10-K: Annual report [Section 13 and 15(d), not S-K Item 405]

Published on February 27, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2024

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission file number 001-40887

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||

(952 ) 947-0000

(Address of principal executive offices, including zip code and Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered | ||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes x No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| x | Accelerated filer | ☐ | ||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No x

As of June 30, 2024, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $958.0 million (based upon the closing sale price of the common stock on that date on the NYSE).

As of February 24, 2025, the registrant had 209,592,785 shares of common stock outstanding, par value $0.01 per share.

DOCUMENTS INCORPORATED BY REFERENCE

1

TABLE OF CONTENTS

| Page | |||||

2

Cautionary Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K (this “Annual Report”) includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which are subject to the “safe harbor” created by those sections. Forward-looking statements include all statements that are not historical facts, including statements reflecting our current views with respect to, among other things, our plans, strategies and prospects, both business and financial, including our financial outlook and cash flow, possible or assumed future actions, opportunities for growth and margin expansion, improvements to our balance sheet and leverage, capital expenditures, consumer demand, industry and economic trends, business strategies, events or results of operations. These forward-looking statements are included throughout this Annual Report, including in the sections entitled “Business,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors.” These statements may be preceded by, followed by or otherwise include the words “believes,” “assumes,” “expects,” “anticipates,” “intends,” “continues,” “projects,” “predicts,” “estimates,” “plans,” “potential,” “may increase,” “may result,” “will result,” “may fluctuate,” and similar expressions or future or conditional verbs such as “will,” “should,” “would,” “foreseeable,” “may,” and “could” as well as the negative version of these words or similar terms and phrases. In addition, any statements or information that refer to expectations, beliefs, plans, projections, objectives, performance or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking.

The forward-looking statements contained in this Annual Report are based on management’s current beliefs and assumptions and are not guarantees of future performance. The forward-looking statements are subject to various risks, uncertainties, assumptions or changes in circumstances that are difficult to predict or quantify. Actual results may differ materially from these expectations due to numerous factors, many of which are beyond our control, including risks relating to our business operations and competitive and economic environment, risks relating to our brand, risks relating to the growth of our business, risks relating to our technological operations, risks relating to our capital structure and lease obligations, risks relating to our human capital, risks relating to legal compliance and risk management and risks relating to ownership of our common stock and as detailed under the section entitled “Risk Factors” in this Annual Report, as such risk factors may be updated from time to time in our periodic filings with the Securities and Exchange Commission, or SEC, and are accessible on the SEC’s website at www.sec.gov. Since it is not possible to foresee all such factors, these factors should not be considered as complete or exhaustive. Consequently, we caution investors not to place undue reliance on any forward-looking statements, as no forward-looking statement can be guaranteed, and actual results may vary materially.

Any forward-looking statements made by us in this Annual Report speak only as of the date of this Annual Report and are expressly qualified in their entirety by the cautionary statements included in this Annual Report. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, investments or other strategic transactions we may make. Except as required by law, we do not have any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements, whether as a result of new information, future events or otherwise.

3

PART I

Item 1. BUSINESS

Life Time Group Holdings, Inc. (collectively with its direct and indirect subsidiaries, “Life Time,” “we,” “our,” “us,” or the “Company”) is a holding company incorporated in the state of Delaware. Life Time Group Holdings, Inc. completed its initial public offering (“IPO”) in October 2021 and its common stock trades on the New York Stock Exchange (“NYSE”) under the symbol “LTH.”

Who We Are

Life Time, the “Healthy Way of Life Company,” is a premier lifestyle and leisure brand offering premium health, fitness and wellness experiences to a community of more than 1.5 million individual members, who together comprise more than 866,000 memberships, as of December 31, 2024. We are a leading innovator in the industry having successfully created a leisure model that incorporates the country club wellness lifestyle within a fitness and active living community. We have earned the trust of our members for over 30 years to make their lives healthier and happier by offering them the best places, programs and performers. We believe that consumers equate our brand with the uncompromising quality, luxury and “Healthy Way of Life” experiences that Life Time offers. We have built our reputation and robust brand equity through our continuous focus on delivering high-quality experiences through our omni-channel physical and digital ecosystem that includes more than 175 centers—distinctive, resort-like athletic country club destinations—across 31 states in the United States and one province in Canada. Our continuous commitment to members has resulted in strong brand loyalty and fueled our strong, long-term financial performance.

Our centers serve communities in both suburban and urban markets across North America. Depending on the size and location of a center, we offer expansive fitness floors with top-of-the-line equipment, spacious locker rooms, group fitness studios and spaces, indoor and outdoor pools and bistros, indoor and outdoor tennis courts, indoor and outdoor pickleball courts, basketball courts, LifeSpa, LifeCafe and our childcare and Kids Academy learning spaces. Our premium service offerings are delivered by over 42,000 Life Time team members, including over 10,800 certified fitness professionals, ranging from personal trainers to studio performers.

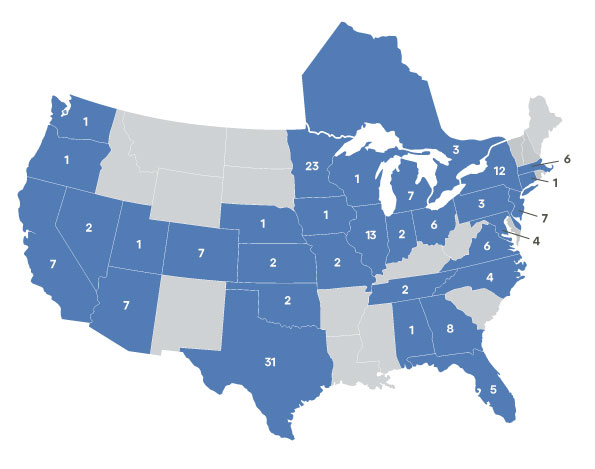

We have a model and scale that would be difficult to replicate. Our premium real estate portfolio of owned and leased athletic country clubs spans over 17 million of indoor square feet and approximately seven million of outdoor square feet. Our footprint of athletic country clubs as of December 31, 2024:

4

Our Membership Offering

We offer a variety of convenient month-to-month memberships with no long-term contracts, including:

•base memberships that provide general access (with some amenities excluded) to a selected home center and all centers with the same or lower base monthly dues rate, with the option for a junior membership as an add-on. The junior membership add-on for children 13 years old and younger currently costs $20-$100 per month. We do not count junior memberships as incremental in our membership count since they are already part of our base membership;

•signature memberships that are base memberships plus access to certain products, services or spaces that would otherwise be accessible only upon payment of additional dues or fees such as small group training and court time for certain racquet sports at certain centers;

•qualified base memberships that can be purchased at a reduced rate through partnerships with third party administrators including certain medical insurance providers and which may have limited hours; and

•digital on-hold memberships for members who do not currently wish to access our centers, but still want to maintain certain member benefits, including the right to convert back to a Center membership without paying an enrollment fee. The majority of our digital on-hold memberships cost $15 per month.

We also have Life Time Digital memberships for direct-to-consumer memberships that do not provide access to our centers and do not convert back to a Center membership. Our digital membership is accessible through our Life Time integrated digital app. Life Time Digital features include live streaming fitness classes, remote goal-based personal training, nutrition and weight loss support, and curated award-winning health, fitness and wellness content. We currently report our Life Time Digital memberships within our digital on-hold membership totals. Our digital offering is available to consumers at no charge through our Life Time digital app. Users of our free digital app are not included in our membership count. As we continue to invest in our technology, including the Life Time app and artificial intelligence, we believe our members and users of our digital app will be able to further utilize and benefit from our “Healthy Way of Life” ecosystem.

Our Highly Predictable Subscription-Based Revenue Model

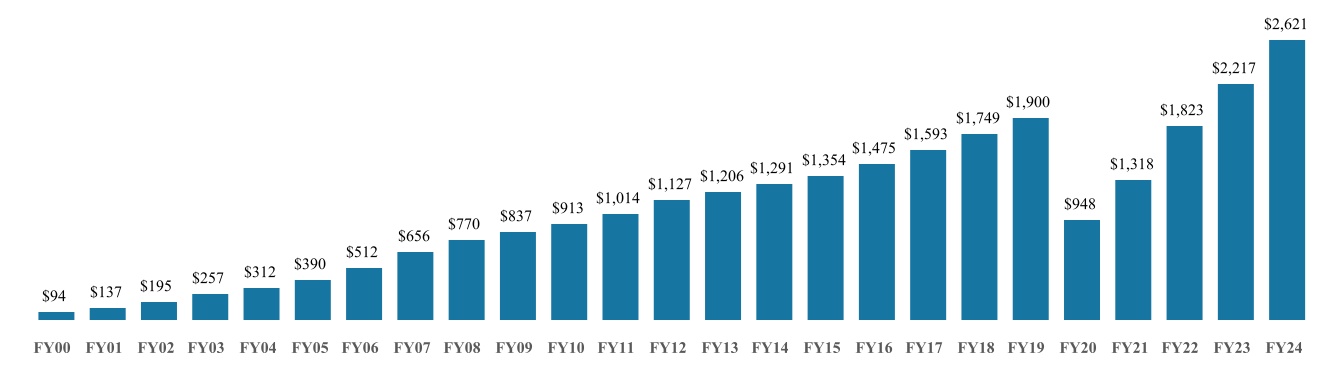

Our subscription-based membership model creates highly predictable and recurring revenue that has proven to be resilient for over 30 years and across economic cycles. Membership dues and enrollment fees comprise our largest source of revenue, representing over 70% of our total Center revenue. Coming out of the pandemic, we made a strategic shift to a more robust subscription offering and, as a result, our membership dues and enrollment fees now represent over 72% of our total Center revenue for the year ended December 31, 2024. We believe this recurring revenue stream, the strength of our brand and the effective execution of our operating strategy have driven our long-term track record of growth. Except in 2020 due to the impact of COVID-19, we have grown our revenue each year since 2000 and, in 2024, we recognized the highest revenue in our history, as shown below.

Revenue ($ in millions)

5

Our Engaged Members

The power of our lifestyle brand, attractive member demographics, breadth and desirability of amenities and services and high utilization of our centers allow us to build deeply meaningful connections with our members, which are difficult for others in our industry to replicate fully.

Our members are highly engaged and draw inspiration from the experiences and community we have created. The value our members place on our community is reflected in the continued strength and growth of our average revenue per center membership, center usage and the visits per membership to our athletic country clubs. Our average revenue per center membership increased to $3,160 in 2024 compared to $2,810 and $2,528 in 2023 and 2022, respectively. Total visits to our clubs were over 114 million in 2024 as compared to 103 million and 86 million in 2023 and 2022, respectively. Average visits per membership to our centers remained strong at 143 for 2024. We believe that no other company in the United States delivers the same quality and breadth of health, fitness and wellness experiences that we deliver, which has enabled us to consistently grow our annual membership dues and in-center revenue.

Our member engagement is driven by the vast array of amenities, services, products and activities that enable an entire family to grow and develop, regardless of where they are in their health and wellness journey. We support our existing and prospective members through a concierge service model that keeps our members’ interests first. We also recruit, hire and certify those whom we believe are the best professionals in our industry to empower, educate and entertain our members. We offer something for every generation, from young children attending our swim lessons and Kids Academy classes, teenagers and adults engaged in our state-of-the-art fitness equipment, Dynamic Personal Training and small group training and more senior adults engaged in our ARORA community, to members of all ages participating in pickleball, our iconic athletic events and a variety of our other in-center activities. The table below displays this wide assortment of physical and digital experiences:

| Amenities | Services | Activities, Products and Events | ||||||||||||

|

Indoor and Outdoor Pools

Group Fitness Studios

Cycle Studios

Yoga & Pilates Studios

Indoor and Outdoor Tennis Courts

Indoor and Outdoor Pickleball Courts

LifeCafe with Poolside Service

Bar and Lounge

Free Weight and Resistance Equipment

Cardiovascular Equipment

Steam Room and Sauna

Racquetball and Squash Spaces

Locker Rooms

Child Center and Kids Academy

Basketball/Volleyball Courts

|

Dynamic Personal Training

Dynamic Stretch

Small Group Training

ARORA

MIORA

Weight Loss Coaching

Nutrition Coaching

LifeSpa and Medi-spa

Physical Therapy and Chiropractic

Assessments and Lab Testing

Sport Specific Coaching

Endurance Coaching

Swim Lessons and Team Coaching

Towel and Locker Service

Experience Life

|

Athletic Leagues and Tournaments

Kids’ Birthday Parties

Summer and Vacation Camps for Kids

Sports Training Camps

Athletic Events

Social Events

Outdoor Group Runs

Outdoor Group Cycle Rides

Swim Meets

Charity Events

Nutritional Supplements

Apparel

|

||||||||||||

During 2024, we also organized approximately 44,100 events and served as a social and community hub for our members.

Our member base is primarily made up of members in affluent suburban and urban locations. We believe our membership base has a discretionary spending level that, on average, is less susceptible to adverse economic conditions. As of December 31, 2024, our members had a median household income of $158,000, which is 1.4 times the median income in the respective trade areas, 73% owned a home, approximately 58% are part of a couples or family membership and these members typically engage more fully within our centers, and approximately 56% had at least a college education. Additionally, our gender mix is balanced and approximately 44% are under 35 years of age and approximately 78% are under 55 years of age.

Our Growth Strategies and Member Experience Initiatives

We have built a strong foundation with an engaged membership base in pursuit of a healthy way of living. We continue to build on that foundation by executing several strategies and initiatives to grow and expand our business, further engage our members, optimize our memberships and member experience, and increase revenue per center membership. We are elevating our member experiences through new and improved in-center service offerings, omni-channel offerings and wellness products. We are also expanding the number of our centers in an asset-light model that targets higher income members, higher average annual revenue per center membership and higher returns on invested capital.

6

Expand and Elevate In-Center Service Offerings

We continue to evolve our premium lifestyle brand in ways that elevate and broaden our member experiences and allow our members to integrate health, fitness and wellness into their lives with greater ease and frequency.

Over the past few years, we have increased our investment in the following strategic initiatives, which are driving member engagement and significant increases in unique participants or total sessions in these areas:

•Pickleball. We now have over 700 dedicated pickleball courts and we had approximately 5.2 million participations during 2024. We believe pickleball is driving both new memberships and member engagement.

•Dynamic Personal Training. During 2024, we averaged over 180,000 Dynamic Personal Training sessions per month, an 18% increase in total sessions compared to 2023. We also launched Dynamic Stretch in the third quarter of 2023.

•Small Group Training. During 2024, we averaged over 39,000 small group training sessions per month, a 25% increase in total sessions compared to 2023, while also increasing total participation and average participants per session. Our small group training includes Alpha, GTX and Ultra Fit.

•ARORA. Our ARORA community is focused on members aged 55 years and older. We averaged over 9,000 classes per month in 2024, a 34% increase in total sessions compared to 2023. We believe we have opportunities to further grow our offerings to this community as the U.S. population continues to age.

•MIORA. Our new MIORA health optimization and longevity services include comprehensive assessments, proprietary therapies, supplements and recovery and rejuvenation tools. After launching a pilot location in 2024, we plan to expand these services to additional locations in 2025 and beyond.

We have also been executing on enhanced offerings within our LifeCafe, LifeShop and LifeSpa, including our newly branded LTH nutritional products.

Optimize Revenue per Center Membership

We expect to continue to elevate and expand our member experiences with a continued focus on increasing member engagement, while optimizing membership levels and membership dues in our centers. We believe that the pricing actions we have taken to better reflect our premier brand and the value our members receive has resulted in higher revenue and better member experiences. Our optimized pricing for a Center membership is determined center-by-center based on a variety of factors, including geography, market presence, demographic nature, population density, competition, initial investment in the center and available services and amenities. We expect to continually refine our strategy to strike the right balance between the number of members at any given center with the membership dues for that center.

We have grown our average revenue per center membership to $3,160 in 2024, up from $2,810 in 2023 and $2,528 in 2022. We believe our average revenue per center membership will continue to grow as we open new centers in desirable locations across the country, new members join at higher membership dues rates, our new centers ramp to expected performance and we continue to execute on our strategic initiatives discussed above. Our new centers on average have taken three to four years to ramp to expected performance. As of December 31, 2024, we had 29 centers open for less than three years and 12 new centers under construction, with significant growth capital expenditures already invested into these new centers that have yet to open. We believe these combined dynamics create a strong tailwind for the continued growth of our total Center revenue.

Expand National Footprint in Affluent Metropolitan Statistical Areas

Our new center expansion initiatives are focused on strategic locations in increasingly affluent markets with higher income members that will generate higher average dues, higher in-center revenue per membership and higher revenue per square foot. We believe we have significant whitespace opportunity for our premium athletic country clubs across the United States and Canada, as well as internationally. Since 2015, we have introduced more strategic and flexible asset-light center formats that can be modified to accommodate various settings, including ground-up suburban builds, mall or retail locations, vertical residential and urban locations. The strength of our brand, paired with this flexibility, has allowed us to expand our footprint on the East and West coasts and increased our presence in premium urban and coastal areas such as Boston, Chicago, New York City, Florida and California.

We have developed a disciplined and sophisticated process to evaluate markets and specific sites in those markets where we may want to build, lease or acquire new centers. This dynamic process is based upon demographic, psychographic and competitive criteria generated from profiles of our most successful centers, and we continue to refine these criteria based upon

7

the performance of our centers. We believe that the presence of a Life Time center benefits landlords and property developers by bringing our attractive membership base to their locations and increasing the value of the underlying property and surrounding neighborhoods. We seek to leverage this halo effect of our brand, as well as long-term relationships with landlords and property developers, to achieve favorable lease or development agreements and increased construction reimbursements to support our asset-light expansion.

We opened eight, 11 and 10 new centers in 2024, 2023 and 2022, respectively. We are targeting opening 10 to 12 new locations on average per year going forward.

Flexible Asset-light Real Estate Model

We have a diversified portfolio of 179 resort-like athletic country club destinations that are primarily located in affluent markets across 31 states and one Canadian province. Since 2015, we have expanded our center base using an asset-light strategy that has also allowed us to grow the number of centers in a more cost-effective manner and to enter attractive urban and coastal markets with premium centers, where the price of real estate had historically been a deterrent to entry. Our growth strategy is flexible and we can capitalize on a variety of opportunities including (i) within existing facilities that we can acquire at below market value and open more quickly; (ii) by entering into or taking over leases with tenant improvement contributions from landlords; (iii) by adapting existing retail or office space with tenant improvement contributions; and (iv) through ground-up suburban builds leveraging sale-leaseback proceeds as a mechanism to recycle capital and reduce our overall net invested capital.

Approximately 68% of our centers are now leased, including approximately 87% of our new centers opened since 2015, versus a predominantly owned real estate strategy prior to 2015.

We also benefit from our in-house architecture, design and construction expertise that allows us to create operationally efficient centers and a consistent feel across our centers. This internal expertise has also helped us control the cost and pace of capital expenditures, including in determining when to begin construction on a new location after we have purchased the land as we balance the timing of our growth with any inflationary, labor or supply pressures.

Our asset-light strategy helped us achieve our objective to be free cash flow positive starting in the second quarter of 2024 and we expect to remain free cash flow positive on an annual basis while maintaining a robust pipeline of new centers. We generally expect to have net invested capital, which we define as gross invested capital, net of construction reimbursements, less net proceeds from sale-leaseback transactions, of $25-$30 million per new location on average, with an average return on net invested capital across our portfolio targeted at in excess of 30% after the three to four years it takes on average for our new centers to ramp to expected performance.

We have acquired, and expect to continue to acquire, centers as well as events and services that complement our offerings. Our acquisitions can be single assets or portfolios of assets. We take a disciplined approach to sourcing, acquiring and integrating high quality assets and/or locations and complementary businesses that can help us continue to expand into new geographic areas, acquire key talent and offer new services and experiences. Our post-acquisition integration process often involves significant investments in both the acquired physical assets and human capital to improve each acquired site and to rebrand the look and feel of the center to create the Life Time brand experience for our members.

Continue to Expand Our Omni-Channel Offerings

We believe the importance of health, fitness and wellness coupled with the structural shift of consumer preferences toward experiential and proactive health and wellness spending creates new opportunities for us to leverage our “Healthy Way of Life” lifestyle and leisure brand. We expect to leverage our brand reputation and deep understanding of the member experience to add a growing portfolio of products and services to our omni-channel platform.

We continue to invest in our digital capabilities, including in the Life Time integrated digital app and artificial intelligence, which we believe will enable our members to further utilize our “Healthy Way of Life” ecosystem. We have also made our digital app available to everyone free of charge, which we believe will strengthen our brand and allow many more people to experience and benefit from our ecosystem. Our digital app user base continues to grow and we are strengthening our streaming and on-demand offerings and content. In addition, we are improving our e-commerce presence that includes the purchase of a wide variety of equipment, wearables, apparel, beauty products and nutritional supplements, including our newly branded LTH nutritional products.

8

We also continue to expand our “Healthy Way of Life” ecosystem in response to the desire of our members to holistically integrate health and wellness into every aspect of their daily lives. In 2018, we launched Life Time Work, an asset-light branded co-working model that offers premium work spaces in close proximity to our athletic country clubs and integrates ergonomic furnishings and promotes a healthy working environment. Life Time Work members also have the ability to receive access to all of our resort-like athletic country club destinations across the United States and Canada. Additionally, our Life Time Living locations, which are also an asset-light model, offer luxury wellness-oriented residences, also in close proximity to our athletic country clubs. As of December 31, 2024, we had 15 Life Time Work and four Life Time Living locations open and operating. Our Life Time Living offering is generating interest from new property developers and presenting opportunities for new center development and deal terms that were not previously available to us. While we are in the early stages of capitalizing on this opportunity, we believe integrating how and where consumers live, work, move and play is a promising opportunity that Life Time is uniquely positioned to capture. As we expand our footprint with new centers and nearby work and living spaces, as well as strengthen our digital capabilities, we expect to continue to grow our omni-channel platform to support the “Healthy Way of Life” journey of our members wherever they are in the United States and Canada.

Impact of COVID-19 on Our Financial Performance

In March 2020, the World Health Organization declared the outbreak of COVID-19 as a pandemic, the United States declared a National Public Health Emergency and we closed all of our centers based on orders and advisories from federal, state and local governmental authorities regarding COVID-19. Throughout this Annual Report, including in this “Business” section and the sections entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” when we refer to “COVID-19” or “the pandemic,” such as when we describe the “impact of COVID-19” on our operations, we mean the coronavirus-related orders issued by governmental authorities affecting our operations and/or the presence of coronavirus in our centers, including COVID-19 positive members or team members.

Human Capital

Our unwavering commitment to excellence and a “Healthy Way of Life” culture is driven by our passionate team members and strong leadership team that includes Bahram Akradi, our founder, Chairman and Chief Executive Officer. Life Time was founded by Mr. Akradi in 1992 to help people achieve their health, fitness and wellness goals by delivering entertaining, educational and innovative experiences with uncompromising quality and unparalleled service. Since our founding, we have believed that creating and sustaining a trusted community requires a high level of passion and commitment from our team. We therefore recruit, hire and certify those whom we believe are the best professionals in the industry to empower, educate and entertain our members. In addition, to enhance our member experiences and drive consistency in our hospitality and services, we have a strong focus on team member culture, training and certification. We value a welcoming and inclusive culture. Our focus on engagement among team members attracts and fosters our multi-generational member base.

By building a strong team, Life Time has continued to grow and consistently deliver exceptional experiences and strong financial results. As of December 31, 2024, we employed over 42,000 Life Time team members, including over 33,000 part-time employees and over 10,800 certified fitness professionals, ranging from personal trainers to studio performers. On average, our centers are generally staffed with approximately 210 to 260 full-time and part-time employees depending on center activity levels.

Our team members are at the heart of our Company. We have an entrepreneurial spirit that we believe makes us highly adaptable, reflects an ownership mentality and allows us to navigate shifts in the health, fitness and wellness landscape. Our team members are dedicated to providing the best programs and experiences in the best facilities, and we know this happens by hiring and inspiring the best people. By consistently delivering extraordinary experiences, we have built a highly trusted, premium lifestyle and leisure brand that embraces all aspects of healthy living, healthy aging and healthy entertainment. We call this collective approach and lens to physical, mental and social well-being “Healthy Way of Life” (“HWOL”).

To build our HWOL brand, we aim to recruit, train, promote and empower team members through our culture of care and such initiatives as the Life Time Inclusion Council and Life Time University discussed below. Our culture of care encourages our team members to exemplify HWOL in their personal and professional lives. We believe in supporting our team members throughout their journey from casting, onboarding, training, certification, career-path planning and employee resource or affinity groups. We also offer numerous supportive programs, including education, training and surveys.

9

Inclusion at Life Time

At Life Time, we are committed to inspiring healthy, happy lives for everyone in our communities. We aspire to create healthy environments and workspaces that recognize, empower and celebrate the unique talents, backgrounds and perspectives of individuals so team members feel welcomed, respected, supported and valued. We believe inclusion is at the heart of our team members’ and members’ sense of belonging, and so our efforts are focused on making Life Time “A Place for Everyone.”

To help create “A Place for Everyone” at Life Time, we created the Life Time Inclusion Council, which is comprised of a small group of core team members, along with a larger group of ambassadors representing each of our club locations and many corporate divisions. Our inclusion council works through committees to identify and incubate areas for enhancing diversity and inclusion within our organization. Among other initiatives, Life Time has supported mentoring, coaching, engagement forums and inclusive leadership feedback and learning.

Development and Training

Our recruiting and talent acquisition teams seek diverse and highly skilled team members who promote a friendly and inviting environment and uphold consistency in performance and excellence in hospitality. Through this casting, we select team members whom we believe are the best fitness professionals in the industry to empower, educate and entertain our members. Additionally, all center team members are required to participate in a training and certification program that is specifically designed for their role and in education that promotes health and safety and reinforces our non-discrimination and anti-harassment policies. We also provide comprehensive training through our Life Time Education platform that is comprised of both an externally licensed school branded as Life Time Academy (“LTA”) and an internal team member education and certification division that we call Life Time University (“LTU”). LTA offers a certification for entry-level professionals to prepare for a career with Life Time or within the health, fitness and wellness industry. LTU delivers certification, learning, education and development opportunities for all team members. Life Time Education supports the culture of Life Time through programs in service, inclusion and diversity and personal and professional growth. Team members may also engage in ongoing mentoring and continuing education. We require an annual re-certification before any team member is permitted to work or to advance to other positions within our Company.

Our personal trainers, registered dietitians, massage therapists and cosmetologists are required to maintain a professional license or one of their industry’s top certifications.

Compensation and Benefits

We believe that supporting our team members to be successful in their roles enables them to provide extraordinary experiences to our members. We offer a wide range of benefits designed to holistically support our team members in all areas of their lives. In addition to paid time off, paid sick leave, parental leave, adoption assistance, subsidized medical, dental and vision insurance, company paid life insurance, short and long-term disability, and a center membership, we also provide:

•Employee Assistance Program – Offers confidential assistance with personal, legal, work, financial and other life issues on a 24-hours-a-day, 7-days-a-week basis; and

•Life Time Mind (“LT Mind”) – LT Mind is a holistic performance coaching program proprietary to Life Time aimed at helping team members optimize their performance, achieve their goals and enhance their well-being. Offerings for team members include online training and virtual mental resiliency coaching.

We are not a party to a collective bargaining agreement with any of our employees. We believe we have created a positive environment where our employees can thrive while delivering an uncompromising member experience, and we believe relations with our employees are good.

Information Systems

In addition to our standard operating and administrative systems, we use an integrated and proprietary member management system to manage the flow of member information within and between each of our centers and our corporate office. We have designed and developed our proprietary system to allow us to easily collect and process information. Our system enables us to, among other things, enroll new members with an electronic membership agreement, capture digital pictures of members for identification purposes and capture and maintain specific member information, including usage. The system allows us to streamline the collection of membership dues electronically, thereby offering additional convenience for our members while at the same time reducing our corporate overhead and accounts receivable. In addition, we use a customer relationship

10

management system to enhance our marketing campaigns and management oversight regarding daily sales and marketing activities.

Competition

We consider the following groups to be the primary participants in the health, fitness and wellness industry:

•health center operators, including, but not limited to, Equinox Holdings, Inc., The Bay Club Company, Invited (formerly ClubCorp), LA Fitness International, LLC and 24 Hour Fitness Worldwide, Inc.;

•the YMCA and similar non-profit organizations or community centers;

•physical fitness and recreational facilities established by local governments, hospitals and businesses;

•local salons, cafes and businesses offering similar ancillary services;

•small fitness clubs and studios and other boutique fitness offerings, including Anytime Fitness, Snap Fitness, Planet Fitness, Orange Theory, Barre3, StretchLab and others;

•racquet, tennis, pickleball and other athletic centers;

•rental unit and condominium amenity centers;

•country clubs;

•digital fitness and health services, including online or other technology-based personal training and fitness and nutrition coaching;

•the home-use fitness equipment industry;

•athletic event operators and related suppliers;

•providers of office co-working spaces and luxury apartments; and

•providers of wellness and other health and wellness-orientated products and services.

While competition in the industry varies from market to market, it may be impacted by various factors, including the breadth and price of membership offerings and other products and services, the flexibility of membership options, the overall quality of the offering, name or brand recognition and economies of scale. We believe that our brand, our comprehensive product offering and focus on premium services and amenities and our value provide us with a distinct competitive advantage that positions us well in the health, fitness and wellness industry.

Intellectual Property

Our business depends on the quality and reputation of our brand. We file a substantial number of our trademarks and service marks with the United States Patent and Trademark Office, including for Life Time and many of our branded studio classes, service offerings and products. We consider our brand to be one of our most important assets and certain of our trademarks and service marks to be of material importance to our business and actively defend and enforce such trademarks and service marks. Examples include LIFE TIME®,  , EXPERIENCE LIFE®, DPT DYNAMIC PERSONAL TRAINING, ARORA, MIORA, LIFECAFE®, LTH,

, EXPERIENCE LIFE®, DPT DYNAMIC PERSONAL TRAINING, ARORA, MIORA, LIFECAFE®, LTH,  , LIFESPA®, LIFE TIME HEALTHY WAY OF LIFE®, LIFE TIME WORK® and LIFE TIME LIVING®. Solely for convenience, our trademarks, service marks or tradenames may appear in this Annual Report without the corresponding ® or TM symbols, but such references are not intended to indicate in any way that we will not assert, to the fullest extent, our rights to such trademarks, service marks and tradenames.

, LIFESPA®, LIFE TIME HEALTHY WAY OF LIFE®, LIFE TIME WORK® and LIFE TIME LIVING®. Solely for convenience, our trademarks, service marks or tradenames may appear in this Annual Report without the corresponding ® or TM symbols, but such references are not intended to indicate in any way that we will not assert, to the fullest extent, our rights to such trademarks, service marks and tradenames.

, EXPERIENCE LIFE®, DPT DYNAMIC PERSONAL TRAINING, ARORA, MIORA, LIFECAFE®, LTH,

, EXPERIENCE LIFE®, DPT DYNAMIC PERSONAL TRAINING, ARORA, MIORA, LIFECAFE®, LTH,  , LIFESPA®, LIFE TIME HEALTHY WAY OF LIFE®, LIFE TIME WORK® and LIFE TIME LIVING®. Solely for convenience, our trademarks, service marks or tradenames may appear in this Annual Report without the corresponding ® or TM symbols, but such references are not intended to indicate in any way that we will not assert, to the fullest extent, our rights to such trademarks, service marks and tradenames.

, LIFESPA®, LIFE TIME HEALTHY WAY OF LIFE®, LIFE TIME WORK® and LIFE TIME LIVING®. Solely for convenience, our trademarks, service marks or tradenames may appear in this Annual Report without the corresponding ® or TM symbols, but such references are not intended to indicate in any way that we will not assert, to the fullest extent, our rights to such trademarks, service marks and tradenames.

Governmental Laws and Regulations

Our operations and business practices are subject to laws and regulations at federal, state, provincial and local levels, including consumer protection laws, health and safety regulations, licensing requirements and regulations related to our training, cafe and bistro, spa, aquatics, child care and ancillary health and fitness-related products and services, environmental laws and regulations, including those related to the handling, use, investigation, remediation and storage of hazardous materials, the emission, release and discharge of hazardous materials into the environment, the health and safety of our employees and the disclosure of our environmental initiatives, fair housing laws, accessibility laws, regulations and laws related to the collection,

11

use and security of personal information about our members, guests and other third parties, and wage and hour and other labor and employment laws.

In particular, within the health, fitness and wellness industry, state statutes regulate the sale and terms of our membership contracts. State statutes often require that we:

•include certain terms in our membership contracts, including the right to cancel a membership, in most cases, within three to 10 days after joining, and receive a refund of enrollment fees paid;

•escrow funds received from pre-opening sales or post a bond or proof of financial responsibility; and

•adhere to price or financing limitations.

Seasonality of Business

Seasonal trends have an effect on our overall business. Generally, we have experienced greater membership growth at the beginning of the year. We also typically experience increased levels of membership in certain centers during the summer pool season. During the summer months, we also experience a slight increase in our in-center business activity with summer programming and operating expenses due to our outdoor aquatics operations and kids programming. We typically experience an increased level of membership attrition during the third and fourth quarters as the summer pool season ends and we enter the holiday season. This can lead to a sequential decline in memberships during those quarters.

Life Time Foundation

We believe in giving back to our communities in ways that empower people to live happy, healthy lives. In 2003, we formed the Life Time Foundation with a focus on inspiring healthier families. In 2010, we further focused on helping children reach their full potential by collaborating with school food leaders to help them serve wholesome, nourishing, minimally processed food in schools across the United States. In 2022, we complemented these efforts with a focus on increasing physical activity and healthy movement in our nation’s youth. Since 2010, the Life Time Foundation has given over $10 million and positively impacted millions of children across the country in these areas. In 2023, we expanded the mission of the Life Time Foundation to promote a healthy planet including forestation and environmental conservation efforts. The Healthy Planet program supported planting over 230,000 trees across the United States in 2024.

Available Information

We file annual, quarterly and special reports and other information with the SEC. Our filings with the SEC are available to the public on the SEC’s website at http://www.sec.gov. Those filings are also available to the public free of charge on, or accessible through, our investor relations website at www.ir.lifetime.life under the “SEC Filings” tab. The information we file with the SEC or contained on or accessible through our corporate website or any other website that we may maintain is not part of this Annual Report.

Item 1A. RISK FACTORS

Risks Relating to Our Business Operations and Competitive Environment

We may be unable to attract and retain members and we may not effectively optimize revenue per center membership, either of which could have a negative effect on our business, results of operations and financial condition.

The success of our business depends on our ability to attract and retain members and to optimize our revenue per center membership. There are numerous factors that could prevent us from increasing, or cause a decline in, our memberships and in-center business or that could prevent us from optimizing our revenue per center membership, any of which could adversely impact our business, results of operations and financial condition. These factors include (i) our ability to deliver premium member experiences, (ii) members valuing our offerings at the prices we charge, (iii) changing desires, confidence, discretionary spending and behaviors of consumers and our ability to anticipate and respond to such shifts, (iv) introductions or terminations of products, services, benefits or technology, (v) general economic and environmental conditions, (vi) market or center maturity or saturation, (vii) direct and indirect competition in our trade areas and (viii) social fears such as terror or health threats.

All of our members are able to cancel their membership at any time upon providing advance notice. We must therefore continually engage existing members and attract new members in order to maintain our membership and in-center service levels

12

and earn the membership dues and service fees that we charge our members. Elevating our member experiences to meet and exceed their expectations requires investment in our team members, programs, products, services and centers. These investments may impact our short-term results of operations and cash flows as our investments in our business may be made more quickly than we see the returns on our investments. Additionally, we cannot be certain that these strategies will attract and retain members or deliver higher revenue per center membership.

Our business, results of operations and prospects may be adversely affected by the environments in which we operate, including with respect to the macroeconomy, the political climate, global pandemics or other health crises, severe weather, natural disasters, hostilities, gun violence and social unrest.

The macroeconomic environment in which we operate can adversely impact our business, results of operations and prospects, including with respect to inflation, interest rates, taxes or tariffs, labor and supply chain issues, and economic recession. While the inflation rate has improved, the extended period of elevated inflation and overall higher costs has impacted our expenses and capital expenditures in several areas, including wages, construction costs and other operating expenses. These inflationary impacts pressure our margin performance and increase our capital expenditures. Similarly, while interest rates have begun to decrease, the comparatively higher interest rate environment has also increased the cost of our borrowings. The combined impact of inflation and higher interest rates caused us to temporarily slow down the start of new construction on our ground-up suburban builds. We have restarted our ground-up builds, but the slowdown impacted the number and mix of new centers that we opened in 2024 and will impact the mix of new centers that we will open in 2025. Higher investment in new centers than we had originally planned, coupled with capitalization rates on our sale-leaseback transactions that are higher than historical levels or investment that takes longer to execute due to any number of reasons, requires us to outperform our operational plan to achieve our targeted return.

Global pandemics or other health crises can also adversely impact our business, results of operations, financial condition and prospects. We experienced significant reductions in membership levels, revenue per center membership, center activity and new center growth related to the COVID-19 pandemic, including from the responses of diverse governmental authorities in closing or restarting our operations. Our business took time to recover from that pandemic, similar to how our new centers take several years to mature to expected performance, and the recovery varied by center and geography. We cannot be certain that we will not need to close our centers, restrict operations within our centers or suspend or reduce the level of real estate or construction activities again related to another pandemic or health crisis.

Severe weather, natural disasters and shifting climate patterns, including fires, hurricanes and more extreme temperatures, hostilities, gun violence including active threats, social unrest or terrorist activities (or expectations about them) can adversely affect our members, consumer spending and confidence levels, supply availability and costs, as well as the local operations in impacted markets, all of which could have an adverse effect on our results of operations and financial condition. We may also be forced to temporarily or permanently close centers due to any number of such circumstances. The severity and impact of center closures and center damage or destruction, and the cost to operate our centers, could increase as the climate, geopolitical and social environment changes, including with respect to our water usage in environments where water may be scarce or costly and the cost to cool our facilities in environments that experience higher temperatures. That severity and impact could also be greater in the various geographical locations across the country where we operate multiple centers and as we expand. Our receipt of proceeds under any insurance we maintain with respect to some of these risks may be delayed or the proceeds may be insufficient to cover our losses fully. Additionally, while we have been a company focused on environmental, social and governance (“ESG”) matters from our formation, as we continue to develop and execute on our ESG initiatives, we could incur additional costs or risks that adversely impact our business.

Our business could be adversely affected by competition in the competitive health, fitness and wellness industry.

We compete with numerous industry participants as detailed in “Item 1—Business—Competition” of this Annual Report. Competitors compete with us to attract members in our markets and digitally. Competitors also attempt to copy all or portions of our business model or services, which could erode our market share and brand recognition or impair our business and results of operations. It is also possible that competitors could introduce new products and services or new ways to provide those products and services that negatively impact consumer preference or willingness to pay for our products and services. Certain competitors have advantages over us, including greater name recognition and/or resources, and non-profit and government organizations may be able to obtain land and construct centers at a lower cost and collect membership fees without paying taxes, thereby allowing them to charge lower prices. Additionally, consolidation in the health, fitness and wellness industry could result in increased competition among participants. This competition may limit our ability to attract and retain members or to optimize our revenue per center membership, each of which could materially and adversely affect our business, results of operations and financial condition.

13

Our dependence on third-party suppliers for equipment and certain products and services could result in disruptions to our business and could adversely affect our business, results of operations and financial condition.

Equipment and certain products and services needed for us to operate our business efficiently and to consistently meet our business requirements are sourced from third-party suppliers. The ability of these third-party suppliers to successfully provide reliable and high-quality products and services is subject to economic, technical and operational uncertainties that are beyond our control. Any disruption to our suppliers’ operations, or any inability by us to identify and enter into agreements with alternative suppliers on a timely basis and on acceptable terms, could impact our supply chain and our ability to service our centers and elevate and expand our brand. Transitioning to new suppliers could be time-consuming and expensive and may result in interruptions in our operations. If any of these events occurs, it could have a material adverse effect on our business, results of operations and financial condition.

Risks Relating to Our Brand

Our business depends on the quality and reputation of our brand, and any deterioration in the quality or reputation of our brand or in the health, fitness and wellness industry could materially adversely affect our market share, business, results of operations and financial condition.

Our brand and reputation are among our most important assets. Our ability to attract and retain members and expand our business is impacted by the external perceptions of Life Time as a leading lifestyle and leisure brand that consistently delivers premium experiences. Any operation of our centers or omni-channel ecosystem that does not meet expectations, any adverse incidents, including involving the safety of our members, guests or employees, physical or sexual abuse, or harm to a child at any of our children areas, or any negative events or publicity regarding us, our competitors or the health, fitness and wellness industry, may damage our brand and reputation, cause a loss of consumer confidence in Life Time and our industry and have an adverse effect on our market share, business, results of operations and financial condition.

Use of social media platforms, and email, text messaging, phone and social media marketing, may adversely impact our reputation, business, results of operations, and financial condition or subject us to fines or other penalties.

Negative commentary about us or calls for collective action against us, such as boycotts, may be posted on social media platforms or similar at any time to a broad audience, which may harm our brand, reputation or business without affording us an opportunity for redress or correction in a timely manner or at all. Consumers value readily available information about health, fitness and wellness and often act on such information without further investigation and without regard to its accuracy.

We also use email, text messaging, phone and social medial platforms as marketing tools. As laws and regulations rapidly evolve to govern the use of these platforms and devices, the failure by us, our employees or third parties acting at our direction to abide by applicable laws and regulations in the use of these platforms and devices could adversely impact our business, results of operations and financial condition or subject us to fines or other penalties.

Our intellectual property rights may be inadequate to protect our business or may be infringed, misappropriated or challenged by others. We may also become involved in costly litigation or be required to pay royalties or fees.

We attempt to protect our intellectual property rights through a combination of patent, trademark, copyright and trade secret laws, as well as licensing agreements and third-party nondisclosure and assignment agreements. Our failure to obtain or maintain adequate protection of our intellectual property rights for any reason, whether in the United States or internationally, could have a material adverse effect on our business, results of operations and financial condition.

We rely on our trademarks, trade names and brand names to distinguish our products and services from the products and services of our competitors, and we have registered or applied to register many of these trademarks. There is no assurance that our trademark applications will be approved in the United States or internationally. Third parties may also oppose our trademark applications, or otherwise challenge our use of the trademarks. In the event that our trademarks are successfully challenged, we could be forced to rebrand our products or services, which could result in loss of brand recognition, and could require us to devote resources to advertising and marketing new brands and to replacing products. In particular, although we own a United States federal trademark registration for use of the LIFE TIME® mark in the field of health and fitness centers, we are aware of entities in certain locations around the country and internationally that use LIFE TIME FITNESS, LIFE TIME or other similar marks in connection with goods and services related to health, fitness and wellness, including dietary food supplements. The rights of these entities in such marks may predate our rights. Accordingly, if we open any centers or otherwise operate in the areas in which these parties operate, we may be required to pay royalties or other fees or may be prevented from using the mark in such areas. Furthermore, if any third party were to successfully seek cancellation of our trademark registrations, we may be prevented from using such marks throughout the United States or internationally.

14

Further, there is no assurance that competitors or other businesses will not infringe on our intellectual property rights or that we will not have disputes with third parties to enforce our intellectual property rights, protect our trademarks, determine the validity and scope of the proprietary rights of others or defend ourselves from claims of infringement, invalidity, misappropriation or unenforceability. Our risk of infringement or misappropriation may increase with the increased use of generative artificial intelligence. In the event of any such infringement or claimed infringement or any misappropriation, the value of our brand may be harmed and we may be required to incur substantial costs and divert resources to pursue, or defend against, any claim. Additionally, any damage to our brand or reputation could cause membership levels to decline and make it more difficult to attract new members. If we were to fail to successfully defend a claim against us, we may have to pay significant fees (and fines and penalties) and enter into royalty or licensing agreements, we may be prevented from using the intellectual property within certain markets in connection with goods and services that are material to our business or we may be unable to prevent a third party from using our intellectual property. Any such failure to successfully protect our intellectual property rights, or to defend against any claims or infringement, invalidity, misappropriation or unenforceability, for any reason, could have an adverse effect on our business, results of operations and financial condition.

Risks Relating to the Growth of Our Business

If we are unable to successfully execute our asset-light growth strategy, our results of operations, cash flow and return on invested capital may be negatively impacted. Our center profitability may decline as we open new centers.

We are executing on a strategy to grow our business in an asset-light manner as detailed in “Item 1—Business—Our Growth Strategies and Member Experience Initiatives” of this Annual Report. One key focus area is expanding the number of our centers in an asset-light manner. To successfully expand the number of our centers, we must identify and acquire or lease sites that meet the site selection criteria we have established. We may face significant competition for sites that meet our criteria, and as a result, we may lose those sites or we could be forced to pay significantly higher prices for those sites. Additionally, we must engage and negotiate with numerous third parties, including landlords, developers, sellers, contractors and governmental authorities. Their timeline and ability to move forward may differ from ours. If we are unable to cost-effectively identify and acquire or lease sites for new centers, or if our analysis of the suitability of a site is incorrect, our revenue growth rate, profits, cash flow and return on invested capital may be negatively impacted. Additionally, if we do not adapt to or anticipate the challenges relating to expanding our operations, including more diverse locations, sizes and types of buildings, executing remodels and determining timelines in new markets and spaces, we may not be able to expand profitably at our targeted returns on invested capital and on the timeline or at the rate we expected. Any of these results could have a negative impact on our revenue growth rate, profits, cash flow and return on invested capital.

Our focus for new centers continues to include wealthier demographic and coastal locations for ground-up suburban builds, mall or retail locations, vertical residential and urban locations. If we are unable to leverage our brand and what we bring to these markets and locations, we may be required to pay relatively higher costs for land or lease payments. Our construction and development costs are higher to offer more luxurious amenities and features within the new centers. We have also experienced escalating construction costs more generally due to inflation. Higher gross invested capital and higher occupancy costs at these centers require increases in the value of sale-leaseback transactions or higher operating profits per center to produce our targeted rate of return. Our center operating margins may also be lower while the new centers build membership base. An increase in pre-opening expenses and lower revenue volumes characteristic of newly opened centers affect our operating margins at these new centers.

Opening new centers in existing markets may attract some memberships away from other centers in those markets, which could lead to diminished revenue and profitability. In addition, as a result of new center openings in existing markets, and because older centers will represent an increasing proportion of our center base over time, our same-center revenue increases may be lower in future periods than in the past.

Delays in new center openings could have an adverse effect on our growth.

A significant amount of time and capital expenditures is required to develop and construct or remodel our new centers. Our temporary delay in the start of new ground-up suburban builds due to elevated construction costs, a higher interest rate environment and management of capital expenditures impacted the number and mix of new centers that we opened in 2024 and will impact the mix of new centers that we expect to open in 2025, and it could hurt our ability to meet our new center growth objectives and could have an adverse effect on our results of operations.

Our ability to open new centers on schedule and on budget or at all depends on a number of factors, many of which are beyond our control. These factors include:

15

•obtaining acceptable financing including executing sale-leaseback transactions to fund construction of new sites and negotiating tenant improvement contributions from developers and landlords;

•obtaining entitlements, permits and licenses necessary to complete construction of the new center on schedule and to operate the center;

•negotiating the terms of the acquisition or lease of new centers;

•securing access to centers and the costs of labor and materials necessary to develop and construct or remodel our centers;

•delays or cost increases due to inflation, material shortages, labor issues, design changes, weather conditions, acts of God, pandemics or epidemics, discovery of contaminants, accidents, deaths or injunctions;

•recruiting, training and retaining qualified employees; and

•general economic conditions.

Our growth and changes in the industry could place strains on our management, employees, information systems and internal controls, which may adversely impact our business.

Our plans for expansion and development, including an increase in the number of our centers, development of existing and new businesses and memberships, expansion of our “Healthy Way of Life” ecosystem and acquisitions of other businesses, as well as changes in the industry, may place significant demands on our administrative, operational, financial, technological and other resources. Any failure to manage growth and development effectively could harm our business. To be successful, we will need to continue to develop technologically and implement management information systems and improve our operating, administrative, financial and accounting systems and controls. We will also need to train new employees and maintain close coordination among our executive, accounting, finance, legal, human resources, risk management and operations functions. These processes are time-consuming and expensive, increase management responsibilities and divert management attention.

We may incur significant costs in the development and implementation of new or re-imagined businesses or strategies with no guarantee of success.

In order to elevate and broaden member experiences, increase our revenue per center membership, remain competitive, respond to consumer demands and expand our business, we have developed, and expect to continue to develop and re-imagine, in-center, digital and ancillary businesses and strategies as well as co-working and living spaces. We may incur significant costs in the development or refinement of these businesses and strategies, some of which may be outside of our core competency. In addition, we cannot guarantee that these businesses or strategies will be successful and contribute to earnings, and any of these businesses or strategies may lose money and have an adverse effect on our business, financial condition and operating results.

We may be unable to successfully acquire or invest in suitable businesses or, if we do acquire or invest in them, they may disrupt our existing business, we may be unable to successfully integrate the businesses into our existing business or the acquired assets may be subject to impairment, any of which may have an adverse effect on our results of operations and financial condition.

To remain competitive and expand our business, we acquire and invest in complementary businesses and centers. We may not be able to find suitable acquisition candidates or joint venture partners in the future. If we do find suitable candidates, we may not be in a financial position to pursue the transactions or we may not be able to conduct effective due diligence or execute the transactions on favorable terms or at all. We may also have to incur debt or issue equity securities to pay for any acquisition or investment, which could adversely affect our financial condition or dilute our stockholders.

If we do acquire other businesses, we cannot provide any assurances that we will be able to successfully integrate those businesses and integrating those businesses into our existing business may place significant demands on our administrative, operational, financial and other resources and may require significant management time, which may disrupt our other businesses. We may also need to invest significant capital into the acquired businesses or centers to deliver experiences consistent with the Life Time brand. Our ability to acquire and integrate larger or more significant companies is unproven. Any failure to integrate an acquired business or center into our existing business could have an adverse effect on our existing business, results of operations and financial condition.

16

Additionally, as we have acquired other businesses, we have recorded assets, liabilities and intangible assets at fair value at the time of acquisition. If the fair value of the long-lived assets or intangible assets were determined to be lower than the carrying value, the assets would be subject to impairment, which could adversely affect our financial results.

Risks Relating to Our Technological Operations

We rely on technology and if we are unable to adapt to significant and rapid technological change and deliver connected and digital experiences, we may not compete effectively and our business could be adversely affected.

Technology is a key component of our business model and we regard it as crucial to our success moving forward. We increasingly use electronic and digital means to interact with our members, provide services and products and collect, maintain and store individually identifiable information. We use an integrated and proprietary member management system to manage the flow of member information within each of our centers and between centers and our corporate office. We also continue to invest in our mobile application and systems. While we seek to offer our members best-in-class technology solutions, we operate in an environment of significant and rapid technological change, including with respect to artificial intelligence. To remain competitive, we must continue to maintain, enhance and improve the functionality, capacity, accessibility, reliability and features of our mobile application, automated member interfaces and other technology offerings.

Our growth and success will depend, in part, on our ability to continue to elevate and broaden our member experiences and product and services offerings, including through developing our omni-channel ecosystem, licensing leading technologies, systems and use rights, enhancing our existing platforms and services and creating new platforms and services. We must also respond to member demands, technological advances and emerging industry standards and practices on a cost-effective and timely basis. The adoption of new technologies or market practices (including artificial intelligence) requires us to devote significant resources to improve and adapt our services. We may also need to secure and maintain the rights to use music with our content, which can be costly depending on the method we use to provide our content and may involve many third parties and navigating complex and evolving legal issues. Keeping pace with these ever-increasing technological and use requirements can be expensive, and we may be unable to make these improvements to our technology infrastructure or obtain the necessary use rights in a timely manner or at all. If we are unable to anticipate and respond to the demand for new services, products and technologies on a timely and cost-effective basis, or to adapt to and leverage technological advancements and changing standards, our business, results of operations and financial condition could be materially and adversely affected. Furthermore, we may rely on the ability of our members to have the necessary hardware products (smartphones, tablets, watches, etc.) to support our new product offerings. To the extent our members are not prepared to invest or lack the necessary resources or infrastructure, the success of any new initiatives may be compromised.

If we fail to properly maintain the operation, integrity and security of our systems and the security of our data or the data of our members, guests and employees, to comply with applicable privacy laws, or to strategically implement, upgrade or consolidate existing information systems, our reputation and business could be adversely affected.

The operation, integrity and security of our systems and the security of our data and the data of our members, guests and employees is critical to us. Despite the security measures we have in place and our continuous assessment and improvements, our systems, and those of our third-party service providers, may be vulnerable to security breaches, acts of cyber terrorism, malicious attacks, misinformation, demands for ransom, vandalism or theft, computer viruses, misplaced or lost data, programming and/or human errors or other similar events. Because such attacks and other events are increasing in sophistication (including from the use of artificial intelligence) and frequently change in nature, we and our third-party service providers may be unable to anticipate such events or implement adequate preventative measures, and any compromise of our systems, or those of our third-party providers, may not be discovered and remediated promptly. Changes in consumer behavior following such an event affecting us or a third party may materially and adversely affect our business, which in turn may materially and adversely affect our reputation, results of operations and financial condition. Our receipt of proceeds under any insurance we maintain with respect to some of these risks may be delayed or the proceeds may be insufficient to cover our losses fully, which could have a material adverse effect on our business, results of operations and financial condition.

Additionally, the collection, maintenance, use, disclosure and disposal of individually identifiable or other personal data by our businesses are regulated at the federal, state and foreign levels as well as by certain financial industry groups, such as the Payment Card Industry Security Standards Council, Nacha, Canadian Payments Association and individual credit card issuers. Some of this data is sensitive and could be an attractive target of a criminal attack by malicious third parties with a wide range of motives and expertise. Federal, state and foreign regulators and financial industry groups continue to adopt or consider new privacy and security requirements that may apply to our businesses. Compliance with evolving and fragmenting privacy and security laws, requirements and regulations results in time and cost increases due to necessary systems changes, new limitations or constraints on our business models and the development of new administrative processes. They also may impose further

17

restrictions on our collection, disclosure and use of information that is housed in one or more of our databases. Noncompliance with privacy laws, financial industry group requirements or a security breach involving the misappropriation, loss or other unauthorized disclosure of personal, sensitive and/or confidential information, whether by us or by one of our vendors, could have adverse effects on our business, operations, brand, reputation and financial condition, including decreased revenue, fines and penalties, increased financial processing fees, compensatory, statutory, punitive or other damages, adverse actions against our licenses to do business and injunctive relief.