status change.

Committees of the Board of Directors

Our Board of Directors has assigned certain of its responsibilities to permanent committees consisting of directors appointed by it. The Board of Directors has an Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee and Capital Allocation Committee, each of which has the composition and responsibilities described below. The Board has adopted a written charter for each of these committees under which they operate.

Our Board of Directors determined on February 15, 2023, to appoint new chairs of the Audit Committee and Compensation Committee. Effective immediately upon such determination, Mr. Lasher replaced Mr. Danhakl as chair of the Compensation Committee. Effective March 15, 2023, Ms. Coallier replaced Mr. Small as chair of the Audit Committee.

| | | | | |

| AUDIT COMMITTEE |

| Functions | Members |

•Appoints, compensates, retains and oversees the work of the Company’s independent auditor •Reviews and discusses the Company’s quarterly and annual financial statements and management’s discussion and analysis of financial condition and results of operations •Prepares audit committee reports to be included in proxy statements filed under SEC rules •Discusses the Company’s earnings releases and guidance •Oversees related person transactions, the Company’s code of business conduct and ethics and complaint procedures •Oversees the risk areas set forth in the table below under “—Role of the Board in Risk Oversight” | Donna Coallier, Chair * Joel Alsfine * Andres Small

* Audit Committee Financial Expert

Each member is financially literate

Number of Meetings in 2023: 9 |

| | | | | |

| COMPENSATION COMMITTEE |

| Functions | Members |

•Reviews and approves matters involving executive and director compensation •Authorizes equity and other incentive arrangements and administers the Company’s equity-based plans and clawback policy •Reviews and discusses the Company’s compensation discussion and analysis to be included in the Company’s proxy statement •Oversees the evaluation of management and succession planning •Prepares compensation committee reports to be included in proxy statements filed under SEC rules •Authorizes the Company to enter into employment and other employee-related agreements •Recommends changes in employee benefit programs •Reviews and discusses the results of our Say-on-Pay Vote results | Stuart Lasher, Chair Bahram Akradi Jonathan Coslet John Danhakl David Landau

Number of Meetings in 2023: 4 |

| | | | | |

| NOMINATING AND CORPORATE GOVERNANCE COMMITTEE |

| Functions | Members |

•Identifies individuals qualified to become Board members, consistent with criteria approved by the Board of Directors and in accordance with the terms of the NYSE, subject to the Stockholders Agreement •Makes recommendations for Board leadership and committee structures and nominees for committees •Oversees the evaluation of the Board of Directors and its committees •Develops, reviews and recommends to the Board of Directors our corporate governance guidelines •Oversees and monitors our commitment and actions on corporate responsibility matters, including environment, social and political matters | Bahram Akradi, Chair Jonathan Coslet John Danhakl J. Kristofer Galashan Paul Hackwell

Number of Meetings in 2023: 3 |

| | | | | |

CAPITAL ALLOCATION COMMITTEE |

Functions | Members |

•Assists the Board in fulfilling its oversight responsibilities for the Company’s management of capital, including the Company’s property development business plans and certain real estate-related and financial-related activities •Reviews and recommends to the Board certain individual property development business plans, sale-leaseback transactions, capital expenditures and construction litigation settlements or claims •Reviews from time to time the financial metrics and performance under previously approved property development business plans | Bahram Akradi, Chair J. Kristofer Galashan Paul Hackwell David Landau Joel Alsfine Stuart Lasher

Number of Meetings in 2023: 6 |

Non-Employee Directors

Under Rule 16b-3 of the Exchange Act, transactions between the Company and its officers and directors are exempt from the “short-swing profit” rules of Section 16(b) of the Exchange Act if the transaction is approved by either (i) the full Board of Directors or (ii) a committee that is composed solely of two or more “non-employee directors” as defined under such rule. Because our Compensation Committee is not composed entirely of “non-employee directors,” we have established a sub-committee of our Compensation Committee comprised entirely of non-employee directors.

Compensation Committee Interlocks and Insider Participation

None of our executive officers serve, or in the past year have served, as a member of the Board of Directors or compensation committee (or other committee performing equivalent functions) of any entity that has one or more executive officers serving on the Board of Directors or compensation committee. No interlocking relationship exists between any member of our Compensation Committee (or other committee performing equivalent functions) and any executive, member of the board of directors or member of the compensation committee (or other committee performing equivalent functions) of any other company. We are party to certain transactions with certain of the Principal Stockholders and affiliates thereof as described in “Certain Relationships and Related Person Transactions.”

Leadership Structure of the Board of Directors

The Board of Directors has combined the roles of Chairman of the Board and Chief Executive Officer, which are held by Mr. Akradi, as our Founder, Chairman and Chief Executive Officer. The Board of Directors has determined that combining these positions will serve the best interests of the Company and its stockholders. The Board of Directors believes that the Company’s Founder and Chief Executive Officer is best situated to serve as Chairman because he is the director most familiar with the Company’s business and industry, and most capable of effectively identifying strategic priorities and leading the consideration and execution of strategy. The Board of Directors believes that the combined position of Chairman and Chief Executive Officer promotes the development of policy and plans and facilitates information flow between management and the Board of Directors, which is essential to effective governance.

Our corporate governance guidelines provide that if we do not have an independent chair, the independent directors may appoint an independent director to serve as lead director. In March 2023, the independent directors of the Board appointed Mr. Danhakl as our independent lead director. Pursuant to our corporate governance guidelines, Mr. Danhakl is responsible for presiding over all meetings of the Board at which our Chairman is not present, including executive sessions of the independent

directors, approving Board meeting schedules and agendas and acting as the liaison between the independent directors and our Chief Executive Officer and Chairman.

Role of the Board in Risk Oversight

The Board of Directors oversees risk management of our business and accomplishes this oversight primarily through the Audit Committee and the allocation of particular areas of risk oversight to other committees, as described below. We believe that our current board leadership structure, which combines the roles of Chairman of the Board and Chief Executive Officer, facilitates the process of ensuring that the risks identified and assessed by management are clearly and timely reported to the Board, along with discussion of appropriate risk management strategies.

| | |

| BOARD OF DIRECTORS |

•Overall oversight of the risk management process •Development of business strategy and major resource allocation •Leadership of management succession planning •Business conduct and compliance oversight •Receipt of regular reports from Board committees on specific risk oversight responsibilities |

| | | | | | | | | | | |

| BOARD COMMITTEES |

| Audit | Compensation | Nominating and Corporate Governance | Capital Allocation |

•Oversight of the integrity of the Company’s financial statements and financial reporting process •Oversight of the Company’s accounting principles, accounting policies and financial reporting and accounting practices •Oversight of the Company’s compliance with legal and regulatory requirements •Oversight of the effectiveness of internal controls •Oversight of the Company’s risk management program, including risks related to privacy, data and information security (including cybersecurity) •Oversight of the qualifications, independence and performance of the Company’s independent auditor •Oversight of the performance of the Company’s internal audit function | •Oversight of compensation-related risks and overall philosophy •Oversight of regulatory compliance with respect to compensation matters •Oversight of management succession planning •Oversight of clawback policy | •Overall corporate governance leadership •Provides recommendations regarding Board and committee structure and composition •Board succession planning •Oversight of environmental, social and corporate governance initiatives •Oversight of the evaluation of the Board and its committees | •Oversight of the Company’s capital management, including with respect to property development business plans and certain real estate-related and financial-related activities •Oversight of project performance |

| | |

| MANAGEMENT |

•Identify material and credible risks and emerging risks •Identify and assess key risk drivers •Implement appropriate risk management and mitigation strategies •Integrate risk management into our decision-making process •Ensure that information with respect to material and credible risks is transmitted to senior executives and the Board, as appropriate |

| | | | | | | | | | | |

| RISK AREAS |

| Business Operations | Growth of Business | Capital Structure and Lease Obligations | Legal and Regulatory Compliance |

| Brand | Technology | Human Capital | Financial Performance |

Meetings of the Board of Directors

During fiscal 2023, our Board of Directors met six times. Our non-management directors also regularly meet in executive session. Mr. Danhakl, our lead independent director, serves as chair of such executive sessions. Each Board member other than Mr. Coslet attended 75% or more of the aggregate meetings of the Board of Directors and of the committees on which they served that were held during the period for which they were a director or committee member. Mr. Coslet attended 69% of the aggregate meetings of the Board and committees on which he served, missing certain meetings due to unforeseen scheduling conflicts. The Nominating and Corporate Governance Committee discussed Mr. Coslet’s attendance with him.

Attendance at Stockholder Meetings

The Board does not have a formal policy regarding director attendance at the annual meeting of stockholders. However, all directors are strongly encouraged to attend the meeting. Eight of our 12 then-serving directors attended the 2023 annual meeting of stockholders.

Communications with the Board of Directors

Stockholders and other interested parties may initiate in writing any communication with the Board of Directors or any individual director by sending the correspondence to Life Time Group Holdings, Inc., Attn: General Counsel, 2902 Corporate Place, Chanhassen, Minnesota 55317. This centralized process assists the Board of Directors in reviewing and responding to communications in an appropriate manner. The General Counsel will initially review and compile all such communications and may summarize such communications prior to forwarding to the appropriate party.

The General Counsel will not forward communications that are not relevant to the duties and responsibilities of the Board of Directors, including spam, junk mail and mass mailings, product or service inquiries, new product or service suggestions, resumes or other forms of job inquiries, opinion surveys and polls, business solicitations or advertisements or other frivolous communications.

Governance Documents on our Website

We maintain a governance section on our Life Time investor relations website that includes key information about our governance initiatives and our code of business conduct and ethics. The governance information can be found at

https://ir.lifetime.life, by clicking on “Governance” at the top of our website. Copies of our corporate governance guidelines, our code of business conduct and ethics and the charters for each of the Board’s Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee and Capital Allocation Committee can be found on this website under “Governance Documents.”

Code of Business Conduct and Ethics

We have adopted a code of business conduct and ethics applicable to all of our directors, officers (including our principal executive officer, principal financial officer and principal accounting officer) and employees that addresses legal and ethical issues that may be encountered in carrying out their duties and responsibilities, including the requirement to report any conduct they believe to be a violation of the code of business conduct and ethics. If we ever were to amend or waive any provision of our code of business conduct and ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or any person performing similar functions, we intend to satisfy our disclosure obligations with respect to any such waiver or amendment by posting such information on our internet website set forth above rather than by filing a Form 8-K.

Anti-Hedging and Anti-Pledging Policy

The Board has approved an insider trading compliance policy and procedures for our officers, directors and employees. Under this policy, all of our officers, directors and employees are prohibited from engaging in short-sales, transactions in puts, calls or other derivative securities involving the Company’s equity securities, hedging transactions or other inherently speculative transactions in Life Time stock or pledging Life Time stock in any circumstance, including by purchasing Life Time stock on margin or holding Life Time stock in a margin account.

Executive Incentive Compensation Recovery Policy

In 2023, the Board approved an amended executive incentive compensation recovery, or clawback, policy for our executives that is compliant with the new NYSE and SEC rules. Under this policy, in the event that the Company is required to prepare an accounting restatement due to material noncompliance with any financial reporting requirement under the securities laws, the Company will require, except in limited circumstances, the reimbursement of any excess incentive-based compensation that was granted, earned or vested based wholly or in part upon the achievement of a financial reporting measure that was the subject of the restatement during the preceding three-year period.

Stock Ownership Guidelines

The Board has adopted stock ownership guidelines for our executive officers to align their financial interests with those of our stockholders. Under the guidelines, each executive officer is expected to hold shares of our common stock having a value equal to a certain multiple of the executive officer’s base salary. For our CEO, the multiple is five times, and it is three times for our other executive officers. All executive officers have five years from adoption of the guidelines or the date of their appointment to a covered position to comply with their ownership guideline. Shares owned directly and those subject to vested equity awards count toward the ownership guideline; however, unvested equity awards are not included. Executive officers are required to retain at least 50% of the net shares from any option exercise or vesting of a stock award until the executive officer is in compliance with the ownership guidelines, which holding requirement the Compensation Committee determined would not apply to the stock awards received under the 2023 short-term incentive program. All of our executive officers were either in compliance with or progressing towards the ownership guidelines.

DIRECTOR COMPENSATION

Our directors play a critical role in guiding our strategic direction and overseeing the management of Life Time. The many responsibilities and risks and the substantial time commitment of being a director require that we provide adequate compensation commensurate with our directors’ workload and opportunity costs. However, we have determined that our current directors who have been nominated by the Principal Stockholders, including directors initially nominated by a Principal Stockholder as in the case of MSD’s nomination of Mr. Alsfine, which are currently all of our directors other than Ms. Almendares and Ms. Coallier, will not receive compensation from Life Time for their service on the Board other than complementary membership and services at our athletic country clubs for certain of these directors.

For 2023, Ms. Almendares and Ms. Coallier were eligible for the annual compensation set forth below, consisting of a combination of annual cash retainers and an annual grant of restricted stock units, pursuant to our non-employee director compensation policy (the “Director Compensation Program”). No other non-employee directors received any compensation in respect of their service on our Board of Directors in 2023, except for memberships to our athletic country clubs provided to Messrs. Hackwell and Alsfine and Ms. Coallier, and limited other services provided to our directors, the value of which in each case does not exceed $10,000. Mr. Akradi, our only director who is an executive of the Company, was not eligible to receive additional compensation for his service as a director. All compensation paid to Mr. Akradi is reported below under “Summary Compensation Table – Fiscal Years 2023, 2022 and 2021.”

Cash Compensation. The following table is a summary of the annual cash retainers paid under the Director Compensation Program, which are paid quarterly in arrears.

| | | | | |

POSITION | ANNUAL CASH RETAINER ($) |

Board Member | 75,000 |

Committee Chair |

|

Audit | 30,000 |

Compensation | 25,000 |

Nominating and Corporate Governance | 20,000 |

Committee Member |

|

Audit | 15,000 |

Compensation | 10,000 |

Nominating and Corporate Governance | 10,000 |

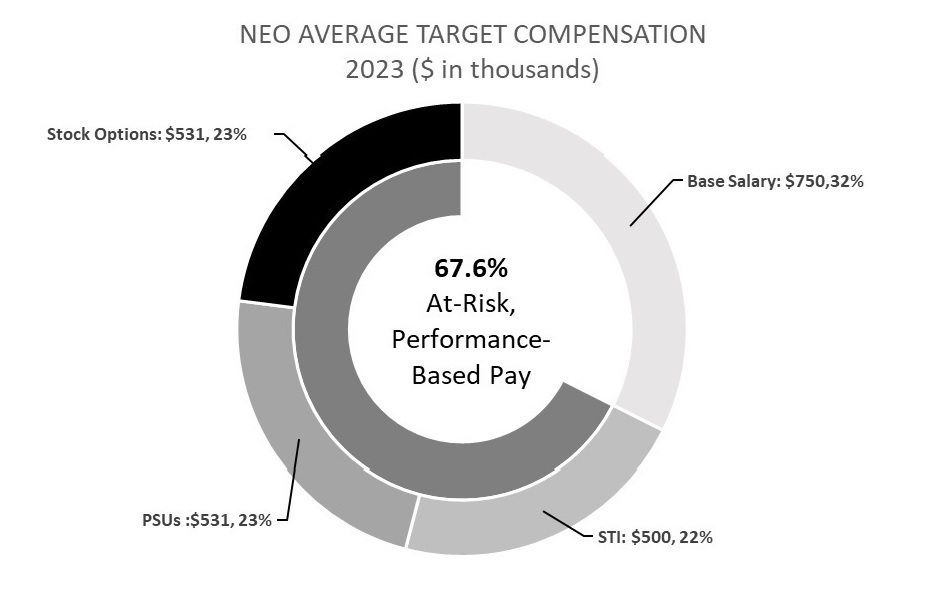

Lead Independent Director | 55,000 |