DRS/A: Draft registration statement submitted by Emerging Growth Company under Securities Act Section 6(e) or by Foreign Private Issuer under Division of Corporation Finance policy

Published on August 27, 2021

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO 17 C.F.R. § 200.83

As confidentially submitted to the Securities and Exchange Commission on August 26, 2021.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission

and all information herein remains strictly confidential.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CONFIDENTIAL DRAFT SUBMISSION NO. 3

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Life Time Group Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 7997 | 47-3481985 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

2902 Corporate Place

Chanhassen, Minnesota 55317

952-947-0000

(Address, including zip code, and telephone number, including area code, of registrants principal executive offices)

Thomas E. Bergmann

2902 Corporate Place

Chanhassen, Minnesota 55317

952-947-0000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Howard A. Sobel John Giouroukakis Jason M. Licht Latham & Watkins LLP 1271 Avenue of the Americas New York, New York 10020 Telephone: (212) 906-1200 Fax: (212) 751-4864 |

Michael Kaplan Derek J. Dostal Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 Telephone: (212) 450-4000 Fax: (212) 701-5800 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of large accelerated filer, accelerated filer, smaller reporting company, and emerging growth company in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

|

||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Offering Price Per Share(1)(2) |

Amount of Registration Fee |

||

| Common stock, $0.01 par value per share |

$ | $ | ||

|

|

||||

|

|

||||

| (1) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes the aggregate offering price of shares of common stock that the underwriters have the option to purchase from the registrant to cover sales of additional shares by the underwriters. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO 17 C.F.R. § 200.83

As confidentially submitted to the Securities and Exchange Commission on August 26, 2021.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission

and all information herein remains strictly confidential.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the Registration Statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and we are not soliciting offers to buy the securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED AUGUST 26, 2021.

Shares

Life Time Group Holdings, Inc.

Common Stock

This is an initial public offering of shares of common stock of Life Time Group Holdings, Inc. We are selling all of the shares to be sold in the offering.

Prior to this offering, there has been no public market for our common stock. The initial public offering price is expected to be between $ and $ per share. After pricing of the offering, we expect that our common stock will trade on the New York Stock Exchange (the NYSE ) under the symbol LTH.

After the consummation of this offering, we expect to be a controlled company within the meaning of the corporate governance standards of the NYSE. Following the consummation of the offering, certain of our existing stockholders (which we refer to as the Voting Group) will hold approximately % of the voting power of our common stock. The Voting Group, among other things, will have the ability to approve or disapprove substantially all transactions and other matters requiring approval by our stockholders, including the election of directors.

Investing in our common stock involves risk. See Risk Factors beginning on page 24 to read about factors you should consider before buying shares of our common stock.

| Per Share | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount(1) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| (1) | See Underwriters for a description of the compensation payable to the underwriters. |

The underwriters may also exercise their option to purchase up to an additional shares from us, at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus to cover sales of additional shares by the underwriters.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Delivery of the shares of common stock will be made on or about , 2021.

| Goldman Sachs & Co. LLC | Morgan Stanley | BofA Securities | ||

| (in alphabetical order) |

||||

| Deutsche Bank Securities | J.P. Morgan | Wells Fargo Securities | ||

The date of this prospectus is , 2021.

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO 17 C.F.R. § 200.83

As confidentially submitted to the Securities and Exchange Commission on August 26, 2021.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission

and all information herein remains strictly confidential.

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO 17 C.F.R. § 200.83

As confidentially submitted to the Securities and Exchange Commission on August 26, 2021.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission

and all information herein remains strictly confidential.

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO 17 C.F.R. § 200.83

As confidentially submitted to the Securities and Exchange Commission on August 26, 2021.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission

and all information herein remains strictly confidential.

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO 17 C.F.R. § 200.83

As confidentially submitted to the Securities and Exchange Commission on August 26, 2021.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission

and all information herein remains strictly confidential.

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO 17 C.F.R. § 200.83

As confidentially submitted to the Securities and Exchange Commission on August 26, 2021.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission

and all information herein remains strictly confidential.

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO 17 C.F.R. § 200.83

As confidentially submitted to the Securities and Exchange Commission on August 26, 2021.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission

and all information herein remains strictly confidential.

| Page | ||||

| ii | ||||

| ii | ||||

| ii | ||||

| iv | ||||

| iv | ||||

| vi | ||||

| 1 | ||||

| 24 | ||||

| 51 | ||||

| 54 | ||||

| 55 | ||||

| 56 | ||||

| 58 | ||||

| Managements Discussion and Analysis of Financial Condition and Results of Operations |

60 | |||

| 89 | ||||

| 121 | ||||

| 130 | ||||

| 159 | ||||

| 162 | ||||

| 168 | ||||

| 173 | ||||

| Material U.S. Federal Tax Considerations To Non-U.S. Holders |

175 | |||

| 180 | ||||

| 191 | ||||

| 191 | ||||

| 191 | ||||

| F-1 | ||||

i

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO 17 C.F.R. § 200.83

As confidentially submitted to the Securities and Exchange Commission on August 26, 2021.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission

and all information herein remains strictly confidential.

We and the underwriters have not authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may provide you. Offers to sell, and solicitations of offers to buy, shares of our common stock are being made only in jurisdictions where offers and sales are permitted.

No action is being taken in any jurisdiction outside the United States to permit a public offering of common stock or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restriction as to this offering and the distribution of this prospectus applicable to those jurisdictions.

INDUSTRY AND MARKET AND OTHER DATA

We have obtained some industry and market share data from third-party sources that we believe are reliable. In many cases, however, we have made statements in this prospectus regarding our industry and our position in the industry based on estimates made from our experience in the industry and our own investigation of market conditions. We believe these estimates to be accurate as of the date of this prospectus. However, this information may prove to be inaccurate because of the method by which we obtained some of the data for our estimates or because this information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. As a result, you should be aware that the industry and market data included in this prospectus, and estimates and beliefs based on that data, may not be reliable. In addition, some publications, studies and reports for the industry and market share data were published before the global COVID-19 pandemic and therefore do not reflect any impact of the COVID-19 pandemic on any specific market or globally. We and the underwriters cannot guarantee the accuracy or completeness of any such information.

Certain monetary amounts, percentages and other figures included in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables and charts may not be the arithmetic aggregation of the figures that precede them, and figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

Unless the context otherwise requires, references in this prospectus to:

| | the term Credit Agreement refers to that certain credit agreement (as amended, restated, modified and/or supplemented from time to time), dated as of June 10, 2015, governing our Credit Facilities; |

| | the term Credit Facilities refers to (i) our $850 million senior secured term loan facility maturing in December 2024 (the Term Loan Facility) and (ii) our $357.9 million senior secured revolving credit facility (the Revolving Credit Facility), approximately $32.7 million of which matures in August 2022 (the Non-Extended Revolving Tranche) and approximately $325.2 million of which will mature in September 2024 (the Extended Revolving Tranche); |

ii

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO 17 C.F.R. § 200.83

As confidentially submitted to the Securities and Exchange Commission on August 26, 2021.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission

and all information herein remains strictly confidential.

| | the term Founder refers to Bahram Akradi, our Founder, Chairman and Chief Executive Officer and, unless otherwise stated or the context otherwise requires, entities affiliated with Mr. Akradi; |

| | the term GAAP refers to the generally accepted accounting principles in the United States; |

| | the term Indentures refers collectively to the indentures governing our Unsecured Notes and our Secured Notes; |

| | the term Intermediate Holdings refers to LTF Intermediate Holdings, Inc., a direct subsidiary of the Company; |

| | the term J. Safra refers to JSS LTF Holdings Limited together with any transferee controlled directly or indirectly by Mr. Joseph Yacoub Safras family or the J. Safra Group; |

| | the term LifeCo refers to LifeCo LLC and its affiliates; |

| | the term LGP refers to Leonard Green & Partners, L.P. and its affiliates as described under SummaryOur Principal Stockholders; |

| | the term LNK refers to LNK Partners and its affiliates; |

| | the term LT Inc. refers to Life Time, Inc. and not to any of its consolidated subsidiaries; |

| | the term MSD refers to MSD Capital, L.P. and its affiliates; |

| | the term Notes refers collectively to the Unsecured Notes and the Secured Notes; |

| | the term PG refers to Partners Group (USA) Inc. and its affiliates; |

| | the term Secured Notes refers to the $925 million aggregate principal amount of 5.750% Senior Secured Notes due 2026 issued by LT Inc. on January 22, 2021; |

| | the term Series A Preferred Stock refers to our Series A Convertible Participating Preferred Stock, par value $0.01 per share, which will be automatically converted into shares of our common stock in connection with the consummation of this offering; |

| | the term SLT refers to SLT Investors, LLC and its affiliates; |

| | the term Stockholders Agreement refers to the amended and restated stockholders agreement to be effective upon the consummation of this offering and to be entered into by and among the Voting Group, certain of our directors and executive officers, certain of our other existing stockholders and the Company; |

| | the term TPG refers to TPG Global, LLC and its affiliates as described under SummaryOur Principal Stockholders; |

| | the term TRS refers to Teacher Retirement System of Texas and its affiliates; |

| | the term Unsecured Notes refers to the $475 million aggregate principal amount of 8.000% Senior Notes due 2026 issued by LT Inc. on February 5, 2021; |

| | the term Voting Group refers collectively to certain affiliates of LGP, TPG, LNK, MSD, LifeCo, PG, TRS, J. Safra, SLT and our Founder, all of whom will be parties to the Stockholders Agreement as described in Certain Relationships and Related Party TransactionsStockholders Agreement. Following the consummation of this offering, the Voting Group will hold in the aggregate a supermajority of the voting power of our common stock; and |

| | the terms we, us, our, its, the Company and Life Time refer to Life Time Group Holdings, Inc. and its consolidated subsidiaries. |

iii

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO 17 C.F.R. § 200.83

As confidentially submitted to the Securities and Exchange Commission on August 26, 2021.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission

and all information herein remains strictly confidential.

We own or otherwise have rights to the trademarks, service marks, copyrights and trade names, including those mentioned in this prospectus, that are used in conjunction with the marketing of our services. This prospectus includes trademarks, such as LIFE TIME®, EXPERIENCE LIFE®, LIFECAFE®, LIFESPA®, LIFE TIME HEALTY WAY OF LIFE®, LIFE TIME WORK® and LIFE TIME LIVING®, which are protected under applicable intellectual property laws and are our property and/or the property of our subsidiaries. This prospectus also contains trademarks, service marks, copyrights and trade names of other companies, which are the property of their respective owners. We do not intend our use or display of other companies trademarks, service marks, copyrights or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies. Solely for convenience, our trademarks and trade names referred to in this prospectus may appear without the ® or symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and trade names.

We present certain non-GAAP measures in this prospectus, such as Adjusted EBITDA and free cash flow before growth capital expenditures and ratios related thereto. These measures are derived on the basis of methodologies other than in accordance with GAAP. We use Adjusted EBITDA as an important performance metric for the Company. In addition, free cash flow before growth capital expenditures is an important liquidity metric we use to evaluate our ability to make principal payments on our indebtedness and to fund our capital expenditures and working capital requirements.

Adjusted EBITDA

We define Adjusted EBITDA as net income (loss) before interest expense, net, provision for (benefit from) income taxes and depreciation and amortization, excluding the impact of share-based compensation expense, pre-opening expenses, gain (loss) on sale-leaseback transactions, capital transaction costs, legal settlements, asset impairment, severance and other items that are not indicative of our ongoing operations, including incremental costs related to COVID-19.

Management uses Adjusted EBITDA to evaluate the Companys performance. We believe that Adjusted EBITDA is an important metric for management, investors and analysts as it removes the impact of items that we do not believe are indicative of our core operating performance and allows for consistent comparison of our operating results over time and relative to our peers. We use Adjusted EBITDA to supplement GAAP measures of performance in evaluating the effectiveness of our business strategies, and to establish annual budgets and forecasts. We also use Adjusted EBITDA to establish short-term incentive compensation for management.

iv

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO 17 C.F.R. § 200.83

As confidentially submitted to the Securities and Exchange Commission on August 26, 2021.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission

and all information herein remains strictly confidential.

Free Cash Flow Before Growth Capital Expenditures

We define free cash flow before growth capital expenditures as net cash provided by (used in) operating activities less center maintenance capital expenditures and corporate capital expenditures. We believe free cash flow before growth capital expenditures assists investors and analysts in evaluating our liquidity and cash flows, including our ability to make principal payments on our indebtedness and to fund our capital expenditures and working capital requirements. Our management considers free cash flow before growth capital expenditures to be a key indicator of our liquidity and we present this metric to our board of directors. Additionally, we believe free cash flow before growth capital expenditures is frequently used by analysts, investors and other interested parties in the evaluation of companies in our industry. We also believe that investors, analysts, and rating agencies consider free cash flow before growth capital expenditures as a useful means of measuring our ability to make principal payments on our indebtedness and evaluating our liquidity, and management uses this measurement for one or more of these purposes.

Adjusted EBITDA and free cash flow before growth capital expenditures should be considered in addition to, and not as a substitute for or superior to, financial measures calculated in accordance with GAAP. These are not measurements of our financial performance under GAAP and should not be considered as alternatives to net income (loss) or any other performance measures derived in accordance with GAAP or as an alternative to net cash provided by operating activities as a measure of our liquidity and may not be comparable to other similarly titled measures of other businesses. Adjusted EBITDA and free cash flow before growth capital expenditures have limitations as analytical tools, and you should not consider these measures in isolation or as a substitute for analysis of our operating results or cash flows as reported under GAAP. Some of these limitations include that:

| | these measures do not reflect our cash expenditures, or future requirements, for capital expenditures or contractual commitments; |

| | not all of these measures reflect changes in, or cash requirements for, our working capital needs; |

| | these measures do not reflect the cash requirements necessary to make principal payments on our indebtedness; |

| | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and not all of these measures reflect cash requirements for such replacements; |

| | non-cash compensation is and will remain a key element of our overall long-term incentive compensation package, although we exclude it as an expense when evaluating our ongoing operating performance for a particular period; and |

| | these measures do not reflect the impact of certain cash charges resulting from matters we consider not to be indicative of our ongoing operations. |

Furthermore, we compensate for the limitations described above by relying primarily on our GAAP results and using Adjusted EBITDA and free cash flow before growth capital expenditures only for supplemental purposes. See our consolidated financial statements included elsewhere in this prospectus for our GAAP results.

For additional information on Adjusted EBITDA and free cash flow before growth capital expenditures, including a reconciliation to the most comparable GAAP measure, see Prospectus SummarySummary Historical Consolidated Financial Information.

v

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO 17 C.F.R. § 200.83

As confidentially submitted to the Securities and Exchange Commission on August 26, 2021.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission

and all information herein remains strictly confidential.

I founded Life Time nearly 30 years ago to create happy and healthy communities places of unmatched size, scope, quality, architecture and design that the entire family could enjoy together and meet all of their health and wellbeing needs conveniently under one roof.

From the very beginning, all aspects of our Life Time athletic resorts have been designed and created from the member point of view, or what we call MPV. This has been our guiding light every day, through every evolution and decision we have made for three decades. The result of this customer-centric obsession is that Life Time has become what we believe is one of the most trusted and loved lifestyle brands in the United States and Canada.

Creating and sustaining a trusted community where members know their experiences will always be exceptional requires the highest levels of passion and commitment from our entire team. Our more than 30,000 professionals are dedicated to providing the best programs and experiences, in the best facilities, delivered by the best people and performers. By consistently delivering extraordinary experiences, we have built a highly trusted, premium lifestyle brand that embraces all aspects of healthy living, healthy aging and healthy entertainment. Collectively, it is what we call Healthy Way of Life, or HWOL. This is a unique lens through which we can examine every aspect of our lives. It is a healthy perspective on physical, mental and social wellbeing.

To build our HWOL brand that is loved and trusted by members, we have dedicated ourselves to identifying, training and empowering team members who trust our company like their own families. This was achieved naturally and intuitively at the start and, as our Company has grown, we have intentionally and systematically made it the foundation of what we call our Culture of Care. Creating and fostering this culture involves numerous critical details and initiatives from casting, onboarding, training, certification and career path planning, to establishing supporting programs, such as our Life Time Team Foundation, Life Time University and Life Time Inclusion Council.

Our Culture of Care for team members and our tireless commitment to provide uncompromising member experiences has allowed thousands of passionate Life Time team members to help a community of millions of members live healthier, happier lives every day.

At Life Time, we have always believed in the power of innovation, imagination and transformation with every opportunity and that adversity and change make us stronger. Since our founding, we have continued to innovate all aspects of our HWOL ecosystem with this in mind. When presented with significant challenges, we have responded with even more intensity to innovate, adapt and find new ways forward always with the objective of enhancing our ability to support members on their health and wellbeing journeys.

During the COVID-19 pandemic, we quickly reexamined every aspect of our operations and made rapid adjustments to ensure we could continue delighting members. We also significantly enhanced our Life Time Digital offering to streamline the athletic resort experience and provide our members with hundreds of weekly, live-streamed classes in every modality of exercise, virtual personal training, nutrition and weight loss programs, meditation, Health Source, Health Talks, and other training and wellness content. Longer term, we see a significant opportunity to provide digital HWOL opportunities to the world through this evolving platform given the tremendous strength of the Life Time brand and our content. Together with our physical athletic resorts, we believe Life Time will offer omni-channel HWOL experiences that simply cannot be matched.

vi

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO 17 C.F.R. § 200.83

As confidentially submitted to the Securities and Exchange Commission on August 26, 2021.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission

and all information herein remains strictly confidential.

Over the last six years, our robust real estate and development capabilities have allowed us to play a direct role in partnership with major shopping mall owners and developers to help reimagine and redefine their retail real estate into mixed-use developments which we believe provide far better experiences for consumers. Our strengths in this area, paired with our powerful brand, have provided us with dozens of new, highly attractive, sought-after locations for our athletic resorts in dense urban environments with very strong economics.

Our dynamic brand and innovative spirit have also allowed us to expand the Life Time HWOL ecosystem through the creation of comprehensive, healthy communities that allow members to live, work, exercise and play in all-in-one, naturally and intuitively environmentally friendly Life Time destinations with the added benefits of no lost time or the need for transportation.

In 2018, we launched Life Time Work a unique approach in the shared workspace industry. Each of our six Life Time Work locations with more currently in development is adjacent to a Life Time athletic resort and features the most elevated shared workspace execution, along with access to all Life Time destinations in the United States and Canada.

In 2021, we launched Life Time Living luxurious, high-end multi-family rental apartments featuring the Life Time brand and experience designed and planned in partnership with best-in-class residential real estate developers. We believe our powerful brand, service and operational expertise, coupled with the unmatched amenity provided by an adjacent Life Time athletic resort, will provide us access to new opportunities and locations for our athletic resorts that previously were unobtainable.

I am extremely proud of the company and brand we have built and even more excited about our future. As we emerge from the COVID-19 pandemic, the consumer demand for Life Time is very strong as evidenced by the acceleration we are currently seeing in new membership acquisition and dues revenue growth. We believe there are incredible growth opportunities ahead to expand our omni-channel ecosystem. As we approach our 30th anniversary, I have never been more passionate about our company and the influence we can have in bringing millions more people a Healthy Way of Life.

vii

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO 17 C.F.R. § 200.83

As confidentially submitted to the Securities and Exchange Commission on August 26, 2021.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission

and all information herein remains strictly confidential.

This summary highlights information contained in greater detail elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our financial statements and the related notes included elsewhere in this prospectus, and the information set forth under Risk Factors and Managements Discussion and Analysis of Financial Condition and Results of Operations.

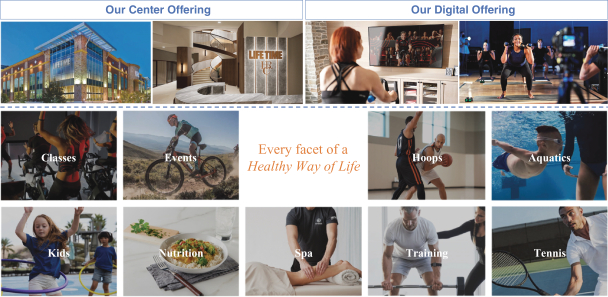

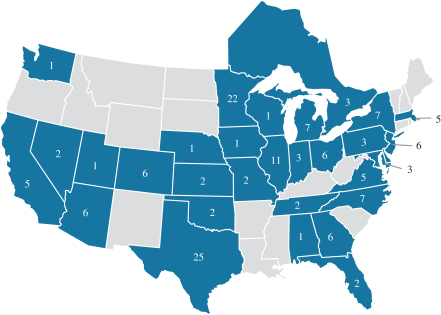

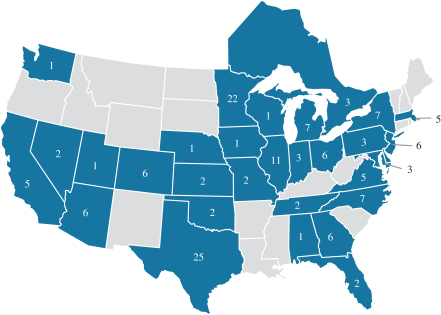

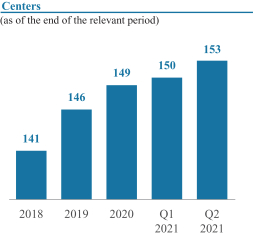

Who We Are

Life Time, the Healthy Way of Life Company, is a leading lifestyle brand offering premium health, fitness and wellness experiences to a community of nearly 1.4 million individual members, who together comprise more than 759,000 memberships, as of June 30, 2021. Since our founding nearly 30 years ago, we have sought to continuously innovate ways for our members to lead healthy and happy lives by offering them the best places, programs and performers. We deliver high-quality experiences through our omni-channel physical and digital ecosystem that includes more than 150 centersdistinctive, resort-like athletic destinationsacross 29 states in the United States and one province in Canada. Our track record of providing differentiated experiences to our members has fueled our strong, long-term financial performance. In 2019, prior to the COVID-19 pandemic, we generated $1.9 billion of revenue and $30 million in net income. In 2020, which was impacted by the COVID-19 pandemic, we generated $0.9 billion of revenue and $360 million in net loss, and in the six months ended June 30, 2021, we generated $0.6 billion of revenue and $229 million in net loss.

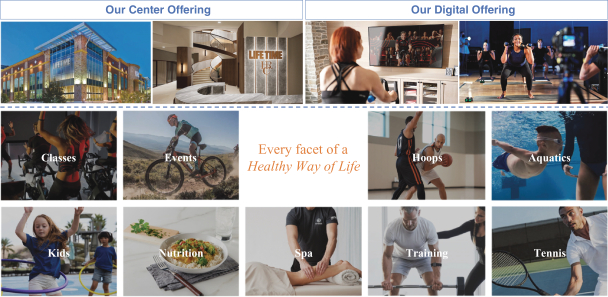

Our Premium Health, Fitness and Wellness Experiences

Our luxurious athletic centers, which are located in both affluent suburban and urban locations, total more than 15 million square feet in the aggregate. We offer expansive fitness floors with top-of-the-line equipment, spacious locker rooms, group fitness studios, indoor and outdoor pools and bistros, indoor and outdoor tennis courts, basketball courts, LifeSpa, LifeCafe and our childcare and Kids Academy learning spaces. Our premium service offering is delivered by approximately 30,000 Life Time team members, including over 6,100 certified fitness professionals, ranging from personal trainers to studio performers. Our members are highly engaged and

| 1 |

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO 17 C.F.R. § 200.83

As confidentially submitted to the Securities and Exchange Commission on August 26, 2021.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission

and all information herein remains strictly confidential.

draw inspiration from the experiences and community we have created, as demonstrated by the 92 million visits to our centers in 2019, the 48 million visits to our centers in 2020 despite the COVID-19 pandemic and the 32 million visits to our centers during the first six months of 2021.

Our Footprint of Premium Athletic Centers

(as of July 31, 2021)

We believe that no other company in the United States delivers the same quality and breadth of health, fitness and wellness experiences as we deliver, which has enabled us to consistently grow our recurring membership dues and in-center revenues for 20 consecutive years, prior to the impact of the COVID-19 pandemic. As of December 31, 2019, December 31, 2020 and June 30, 2021, our recurring membership dues represented 63%, 69% and 68%, respectively, of our total revenue, while our in-center revenue, consisting of Life Time Training, LifeCafe, LifeSpa, Life Time Swim and Life Time Kids, among other services, represented 34%, 29% and 30%, respectively, of our total revenue. Between 2015 and 2019, we grew our average revenue per membership from $1,883 to $2,172, a testament to the significant value that our members place on engaging with Life Time. Our Net Promoter Score increased from 34 as of December 31, 2017 to 53 as of June 30, 2021, demonstrating our ability to continuously enhance our member experience. While average revenue per membership fell to $1,317 in 2020, we have seen a strong rebound already in 2021, with $984 in average revenue per membership during the six months ended June 30, 2021.

We continue to evolve our premium lifestyle brand in ways that allow our members to more easily and regularly integrate health, fitness and wellness into their lives. We are enhancing our digital platform to deliver a true omni-channel experience for our members. Our Life Time Digital offering delivers live streaming fitness classes, remote goal-based personal training, nutrition and weight loss support and curated award-winning health, fitness and wellness content. Through an agreement with Apple®, we also provide Apple Fitness+ to our members, which gives our members expanded content and wellness data monitoring on the go. In addition, our members are able to purchase a wide variety of equipment, wearables, apparel, beauty products and nutritional

| 2 |

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO 17 C.F.R. § 200.83

As confidentially submitted to the Securities and Exchange Commission on August 26, 2021.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission

and all information herein remains strictly confidential.

supplements via our digital health store. We are continuing to invest in our digital capabilities in order to strengthen our relationships with our members and more comprehensively address their health, fitness and wellness needs so that they can remain engaged and connected with Life Time at any time or place.

We are also expanding our ecosystem in response to our members desire to more holistically integrate health and wellness into every aspect of their daily lives. In 2018, we launched Life Time Work, an asset-light branded co-working model, which offers premium work spaces in close proximity to our centers and integrates ergonomic furnishings and promotes a healthy working environment. Life Time Work members also receive access to all of our resort-like athletic destinations across the United States and Canada. Additionally, we opened our first Life Time Living location in 2021, another asset-light extension of our Healthy Way of Life ecosystem, which offers luxury wellness-oriented residences. As we expand our footprint with new centers and nearby work and living spaces, as well as strengthen our digital capabilities, we expect to continue to grow our omni-channel platform to support the Healthy Way of Life journey of our members wherever they are.

Our Transformation Under Private Ownership Since 2015

Since going private in 2015, we have significantly expanded our national footprint, accelerated unit growth in a capital efficient manner and invested in omni-channel capabilities for future growth.

| Expanded National Footprint and Strategic Focus on Locations in Affluent Metropolitan Statistical Areas (MSAs) |

Increased presence in urban and coastal markets such as Boston, Chicago, New York City and California Maximizing full market potential by expanding our center locations to mall/retail, urban and residential tower locations in addition to traditional suburban locations For centers opened prior to 2015, our average annual revenue per center membership was $1,991. For centers opened after 2015, this grew to $3,089 in 2019 prior to the COVID-19 pandemic, was $1,716 in 2020 during the COVID-19 pandemic, and has recovered to $1,345 in the six months ended June 30, 2021

|

|

| Asset-light, Flexible Real Estate Strategy |

58% of centers are now leased, including approximately 84% of new centers opened since 2014, versus a predominantly owned real estate strategy prior to 2015 Flexibility to monetize significant underlying real estate value New center return on invested capital target of mid-to-upper thirties percent, more than double historical trends

|

|

| Expanded Omni-Channel Membership Offerings |

Enhanced our digital capabilities, including our upgraded Life Time Digital app Entered into a strategic relationship with Apple Fitness+ Entering the co-working and residential living markets with Life Time Work and Life Time Living

|

|

In connection with going private in 2015, we incurred a substantial amount of indebtedness. As of June 30, 2021, we had total consolidated indebtedness outstanding of approximately $2,407 million, and for the six months ended June 30, 2021, our interest expense, net of interest income was $136.3 million. As of June 30, 2021, our annual debt service obligation was approximately $185 million, which includes principal and interest payments under the credit agreement governing our Credit Facilities and the indentures governing our Secured Notes and Unsecured Notes. See Capitalization and Managements Discussion and Analysis of Financial Condition and Results of OperationsLiquidity and Capital ResourcesDebt Capitalization. As of June 30, 2021, on an as adjusted basis to give effect to the use of a portion of the proceeds from this offering to repay amounts outstanding under our Term Loan Facility, we

| 3 |

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO 17 C.F.R. § 200.83

As confidentially submitted to the Securities and Exchange Commission on August 26, 2021.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission

and all information herein remains strictly confidential.

would have had total consolidated indebtedness of approximately $ million and our annual debt service obligation would have been approximately $ million, which includes principal and interest payments under the credit agreement governing our Credit Facilities and the indentures governing our Secured Notes and Unsecured Notes. See Use of Proceeds.

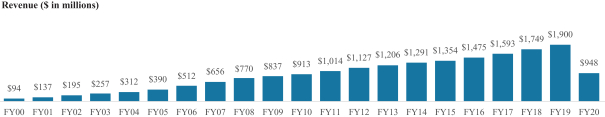

Financial Performance

Our compelling financial profile is distinguished by our long-term track record of consistent revenue growth prior to the COVID-19 pandemic, growth of new centers in attractive markets, a high percentage of predictable recurring membership revenue, increasing revenue per center membership and strong profitability.

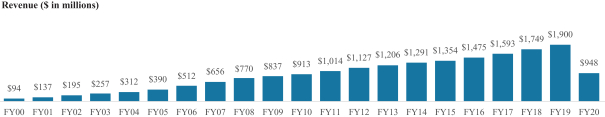

Long-Term Track Record of Revenue Growth. We believe the strength of our brand and the effective execution of our operating strategy have driven our long-term track record of growth. Prior to the impact of COVID-19 in 2020, we grew our revenue each year from 2000 through 2019.

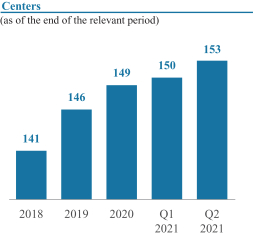

Highly Successful New Center Openings. Our asset-light, flexible real estate strategy and compelling center economics have enabled us to successfully open new centers in attractive markets. From 2016 through June 30, 2021, we opened 38 new centers, increasing our total center count by 33%.

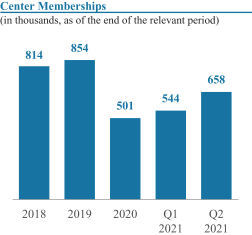

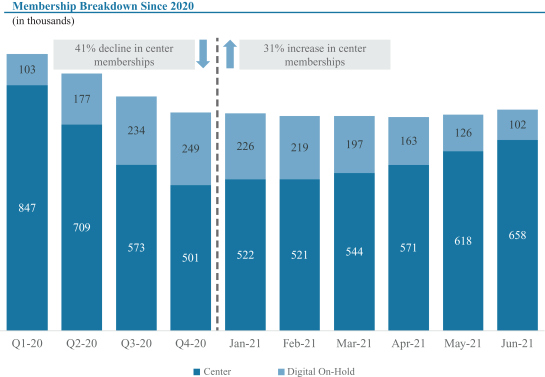

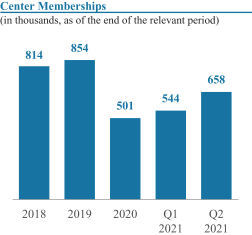

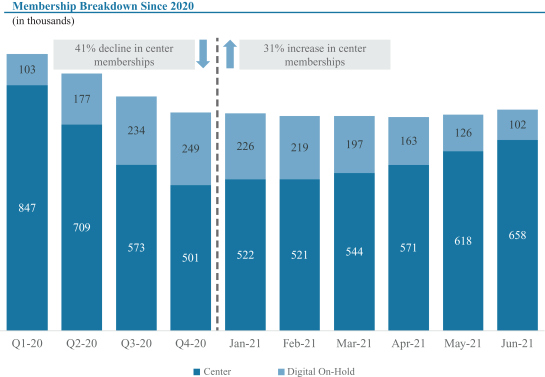

Predictable Recurring Membership Revenue. Due to our strong membership base, our membership dues represent a predictable recurring revenue stream that provides stability to our business. Center memberships grew from approximately 814,000 at the end of 2018 to approximately 854,000 at the end of 2019. Center memberships were approximately 501,000 at the end of 2020 as a result of the COVID-19 pandemic, and have rebounded to approximately 658,000 as of June 30, 2021. With respect to the net increase of approximately 157,000 Center memberships during the first six months of 2021, the percentage of that net increase attributable to members converting from Digital On-hold was approximately 61%, or 96,000 memberships. The proportion of our total revenue generated by the resulting recurring membership dues was 63% in 2019 and 69% in 2020.

Increasing Average Revenue Per Center Membership. Between 2015 and 2019, we grew our average revenue per center membership from $1,883 in 2015 to $2,172 in 2019, a testament to the significant value that our members place on engaging with Life Time. As a result of the COVID-19 pandemic, average revenue per membership fell to $1,317 in 2020, and has recovered to $984 for the first six months ended June 30, 2021.

Strong Profitability. We maintain a highly profitable business model, achieving a 1.6% net income margin and a 23.8% Adjusted EBITDA margin in 2019. These metrics were impacted by the COVID-19 pandemic in 2020, falling to (38.0)% and (5.9)%, respectively, in 2020.

Impact of COVID-19 on Our Financial Performance

On March 16, 2020, we closed all of our centers based on orders and advisories from federal, state and local governmental authorities responding to the spread or threat of spread of COVID-19. While our centers were

| 4 |

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO 17 C.F.R. § 200.83

As confidentially submitted to the Securities and Exchange Commission on August 26, 2021.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission

and all information herein remains strictly confidential.

closed, we did not collect monthly access membership dues or recurring product charges from our members. We re-opened our first center on May 8, 2020 and have continued to re-open our centers in accordance with evolving state and local governmental guidance. As of July 31, 2021, all of our 154 centers were open.

After the onset of the COVID-19 pandemic, we prioritized the health and safety of our members and team members by developing and implementing robust COVID operating protocols, while taking appropriate steps to ensure our financial stability, including by reducing operating expenses, delaying capital investments and securing additional debt financing. We continue to refine these protocols and may take further actions as government authorities require or recommend or as we determine to be in the interests of our members, team members, vendors and service providers as we operate in the evolving COVID-19 environment, including as a result of variants such as the Delta variant. Despite the challenges presented by the governmental response to the COVID-19 pandemic with respect to the health, fitness and wellness industry, we have remained committed to our mission and our members, and have already witnessed a strong recovery and substantial momentum in 2021.

Number of Centers. While our new center construction and growth was slowed as a result of the COVID-19 pandemic, we have successfully opened seven new centers since the end of 2019 through June 30, 2021, five of which opened after the onset of the pandemic. We have also continued our real estate development efforts after initially suspending them during the pandemic, and had 11 centers under construction as of June 30, 2021. We plan to open six new centers in 2021, with a pipeline to open 20 or more new centers in 2022 and 2023.

Revenue and Net Income (Loss). As a result of the COVID-19 pandemic, our total revenue fell from $1,900 million for 2019 to $948 million for 2020. This revenue loss resulted in a reduction of net income from approximately $30 million in 2019 to a net loss of approximately $360 million in 2020.

Memberships. We define memberships for our centers as Center memberships that provide general access (with some amenities excluded) to one or more centers and Digital On-hold memberships that provide certain member benefits but not access to our centers. Both Center memberships and Digital On-hold memberships include Life Time Digital. Center memberships grew from approximately 814,000 at the end of 2018 to approximately 854,000 at the end of 2019. By the end of 2020, as a result of the COVID-19 pandemic, Center memberships had declined to approximately 501,000 as we experienced more conversions of Center memberships to Digital On-hold memberships as well as a higher level of membership terminations. Our attrition rate, which is the number of Center membership terminations plus the net movement to/from Digital On-hold memberships for the trailing period, divided into the average beginning month Center membership balance for the trailing period, was thus higher due to COVID-19. For example, our attrition rate for the first six months of 2020 was approximately 29.1% compared to 16.1% during the first six months of 2019. However, we have recently seen significant improvement in our Center membership numbers and had approximately 658,000 Center memberships as of June 30, 2021, including a lower attrition rate of 5.6% during the first six months of 2021 due in large part to the conversion of Digital On-hold memberships back to Center memberships. With respect to the net increase of approximately 157,000 Center memberships during the first six months of 2021, the percentage of that net increase attributable to members converting from Digital On-hold was approximately 61%, or 96,000 memberships. These Center memberships accounted for approximately 68% of our revenue as of June 30, 2021, underscoring the consistency of our recurring revenue model. During the COVID-19 pandemic, we continued to engage with our members via our enhanced digital offering. For example, we offered members the ability to download and stream workouts and classes. As a result, we generated over 2.4 million digital workouts and class downloads during 2020 and 0.9 million during the six months ended June 30, 2021. We believe this engagement resulted in more of our members converting their Center memberships to Digital On-hold memberships rather than cancelling their memberships.

| 5 |

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO 17 C.F.R. § 200.83

As confidentially submitted to the Securities and Exchange Commission on August 26, 2021.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission

and all information herein remains strictly confidential.

|

|

Our Healthy Way of Life Industry Opportunity

Health, fitness and wellness are core to our mission. As a leading lifestyle brand offering premium health, fitness and wellness experiences, we believe that Life Time is well-positioned in the market today to address the full spectrum of consumers Healthy Way of Life needs.

| 6 |

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO 17 C.F.R. § 200.83

As confidentially submitted to the Securities and Exchange Commission on August 26, 2021.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission

and all information herein remains strictly confidential.

We believe that our health, fitness and wellness opportunity is large and that our growth will accelerate as we emerge from the COVID-19 pandemic for the following reasons:

| | Large and growing industry opportunity: According to the Global Wellness Institute, the Global Wellness Economy represented a $4.5 trillion global market opportunity in 2018. A sustained increase in the prioritization of health, fitness and wellness among consumers drove growth in the Global Wellness Economy nearly twice as fast as global GDP growth from 2015 to 2017, according to the Global Wellness Institute. We estimate that the U.S. wellness economy represents an approximately $900 billion market opportunity. |

| (1) | Includes wellness tourism, traditional & complementary medicine, personal care, beauty, anti-aging and mental wellness. |

| (2) | Source: Global Wellness Institute - 2018 Global Wellness Economy Monitor |

| (3) | Source: Management estimate. |

| | Increased obesity prevalence: According to the Centers for Disease Control and Prevention, U.S. obesity prevalence grew from 30.5% to 42.4% from 2000 to 2018. In February 2021, 42% of U.S. adults reported experiencing unwanted weight gain during the pandemic, with an average gain among that group of 29 pounds, according to a Harris Poll conducted for the American Psychological Association. We believe consumers will place a higher prioritization on their health and that this will present a meaningful tailwind for Life Time. |

| | Demand from displaced gym members: According to the International Health, Racquet, and Sportsclub (IHRSA), approximately 22% of total health clubs and fitness studios closed permanently during 2020. We believe these closures create an opportunity for us to attract new members whose gym may have permanently closed. |

Our holistic Healthy Way of Life vision and ecosystem allow us to comprehensively meet the needs of our members both in and outside of our resort-like athletic destinations. Our members also enjoy a supportive community where strong bonds are formed through shared experiences and goals. As the Life Time brand expands, we believe our ability to penetrate new and existing sections of the health, fitness and wellness market will also increase.

Our Competitive Strengths

We believe that the following strengths power our brand and business model:

Authentic, Premium Healthy Way of Life Brand

We have built Life Time into a premier health, fitness and wellness lifestyle brand, earning the trust of our members for nearly 30 years to make their lives healthier and happier. We believe that consumers equate our

| 7 |

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO 17 C.F.R. § 200.83

As confidentially submitted to the Securities and Exchange Commission on August 26, 2021.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission

and all information herein remains strictly confidential.

brand with the uncompromising quality, luxury and Healthy Way of Life experiences that Life Time offers. We have built this credibility and robust brand equity through our continuous focus on high quality member experiences delivered through what we believe to be the best programs with the best performers in the best places. We believe our brand loyalty will allow us to continue to grow our core business as well as expand our omni-channel platform in digital, work, living and other health, fitness and wellness experiences.

Differentiated and Uncompromising Omni-Channel Experiences

Our omni-channel platform offers members an exceptional breadth of physical and digital experiences that meet or exceed our members expectations:

| | Full Suite of Comprehensive Offerings: Life Time offers an expansive array of amenities, services and activities, thereby enabling members to enjoy a Healthy Way of Life across a diverse and varied set of offerings. Whether taking advantage of our state-of-the-art fitness equipment, partaking in summer camp for kids, competing in one of our sports leagues or relaxing in one of our award-winning spas, Life Time members enjoy a full end-to-end experience that can be utilized by the entire family and enable them to grow and develop, regardless of where they are in their health and wellness journey. |

| | World-Class Talent: We recruit, hire and certify those whom we believe are the best certified fitness professionals and performers in the industry to empower, educate and entertain our members. In addition, to enhance our member experiences and drive consistency in our hospitality and services, we have a strong focus on team member culture, training and certification. Life Time University, our in-house, proprietary |

| 8 |

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO 17 C.F.R. § 200.83

As confidentially submitted to the Securities and Exchange Commission on August 26, 2021.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission

and all information herein remains strictly confidential.

| education and certification division, offers curricula curated by over 20 dedicated professionals providing team members with online and in-person training and certification. |

| | Passionate Culture: Our focus on engagement among team members and performers attracts and fosters our multi-generational member base. We deeply value diversity, equity and inclusion at Life Time and strive to create a welcoming and inclusive culture. In addition, we foster community engagement through a wide range of events and activities, from parent-child dances to pool parties to charity runs. Since the start of 2019, we have organized more than 5,300 events and served as a social and community hub for our members. |

| | Digital Offerings: Life Time Digital enables our members to experience some of our best offerings at their fingertips at any time and wherever they are located in the United States or Canada. During the six months ended June 30, 2021, our members live streamed an average of 540 classes per week. |

Loyal and Engaged Multi-Generational Membership Base with Attractive Demographics

Life Times breadth of premium services and offerings attracts anyone who wants to lead a healthier, happier life. The power of our lifestyle brand, attractive member demographics, breadth of amenities and services and high utilization of our centers allow us to build deeply meaningful connections with our members, which are difficult for others in our industry to replicate fully. From young children attending our swim lessons and Kids Academy classes, or teenagers engaged in our sports and agility training, to members of all ages participating in our iconic athletic events and variety of in-center activities, we have something for every generation. As of June 30, 2021, 70% of our members owned a home and had a median household income of $112,000 and approximately 60% of our members are part of a couples or family membership, and these members typically engage more fully within our centers. On average, our members spent $2,172 and $1,317 at our centers during 2019 and 2020, respectively, and visited our centers an average of 108 and 69 times during the same periods, respectively. We have seen an improvement in these metrics during the six months ended June 30, 2021, with our members spending an average of $984 at our centers and visiting our centers an average of 57 times during that period.

Higher engagement and connectivity with our members drive attractive long-term value per member and higher member retention rates. Over 25% of our new Center memberships each year are driven by individuals and families re-joining the Life Time community following a period of non-membership, highlighting that a meaningful portion of canceled memberships derive from external life changes (such as relocation) rather than a negative club experience.

Flexible Real Estate Strategy with Nationwide Footprint

We have a diversified portfolio of over 150 resort-like athletic destinations that are primarily located in affluent markets across 29 states and one Canadian province. Over the last five years, we have become more asset-light through sale-leaseback transactions and have adopted more strategic and flexible center formats that can be modified to accommodate various settings, including traditional suburban, vertical residential, urban and mall/retail locations. Our focus on a flexible real estate strategy since 2015 has enabled us to develop a business model that targets a new center return on invested capital of mid-to-upper thirties percent, more than double historical trends, grow the number of centers at a faster pace and enter attractive urban coastal markets with premium centers where the price of real estate had historically been a deterrent to entry. We also benefit from our in-house architecture, design and construction expertise that allows us to create sustainable and energy efficient centers. These efforts have helped us control the cost and pace of capital expenditures and have also ensured a consistent feel across our centers.

We have developed a disciplined and sophisticated process to evaluate markets and specific sites in those markets where we may want to build new centers. This dynamic process is based upon demographic, psychographic and competitive criteria generated from profiles of our most successful centers, and we continue to refine these

| 9 |

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO 17 C.F.R. § 200.83

As confidentially submitted to the Securities and Exchange Commission on August 26, 2021.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission

and all information herein remains strictly confidential.

criteria based upon the performance of our centers. We believe that the presence of a Life Time center benefits landlords and the value of the underlying property and surrounding neighborhoods. We seek to leverage this halo effect of our brand, as well as long-term relationships with landlords, to achieve favorable lease agreements and increased tenant improvement allowances from landlords to support our capital light expansion.

Recurring Revenue Model with Consistent Growth

Membership dues from our network of members create a recurring and relatively predictable revenue stream that has proven to be resilient for nearly 30 years and across economic cycles. Membership dues provide our largest source of revenue, representing 63%, 69% and 68% of our total revenue in 2019, 2020 and the six months ended June 30, 2021, respectively.

We have grown from $137 million, $4 million and $36 million in revenue, net income and Adjusted EBITDA, respectively, in 2001 to $1.9 billion, $30 million and $452 million in revenue, net income and Adjusted EBITDA, respectively, in 2019. During that time period, we did not have a year-over-year decline in revenue or Adjusted EBITDA. While revenue, net income and Adjusted EBITDA did decline to $948 million, $(360) million and $(56) million, respectively, during the COVID-19 pandemic in 2020, we have already begun to see a recovery during 2021 as we re-opened our centers and we emerge from the pandemic. During the six months ended June 30, 2021, we generated $572 million, $(229) million and $(10) million in revenue, net (loss) and Adjusted EBITDA, respectively.

Passionate, Visionary, Founder-Led Management Team with Deep Industry Experience

Our unwavering commitment to excellence and a Healthy Way of Life culture is driven by our passionate management team, under the leadership of Bahram Akradi, our founder, Chairman and Chief Executive Officer. Life Time was founded by Mr. Akradi in 1992 with a goal of helping people achieve their health, fitness and wellness goals by delivering entertaining, educational and innovative experiences with uncompromising quality and unparalleled service. From the very beginning, Mr. Akradi has led the Company with a focus on serving members needs first and a belief that business results would naturally follow.

By building a strong and highly experienced executive leadership team, Life Time has continued to grow and consistently deliver exceptional experiences. Our executive leadership includes:

| | Tom Bergmann, President & Chief Financial Officer. Mr. Bergmann has been with Life Time for more than five years and has more than 30 years of leadership experience across various industries, including as Chief Financial Officer at three companies including USF Corporation (prior to being acquired by Yellow Corporation), Amsted Industries and Harley Davidson. |

| | Jeff Zwiefel, President & Chief Operating Officer. Mr. Zwiefel has been with Life Time for over 20 years and has more than 35 years of experience in the health, fitness and wellness industry. |

| | Eric Buss, Executive Vice President & Chief Administrative Officer. Mr. Buss has been with Life Time for over 20 years and has served as a key executive leader in a variety of roles. |

| | Parham Javaheri, Executive Vice President & Chief Property Development Officer. Mr. Javaheri joined Life Time in 2004 and has over 20 years of experience in real estate development. |

| | RJ Singh, Executive Vice President & Chief Digital Officer. Mr. Singh joined Life Time in 2017 and oversees all digital and technology infrastructure, operations and initiatives. |

Our team has an entrepreneurial spirit that we believe makes us highly adaptable, reflects an ownership mentality and allows us to navigate shifts in the health, fitness and wellness landscape, including as a result of the COVID-19 pandemic. We believe the strength of our team, culture and organizational approach position us to continue to grow and deliver strong financial results.

| 10 |

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO 17 C.F.R. § 200.83

As confidentially submitted to the Securities and Exchange Commission on August 26, 2021.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission

and all information herein remains strictly confidential.

Our Growth Strategies

We have built a strong foundation with an engaged membership base in pursuit of a healthy way of living. Leveraging our omni-channel platform, we intend to grow by increasing our membership base through our proven business model, increasing revenue per center membership, growing our number of centers and expanding our ecosystem.

Continue to Grow Our Membership Base

We believe we will expand our membership base as consumer activity accelerates post-pandemic and by continuing to increase our brand awareness, acquire new consumers and retain our current members longer. We expect to grow our consumer reach through the following initiatives:

| | Data-driven, targeted marketing campaigns focused on experiences. Employ targeted marketing campaigns driven by data analytics to increase brand awareness and membership growth, as well as engage in consumer-focused marketing related to improving their health post-pandemic. According to a survey conducted by Momentum Worldwide, 76% of consumers would rather spend their money on experiences than on material items. |

| | Attract and retain members. Continue to expand our offerings to attract and retain members of all ages, from extended childcare hours for kids, to new studio classes, to pickleball for the aging population. We believe extending our existing membership offerings with complementary or fee-based services and benefits will continue to drive broader appeal, higher memberships and longer member retention. |

| | Market share gains. Capture orphaned members from fitness centers that shutdown during the pandemic. According to IHRSA, approximately 22% of health clubs and fitness studios closed permanently during the pandemic. We believe we are well-positioned to capture a portion of these consumers within our markets. |

We believe that employing these strategies will enable us to continue to grow our membership base over the long-term.

Increase Revenue per Center Membership

We expect to increase revenue from our members by executing on the following initiatives:

| | Expand in-center offerings that generate incremental revenue. We nearly doubled our average in-center revenue per membership from 2007 to 2019. Although we saw a decline in average center revenue per membership during 2020, we have begun seeing a recovery during the six months ended June 30, 2021. We intend to continue to expand our health, fitness and wellness offerings to cater to all types of interests and levels, and to drive increased spend by members within our centers. |

| | Enhance membership pricing. We expect to increase spend from consumers by developing new premium centers in more affluent markets that drive higher membership dues, enhancing experiences at our existing centers to create more value and pricing opportunities and, over time, transitioning existing memberships to higher membership prices or tiers as we continue to add more value to their membership. |

| | Drive further digital penetration. We plan to continue growing our digital usage across our members and direct-to-consumer non-center members. We plan to drive these engagement levels higher as we scale and better interconnect our digital platform and full-service centers. In addition to increasing engagement and retention with our center members, we believe our digital offering enables us to attract and retain new members, generate incremental revenues, deliver high-quality fitness content and maintain strong levels of member engagement, even when a member is unable to visit one of our centers. |

| 11 |

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO 17 C.F.R. § 200.83

As confidentially submitted to the Securities and Exchange Commission on August 26, 2021.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission

and all information herein remains strictly confidential.

Grow Our Number of Premium Athletic Centers

We believe we have significant whitespace opportunity for our premium athletic centers across the United States and Canada, as well as internationally. Our new center expansion is focused on strategic locations that we expect will generate higher average dues, higher in-center revenue per membership and higher revenue per square foot. Our asset-light model and flexible center formats allow us to further expand our potential market and strategically target premium locations with wealthier demographic profiles.

Between 2016 and 2019, we opened eight new centers per year on average. After opening three new centers in 2020, we expect to return to growth, and have plans to open six new centers in 2021 with a pipeline to open 20 or more new centers in 2022 and 2023. Our new centers historically have ramped to maturity over three to four years with a high level of consistency. As our annual number of new centers increases, we believe this ramping club dynamic will provide further support and predictability to our overall revenue and earnings growth.

We believe our flexible, vertically integrated real estate capabilities and brand strength provide meaningful runway for Life Times expansion.

We also intend to complement our organic growth through acquisitions. We have acquired, and expect to continue to acquire, athletic centers as well as services and experiences. Our acquisitions can be single assets or portfolios of assets. We take a disciplined approach to sourcing, acquiring and integrating high quality assets and/or locations and complementary businesses that can help us continue to expand into new geographic areas, acquire key talent, and offer new services and experiences. Our post-acquisition integration process often involves significant investments in both the acquired physical assets and human capital to improve each acquired site and to rebrand the look and feel of the center to create the Life Time brand experience for our members.

Expand the Life Time Ecosystem

We believe the importance of health, fitness and wellness coupled with the structural shift of consumer preferences towards experiential and proactive health and wellness spending creates new opportunities for us to leverage our Healthy Way of Life lifestyle brand. As our business model evolves and our membership base grows, we expect to leverage our brand reputation and use our deep understanding of membership needs to add a growing portfolio of products and services to our omni-channel platform. We also believe that we can leverage our brand reputation and deep understanding to expand our operations internationally. While our operations are predominantly in the United States today, we continuously analyze our growth strategy and believe we have opportunities to expand our digital and physical ecosystem and healthy way of life internationally.

We want Life Time to be our consumers second home. For example, in 2018, we launched Life Time Work, a brand extension capitalizing on the broader shift to co-working spaces. We have six Life Time Work locations open and operating, with plans to open two new locations during 2021 and more in the following years. Life Time Work locations average 26,000 square feet and come with a variety of perks and amenities, including complimentary access to our centers in the United States and Canada, secure storage, printing stations, coffee bars and healthy snacks.

We also see significant opportunity to further embed the Life Time brand and healthy way of living through the development of high-end, wellness-oriented residences. To this end, we opened our first Life Time Living location in 2021 and plan to open additional locations during the next few years. While we are in the early stages of capitalizing on this opportunity, we believe integrating how and where consumers live, work, move and play is a promising opportunity that Life Time is uniquely positioned to capture.

| 12 |

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO 17 C.F.R. § 200.83

As confidentially submitted to the Securities and Exchange Commission on August 26, 2021.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission

and all information herein remains strictly confidential.

Summary Risk Factors

We are subject to a number of risks, including risks that may prevent us from achieving our business objectives or that may adversely affect our business, financial condition, results of operations, cash flows and prospects. You should carefully consider the risks discussed in the section entitled Risk Factors, including the following risks, before investing in our common stock:

Risks Relating to Our Business Operations and Competitive Environment

| | the impact of the COVID-19 pandemic; |

| | our ability to attract and retain members; |

| | competition in the health, fitness and wellness industry; |

| | our inability to anticipate and satisfy consumer preferences and shifting views of health, fitness and wellness; |

| | events such as severe weather conditions, natural disasters, global pandemics or other health crises, hostilities and social unrest, among others; |

| | disruptions in the operations of our centers in geographic areas where we have significant operations; |

| | our dependence on a limited number of suppliers for equipment and certain products and services; |

Risks Relating to Our Brand

| | a deterioration in the quality or reputation of our brand or the health club industry; |

| | risks relating to our use of social media and email and text message marketing; |

| | our inability to protect and enforce our intellectual property rights or defend against intellectual property infringement suits against us by third parties; |

Risks Relating to the Growth of Our Business

| | our inability to identify and acquire suitable sites for centers; |

| | increased investments in future centers in wealthier demographic areas and the risk that the level of return will not meet our expectations; |

| | delays in new center openings; |

| | our growth and changes in the industry; |

| | costs we may incur in the development and implementation of new businesses with no guarantee of success; |

| | risks relating to acquisitions, including our inability to acquire suitable businesses or, if we do acquire them, risks relating to asset impairment or the integration of the business into our own; |

Risks Relating to Our Technological Operations

| | our ability to adapt to significant and rapid technological change; |

| 13 |

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO 17 C.F.R. § 200.83

As confidentially submitted to the Securities and Exchange Commission on August 26, 2021.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission

and all information herein remains strictly confidential.

| | our inability to properly maintain the integrity and security of our data or the data of our members, to comply with applicable privacy laws, or to strategically implement, upgrade or consolidate existing information systems; |

| | disruptions and failures involving our information systems; |

| | risks related to automated clearing house (ACH), credit card, debit card and digital payments we accept; |

Risks Relating to Our Capital Structure

| | our ability to generate cash flow to service our substantial debt obligations; |

| | our ability to operate our business under the restrictions in our Credit Facilities and Indentures that limit our current and future operating flexibility; |

| | our ability to incur additional debt; |

Risks Relating to Our Human Capital

| | our inability to retain our key employees and hire additional highly qualified employees; |

| | labor shortages; |

| | attempts by labor organizations to organize groups of our employees or changes in labor laws; |

Risks Relating to Legal Compliance and Risk Management

| | our ability to comply with extensive governmental laws and regulations, and changes in these laws and regulations; |

| | claims related to our health, fitness and wellness-related offerings; |

| | our inability to maintain the required level of insurance coverage on acceptable terms or at an acceptable cost; |

| | claims related to construction or operation of our centers and in the use of our premises, facilities, equipment, services, activities or products; |

Risks Relating to Our Financial Performance

| | potential negative impacts resulting from the opening of new centers, including in our existing markets; |

| | rising costs related to construction of new centers and maintenance of our existing centers and our inability to pass these cost increases through to our members; |

| | risks associated with leases on certain of our centers; |

| | seasonal and quarterly variations in our revenues and net income; |